Have you ever had that feeling where you blink, and suddenly everything’s changed? That’s the investment world right now. We’re seeing a seismic shift thanks to a bunch of emerging technologies. AI, blockchain, and IoT aren’t just the buzzwords of the day; they’re the tools reshaping how we think about and handle our investments. In this article, we look at how emerging technologies are opening up new opportunities and challenges for investors.

Impact on the Investment Landscape

In the investment world, technology has quietly gone from being a handy tool to an essential ally in decision-making. AI and complex algorithms aren’t just fancy terms—they’re workhorses that help investors dig deep into heaps of data, extracting nuggets of insights that make navigating online trading as accurate as it is enlightening. But it doesn’t stop at informed choices. Technology is also a passport to uncharted territories, allowing investors to leap beyond the familiar grounds and tap into a diverse pool of global assets with ease.

And when the conversation shifts to risk management, technology flexes its muscles. It’s not just about identifying potential hiccups. Apps and software are now adept at carving out strategic paths, morphing risks into well-measured steps aligned with investment objectives. In the unpredictable waters of financial markets, technology emerges as more than just a buffer—it’s akin to a seasoned guide. Every decision and every move in the investment journey is steeped in a combination of precision, clarity, and security, turning what was once a complex challenge into a manageable experience.

The Rise of Emerging Technologies

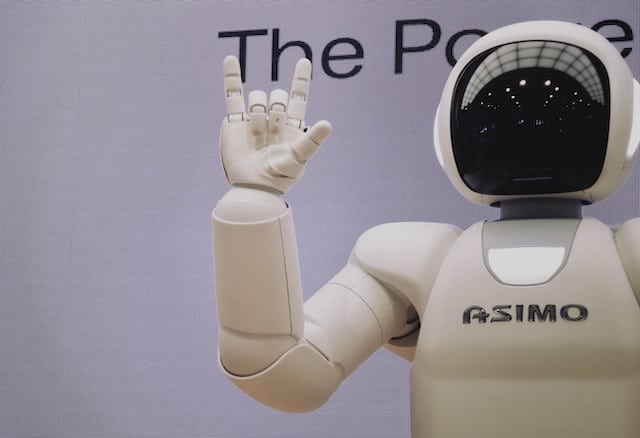

Consider AI and Machine Learning – no longer confined to tech labs or the elite, they’re now mainstream, becoming essential tools for every investor. They serve as the new foundation, turning vast, complex data into actionable, understandable insights that are accessible and valuable.

Blockchain and Cryptocurrency have crossed the chasm from niche to norm. They enhance transparency and security in financial transactions, ensuring visibility and unparalleled integrity in every exchange. Then there’s the IoT. A network of interconnected devices that’s not just about smart homes or connected cars but is spawning a variety of untapped investment opportunities.

Adapting to Technological Innovations

However, harnessing these technological advances necessitates an evolution in our approach. Continuous Learning and Development aren’t just beneficial; they’re essential for investors to harness the full potential of these technological tools. It’s about transforming information into knowledge and knowledge into actionable intelligence.

In strategic planning, technology has claimed its place at the center. It’s a fusion of traditional investment principles and futuristic tech insights, creating a hybrid model that’s robust, resilient, and responsive to the dynamic market landscape.

Future Predictions

The advancement of technologies like AI, blockchain, and IoT seems unstoppable. AI, blockchain, and IoT are not just enhancing the investment landscape but are set to redefine it entirely. They promise an ecosystem where data, analysis, and insights are instantaneous, accurate, and actionable.

As a result, investment strategies will be shaped by a blend of technological innovation and human intelligence. The future investor is not just financially astute but technologically adept, ready to leverage every tool and every insight for optimal returns.

The investment world is undergoing a transformation where technology has moved from being a peripheral element to a central, defining feature. It’s a shift that calls for adaptation and a redefinition of strategies, tools, and approaches. The emerging narrative is one of integration, where technology and investment are intertwined, each shaping and enhancing the other.

For the informed, the prepared, and the adaptive, this shift presents opportunities defined by precision and underscored by innovation. The future of investing will be rich in possibilities, characterized by innovation, and offering unprecedented potential for those ready to engage, adapt, and capitalize on these emerging trends.