The entrepreneurial journey comes packed with exhilarating opportunities and daunting challenges. While you’re busy building your dream business, overlooking legal considerations could derail your success faster than any market competition. Understanding and implementing proper legal safeguards will protect your business interests and set you up for sustainable growth.

1. Business Structure & Registration

Starting a business involves numerous moving parts, and legal compliance forms the backbone of a secure operation. The legal landscape constantly evolves, presenting new challenges for business owners. One significant concern many entrepreneurs face is dealing with regulatory violations.

Business owners must stay vigilant about compliance issues as they can escalate quickly. When authorities identify potential violations, they may issue an immediate threat suspension, requiring swift action to address the concerns. Beyond basic compliance, entrepreneurs must implement comprehensive legal strategies that safeguard their business interests while promoting growth.

For example, similar to an immediate threat suspension issued by the Massachusetts RMV when a driver poses a public safety risk, businesses may face sudden suspensions if they’re deemed a risk to public or financial safety. Maintaining a relationship with a legal advisor helps foresee and manage such risks, ultimately protecting the entrepreneur’s venture in the long term.

- Register your business structure appropriately (LLC, Corporation, etc.)

- Secure necessary permits and licenses

- Maintain accurate financial records

- Document all business relationships

2. Intellectual Property Protection

Trademark registration serves as a crucial first step in protecting your brand identity. Filing for trademarks, patents, or copyrights early helps prevent costly disputes later. Many entrepreneurs overlook this crucial step, only to face challenges when competitors try to capitalize on their innovations.

Patent protection requires thorough documentation and timely filing procedures. Maintaining detailed records of your innovation process strengthens your legal position. Regular patent portfolio reviews ensure the continued protection of your valuable innovations.

Here’s a comparison of common business structures and their legal implications:

| Business Structure | Liability Protection | Tax Treatment | Formation Complexity |

| Sole Proprietorship | None | Personal Tax | Low |

| LLC | Full | Pass-through | Medium |

| C-Corporation | Full | Double Taxation | High |

| S-Corporation | Full | Pass-through | High |

3. Risk Management & Insurance

Insurance coverage plays a vital role in protecting your business assets. Evaluate your specific industry risks and secure appropriate coverage. Professional liability, property insurance, and workers’ compensation form the foundation of a solid risk management strategy.

Cybersecurity and data protection laws demand serious attention in today’s digital landscape. Implement robust security measures and privacy policies to protect sensitive information. Regular security audits and updates help maintain compliance with evolving regulations.

4. Contract Management

Contract management requires careful attention to detail and clear terms. Work with experienced legal professionals to draft and review important agreements. Clear contracts prevent misunderstandings and provide protection when disputes arise.

Vendor and supplier relationships benefit from well-documented agreements that outline expectations, deliverables, and dispute resolution procedures. Regular review and updates ensure these relationships remain legally sound and mutually beneficial. Building trust through transparent communication strengthens these partnerships.

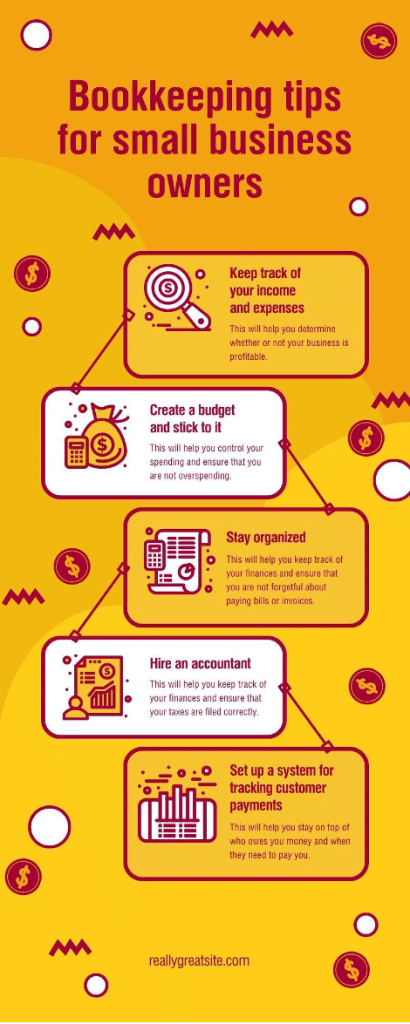

5. Financial Compliance

Proper bookkeeping practices protect your business during tax audits and financial reviews. Regular financial record updates and backup systems prevent costly documentation issues. Professional accounting support ensures compliance with tax regulations and reporting requirements.

Budget allocation for legal compliance helps prevent costly oversights and violations. Regular review of financial procedures ensures continued adherence to regulatory requirements. Professional financial guidance strengthens your business’s legal position.

6. Employment Law Compliance

Creating comprehensive employment agreements and maintaining clear communication channels with your team form the foundation of sound employment practices. Proper hiring procedures, workplace policies, and employee documentation help prevent costly legal disputes. Regular training and updates ensure ongoing compliance with labor laws.

Cross-border hiring and remote work arrangements require additional legal considerations. Understanding different jurisdictional requirements prevents costly employment complications. Professional guidance in employment matters ensures proper compliance across all operations.

7. Digital & Privacy Compliance

Modern businesses must navigate complex digital privacy regulations across different jurisdictions. Implementation of proper data handling procedures protects both your business and customer information. Regular staff training on privacy compliance reduces the risk of costly violations.

Website terms of service and privacy policies require regular updates to maintain compliance. Clear communication of data collection practices builds customer trust and meets regulatory requirements. Regular audits of digital operations ensure ongoing compliance with evolving privacy laws.

Other Important Considerations

International Business Operations

Cross-border transactions require careful attention to international trade laws and regulations. Understanding different jurisdictional requirements prevents costly legal complications. Professional guidance in international business matters ensures proper compliance.

Currency exchange and international payment regulations demand careful documentation and compliance. Regular review of international business practices ensures continued legal compliance. Professional support in international matters protects your global business interests.

Industry-Specific Regulations

Different industries face unique regulatory challenges and compliance requirements. Staying current with industry-specific regulations requires regular monitoring and updates. Professional guidance in your specific sector helps navigate complex regulatory frameworks.

Business Succession Planning

Creating a clear succession plan protects your business’s future operations and stakeholders. Regular updates to succession plans ensure they remain relevant as your business evolves. Professional guidance helps structure effective transition strategies.

Moving Forward

Smart entrepreneurs recognize that legal compliance isn’t just about avoiding problems – it’s about creating a strong foundation for growth. Regular legal reviews and updates help identify potential issues before they become serious problems. Implementing preventive measures saves significant resources in the long run.

Take action today to strengthen your business’s legal position:

- Review your current legal documentation

- Schedule consultations with relevant professionals

- Create a compliance calendar

- Implement recommended security measures

Conclusion

Investing in strong legal protection early on will save you both time and money. Don’t leave these crucial aspects of your business until something goes wrong. These practical legal guidelines will help you to construct an extra resilient, profitable enterprise.

Be proactive in the legal approach you utilize and keep monitoring how your needs will change as your business grows. As the legal landscape changes, stay informed, and make informed decisions as they relate to the future of your company’s future. Try looking at professional organizations or networking groups, learn from other entrepreneurs’ experiences, and stay in touch with industry-specific legal requirements.

Frequently Asked Questions

When should I engage a business attorney?

Use legal counsel when first setting up in business, when contacting major matters, when negotiating a contract, and especially when entering disputes and in front of the government.

How often should one check whether the business is legal or not?

Conduct quarterly reviews of basic compliance and annual comprehensive legal audits. Stay informed about regulatory changes in your industry.

What legal documents should every business maintain?

Business registration, licenses, permits, contracts, employment agreements, financial records, and insurance policies are the essential documents.