In stock analysis, momentum indicators often tell a deeper story than price alone. The Relative Strength Index (RSI)—especially the 14-day version—is one of the most relied upon metrics to detect whether a stock is overheated or undervalued. But what if you could access this insight in a single cell, using only Google Sheets? That’s exactly what the Google Finance Single Cell 14-Day RSI Formula for Sheets empowers you to do.

This isn’t just about formulas. It’s about decision velocity—how quickly you can assess, interpret, and act. Whether you’re a casual trader building your first dashboard or a data-savvy analyst orchestrating macro views, the ability to calculate RSI within Google Sheets means you’re wielding both simplicity and power.

What Is RSI, and Why the 14-Day Period?

RSI, or Relative Strength Index, is a momentum oscillator introduced by J. Welles Wilder in 1978. It measures the magnitude of recent price changes to assess whether a stock is overbought (above 70) or oversold (below 30). A 14-day RSI is standard across platforms because it smooths short-term volatility without sacrificing responsiveness. It’s like tracking heart rate—not every beat, but enough to catch a trend.

RSI values help gauge the strength of a stock’s price movement, giving you a clearer picture of whether the price action is driven by genuine momentum or just short-term noise.

—Welles Wilder, creator of RSI

The 14-day RSI specifically blends immediacy with reliability. Shorter RSIs can whipsaw with every market twitch; longer ones become sluggish. The 14-day window strikes a functional balance.

Decoding the Google Finance Single Cell 14-Day RSI Formula for Sheets

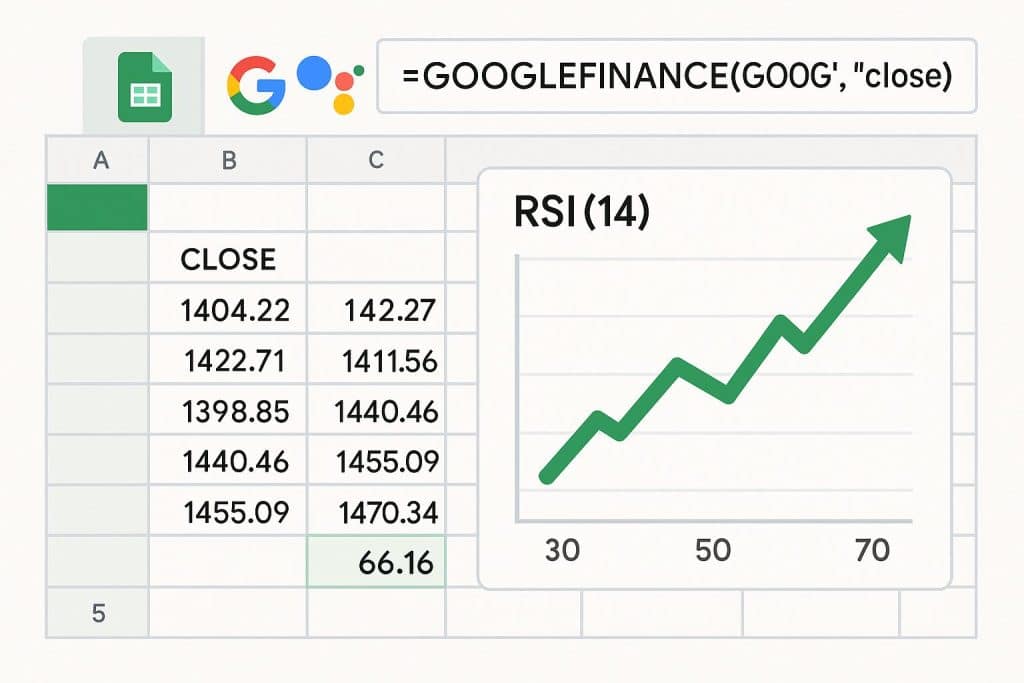

Google Sheets doesn’t offer RSI natively, but you can replicate it using a clever combination of Google Finance data and spreadsheet logic. Here’s a sample formula you can use inside a single cell:

=100 – (100 / (1 + (AVERAGE(IF(B2:B15>B1:B14,B2:B15-B1:B14,0)) / AVERAGE(IF(B2:B15<B1:B14,B1:B14-B2:B15,0)))) )

This formula:

- Uses 14 recent data points (usually closing prices) from Google Finance.

- Calculates gains and losses by comparing each day’s close to the previous day.

- Applies the RSI formula: RSI = 100 – [100 / (1 + RS)]

The result? A value between 0 and 100 that updates dynamically based on real-time or near-real-time data.

7 Powerful Benefits of This Formula Inside Google Sheets

1. Instant RSI Tracking Without Paid Tools

No need for third-party subscriptions like TradingView or MarketSmith. Using Google Finance and built-in Sheet functions, you can track RSI free of cost. This is especially ideal for budget-conscious individual investors or educators designing learning tools.

2. Custom Dashboards for Multiple Assets

Want to watch 10 stocks at once? You can build a personalized dashboard where each ticker has its own RSI cell. Apply conditional formatting to highlight RSI levels beyond 70 (overbought) or below 30 (oversold), and you’ve got visual alerts baked in.

3. Real-Time Data Feed via Google Finance

Google Sheets pulls live or slightly delayed data straight from Google Finance. You can pair this with the =GOOGLEFINANCE(“TICKER”,”close”,start,end) function to feed your RSI calculations in real time.

Google Finance’s real-time data stream combined with spreadsheet logic allows even beginner investors to perform technical analysis that was once the realm of pros.

—Finance tech educator, YouTube channel “Data Trades”

4. Learn-by-Building: Deepen Your Technical Analysis Skills

Implementing this RSI formula is an exercise in hands-on learning. It forces you to understand how gains and losses are calculated, and how averages of each feed into RSI. This builds genuine skill—not just reliance on software dashboards.

5. Lightweight & Shareable: Perfect for Team Collaboration

Google Sheets is inherently collaborative. You can share your RSI dashboard with colleagues or trading communities. Everyone sees the same version, in real-time. That’s perfect for group learning or co-managed portfolios.

6. Easy to Automate With Google Apps Script

If you want even more control, integrate your RSI formula with Google Apps Script. Set alerts, trigger email notifications, or update charts—all automatically. You’re building your own low-code financial tool.

7. Excellent for Strategy Testing and Historical Backtesting

You can test trading strategies by applying the formula to historical price data. How did a certain stock behave when RSI hit 30? What happened when it crossed 70? This is a playground for backtesting without writing a single line of Python.

Step-by-Step: How to Implement the 14-Day RSI in Google Sheets

| Step | Action |

|---|---|

| 1 | Open a new Google Sheet |

| 2 | Use =GOOGLEFINANCE(“AAPL”, “close”, TODAY()-30, TODAY()) to fetch 30 days of closing data |

| 3 | Label your closing prices in Column B, with date in Column A |

| 4 | In Column C, calculate daily gains/losses |

| 5 | Apply the RSI formula to rows 2–15 using logic as described above |

| 6 | Format the RSI cell to 2 decimal places for clarity |

| 7 | Add conditional formatting for RSI <30 or >70 |

With minimal effort, you’ve created a self-refreshing RSI calculator. Update the ticker and the entire view shifts with it.

Limitations to Be Aware Of

- Delay in Data: Google Finance is not 100% real-time for all markets. Prices may lag slightly.

- Volatility Sensitivity: RSI can be affected by sudden price jumps or dips, especially in small-cap or crypto assets.

- No Built-In RSI: The formula must be custom-built every time; there’s no plug-and-play function.

External Resources

This content is for informational and educational purposes only. It is not financial advice. Always consult a licensed advisor before making investment decisions.

FAQs

1. Can I apply this RSI formula to cryptocurrencies?

Not directly with Google Finance, as it doesn’t support crypto. You’ll need a third-party API or add-on like CoinGecko Sheets plugin.

2. Is this suitable for live day trading?

Not really. The data can be delayed. It’s better suited for swing trading, learning, or long-term position tracking.

3. How often does the RSI update in Google Sheets?

It refreshes whenever the sheet reloads or when cell data updates. However, update frequency depends on Google Finance’s refresh rate.

4. Can I automate RSI-based alerts?

Yes. Use Google Apps Script to trigger alerts (like sending an email) when RSI crosses a threshold you specify.

5. Is the formula hard to set up?

Once you’ve done it once, it’s copy-paste friendly. The logic is reusable—just update your data range and ticker.

Final Thoughts: Empowerment Through Simplicity

The Google Finance Single Cell 14-Day RSI Formula for Sheets isn’t just a formula—it’s a gateway. It lowers the technical barrier between you and sophisticated financial analysis. Whether you’re a DIY investor, a student of markets, or simply curious, this is a practical, powerful tool that lives where your data already does.

In a world obsessed with dashboards and platforms, sometimes the most empowering technology is a simple formula in a familiar cell.