Introduction

In recent years, high-leverage crypto trading has exploded in popularity. As volatility brings both outsized gains and heart-stopping losses, traders worldwide are pushing boundaries—none more so than those exploring 1000x, 1500x, and even 2000x leverage.

But is 2000x leverage a realistic opportunity, or a ticking time bomb best left untouched? This article dives deep into the mechanics, risks, and realities of trading at such extremes—specifically focusing on CoinUnited.io, one of the only platforms globally to offer up to 2000x leverage.

For both advanced crypto traders and curious beginners, understanding the true dynamics of ultra-high leverage is critical. Let’s unpack the myth and math of 2000x leverage and see if it’s a revolution or just hype.

Section 1: What is Leverage in Trading?

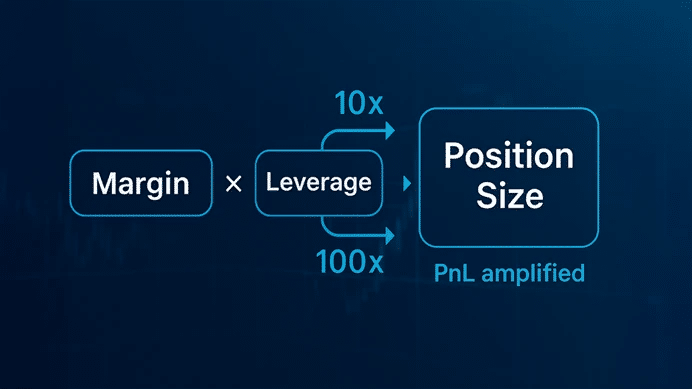

Leverage is a powerful financial tool that lets traders control a larger position size with a much smaller amount of their own capital, known as margin. Leverage is often expressed as a ratio—such as 2x, 10x, or 100x—indicating how much larger your exposure is compared to your deposit.

Traditional Leverage

In traditional markets (stocks, forex), leverage is usually conservative:

- Forex: Commonly up to 50x (1:50)

- Stocks: Often maxes at 2x (1:2) or 4x for professionals

Crypto Leverage

Crypto, due to its digital nature and less regulation, is much more aggressive:

- Most major exchanges offer 10x–100x leverage

- Some offer up to 125x (Bybit, Binance Futures)

- CoinUnited.io stands out, offering 2000x leverage

Math Example: 10x and 100x

- 10x leverage: Deposit $100, control $1,000 position.

If the asset rises 1%, your PnL is +$10, or +10% on your margin.

- 100x leverage: Deposit $100, control $10,000 position.

The same 1% move results in +$100, or +100% PnL.

What’s Margin, Position Size, and PnL?

- Margin: The capital you put up as collateral.

- Position Size: The total trade exposure, magnified by leverage.

- PnL (Profit & Loss) Amplification: Both gains and losses are magnified by the leverage multiple.

Liquidation Price

- The price point where your losses equal your margin, and your position is forcibly closed.

- The higher the leverage, the closer the liquidation price is to your entry.

Section 2: 2000x Leverage – How It Works

The Mechanics of 2000x Leverage on CoinUnited.io

With 2000x leverage, your exposure is multiplied 2000 times your margin. This is possible thanks to sophisticated risk engines, lightning-fast liquidation algorithms, and strict risk management by the platform.

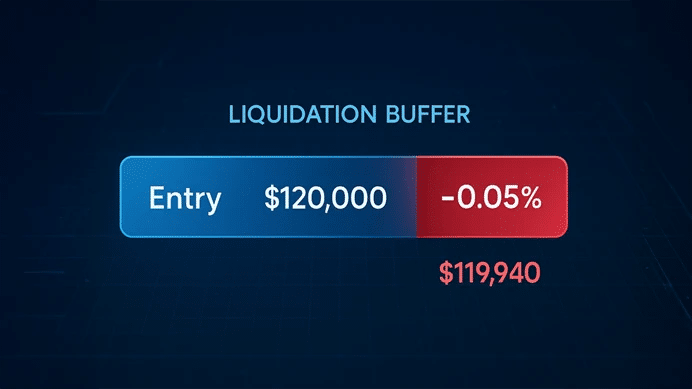

Example Scenario

- Trader Margin: $60

- Leverage: 2000x

- Position Size: $60 × 2000 = $120,000

Suppose you go long BTC/USDT at $120,000.

- Liquidation Buffer:

- With 2000x leverage, even a 0.05% move (yes, that’s just $60) against your position will liquidate your margin.

- $120,000 × 0.0005 = $60

“If the price moves just 0.05% against you, your position is liquidated.”

This means you must be right—instantly—or your trade is over.

Section 3: Why CoinUnited.io Offers 2000x Leverage

CoinUnited.io is a leading-edge crypto derivatives platform, renowned for being among the very few exchanges worldwide to enable up to 2000x leverage for its users.

Infrastructure & Trading Engine

- Ultra-fast order execution: Built for high-frequency, millisecond trades

- Real-time risk controls: Automated, AI-enhanced systems to monitor margin and liquidation

- Advanced order types: Stop-loss, take-profit, trailing stops, and margin auto-close help reduce risk

Security & User Protection

- Industry certifications: ISO 27001/27032/22301/27701, SOC 2, CCSS, NIST Tier-4

- Insurance for cold storage assets

- Bug bounty and periodic audits

Licensing, Transparency, and Reputation

- Global presence in 160+ countries, serving millions of users

- Compliance with multination regulation

- Full transparency on About Us and Security pages

- User protections: Fast withdrawals, multi-factor authentication

Interested traders can sign up at CoinUnited.io/register to explore these advanced features.

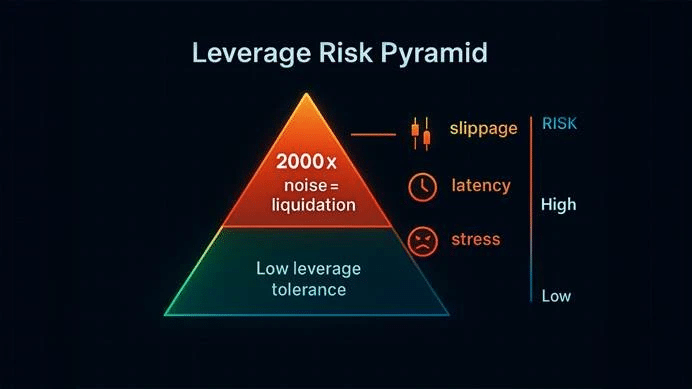

Section 4: Risks of 2000x Leverage

Trading with 2000x leverage is not just high risk—it’s ultra-high risk.

Extremely Tight Liquidation Window

- At 2000x, a 0.05% adverse move triggers liquidation.

- Even normal “market noise” can erase your entire margin in seconds.

- No room for error: Your stop-loss must be placed instantly, and slippage can be fatal.

Comparing with Lower Leverage

- 10x–50x leverage: Greater tolerance for price movement, giving you time to react.

- 2000x leverage: No time; the market can liquidate you before your order is processed.

Emotional & Psychological Toll

- Watching $100,000 positions move with tiny swings creates high stress and impulsive behavior.

- Beginners often lose their entire margin within seconds, leading to loss-chasing and poor decisions.

Warning:

“2000x leverage is only suitable for highly-experienced, fast-paced traders. For most, the risk outweighs the reward.”

Section 5: Benefits of Ultra-High Leverage (When Used Properly)

Despite the risks, 2000x leverage has legitimate use cases when deployed with precision and discipline.

1. Lower Capital Requirements

- Open large positions with small capital, freeing up funds for other opportunities or risk management.

2. Short-Term Arbitrage or Volatility Plays

- High-frequency, algorithmic, or arbitrage traders may use 500x–2000x leverage to capitalize on brief inefficiencies or price discrepancies.

- Examples: Spreads between exchanges, fleeting market signals, or news-driven micro-moves.

3. Tight, Fast Wins

- Some traders have documented using 1000x–2000x leverage for quick scalps—jumping in and out within seconds, often aiming for 0.05%–0.1% gains.

Example

- Enter at $120,000, exit at $120,060 (0.05% move)

- With $60 margin at 2000x, you can double your money if you catch a winning move—but any mistake wipes you out.

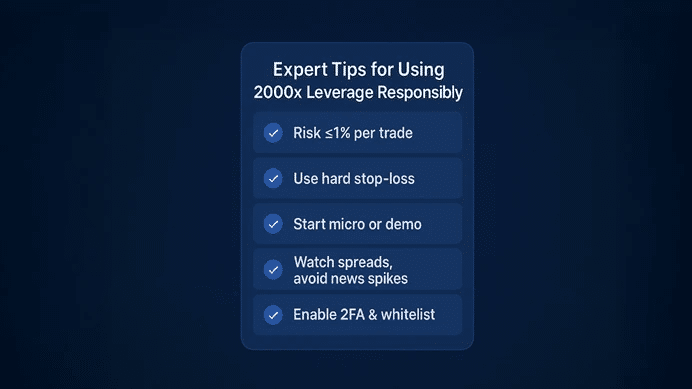

Section 6: Expert Tips for Using 2000x Leverage Responsibly

1. Risk Management is Non-Negotiable

- Never risk more than 1% of your trading capital per position.

- Use hard stop-losses and avoid “hoping” for reversals.

2. Start Small or Use Demo Accounts

- Test strategies with micro-positions or on a demo to understand how quickly things move at 2000x.

3. Monitor Market Volatility and Spreads

- High leverage amplifies slippage and spread risk—trade only in highly liquid markets and avoid volatile news events.

4. Stay Emotionally Disciplined

- Set your loss limits in advance.

- Walk away after a big win or loss—emotional trading is magnified at high leverage.

5. Use Platform Tools

- CoinUnited.io provides stop-loss, margin auto-close, and real-time risk alerts.

- Always enable 2FA and use withdrawal whitelisting for account security.

Section 7: Is It Hype or Real Opportunity?

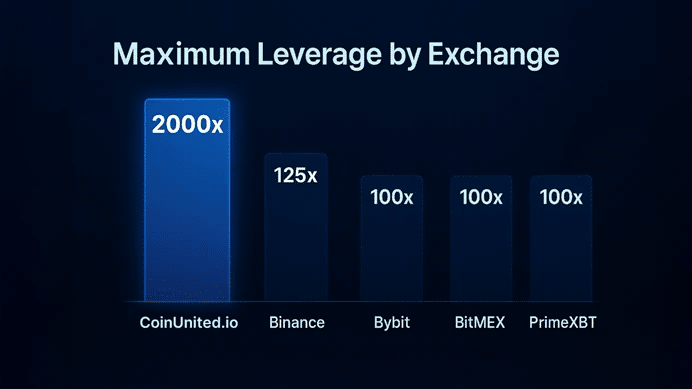

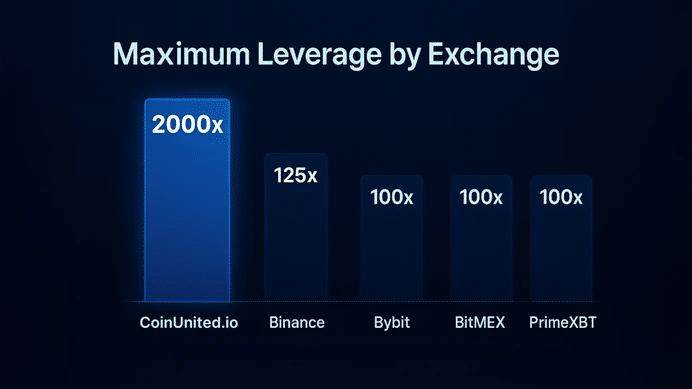

How Does 2000x Leverage Compare?

- CoinUnited.io: Up to 2000x leverage

- Binance: Max 125x

- Bybit: Up to 100x

- BitMEX: Up to 100x

- PrimeXBT: Up to 100x

No other major regulated platform offers 2000x leverage. For advanced traders, it’s a genuine differentiator.

Pros

- Unmatched capital efficiency

- Unique for professional short-term strategies

- Flexible platform features and asset selection

Cons

- Liquidation risk is almost immediate

- Not suitable for most retail traders

- Requires perfect execution, fast reflexes, and strict discipline

Conclusion:

“2000x leverage is real and available on CoinUnited.io, but only true professionals with robust systems should even consider it. For most, lower leverage provides a better risk/reward balance.”

Section 8: Why CoinUnited.io is Leading in Leverage Innovation

CoinUnited.io stands at the forefront of leverage innovation. Here’s how CoinUnited.io leverage is reshaping the industry:

1. Unmatched Leverage Offering

- Only platform to provide up to 2000x leverage on select crypto pairs

- Attracts professional and algorithmic traders seeking unique tactical opportunities

2. Superior User Experience

- Advanced UI/UX designed for speed, clarity, and control

- Real-time order execution with robust risk management tools

3. Global Reach, Local Support

- Accessible from 160+ countries

- Multilingual customer support, deep liquidity, and high reliability

4. Cutting-edge Security

- Multi-signature cold storage, insurance, and best-in-class compliance

- Certifications such as ISO 27001/SOC 2 ensure user trust

The CoinUnited.io leverage advantage is clear: extreme flexibility, industry-leading risk infrastructure, and relentless innovation. This is why CoinUnited.io continues to attract sophisticated traders seeking the sharpest edge.

Conclusion & Call to Action

Ultra-high leverage is not a shortcut to riches—it’s a tool for professionals with deep market knowledge and a robust risk management plan. 2000x leverage amplifies both potential gains and losses at a speed that leaves no room for error.

CoinUnited.io is one of the only platforms to offer this feature, but success with such tools comes down to skill, preparation, and responsibility. If you’re an advanced trader ready to explore the future of leverage, register on CoinUnited.io today—but do so with your eyes wide open and your risk controls firmly in place.

FAQ

Is 2000x leverage real or a scam?

Yes, 2000x leverage is real and available on CoinUnited.io and a handful of other platforms. However, this is an extremely high-risk tool. Most exchanges cap leverage at 100x–125x for safety. If any platform offers higher leverage, ensure you understand the risks and check for independent reviews and regulatory status.

Which exchanges offer the highest crypto leverage?

- CoinUnited.io: Up to 2000x leverage (highest in the industry)

- Binance: Up to 125x

- Bybit, BitMEX, PrimeXBT: Up to 100x

How can I manage risk with ultra-high leverage?

- Never risk more than 1% of your capital per trade

- Use strict stop-losses and avoid emotional trading

- Practice on a demo or with micro-positions before going live

- Only use ultra-high leverage in highly liquid, stable markets

What is CoinUnited.io leverage compared to others?

CoinUnited.io leverage stands out at 2000x, far surpassing the 100x–125x norm of other major exchanges. This unique offering makes CoinUnited.io a destination for advanced traders, but the risk profile is much higher—so it’s only for those with significant experience and risk controls in place.

Final Thoughts

Ultra-high leverage, like the 2000x offered by CoinUnited.io, is not for the faint of heart. It’s a specialized tool for a very specific type of trader. If you’re ready, disciplined, and prepared—explore CoinUnited.io leverage responsibly and see how far your trading edge can take you.

Interested? Experience the future of leveraged trading at CoinUnited.io today.