Remote work has opened up incredible opportunities for businesses everywhere. With just a few clicks, you can tap into a global talent pool — hiring a brilliant developer from Brazil, a customer support star from the Philippines, or a creative marketer in South Africa.

But while the world feels smaller, the challenges of hiring across borders are very real — and often underestimated.

Hiring remote workers internationally isn’t just about finding someone online and sending them money each month. It’s about navigating a maze of laws, taxes, contracts, and cultural expectations.This is precisely why partnering with a global hiring expert like Hire Overseas is beneficial.

If you don’t handle it properly, your company could face penalties, lawsuits, tax trouble, or even damage to your reputation.

In this guide, we’ll walk you through the most common risks of hiring remote workers internationally — and show you practical steps to avoid them.

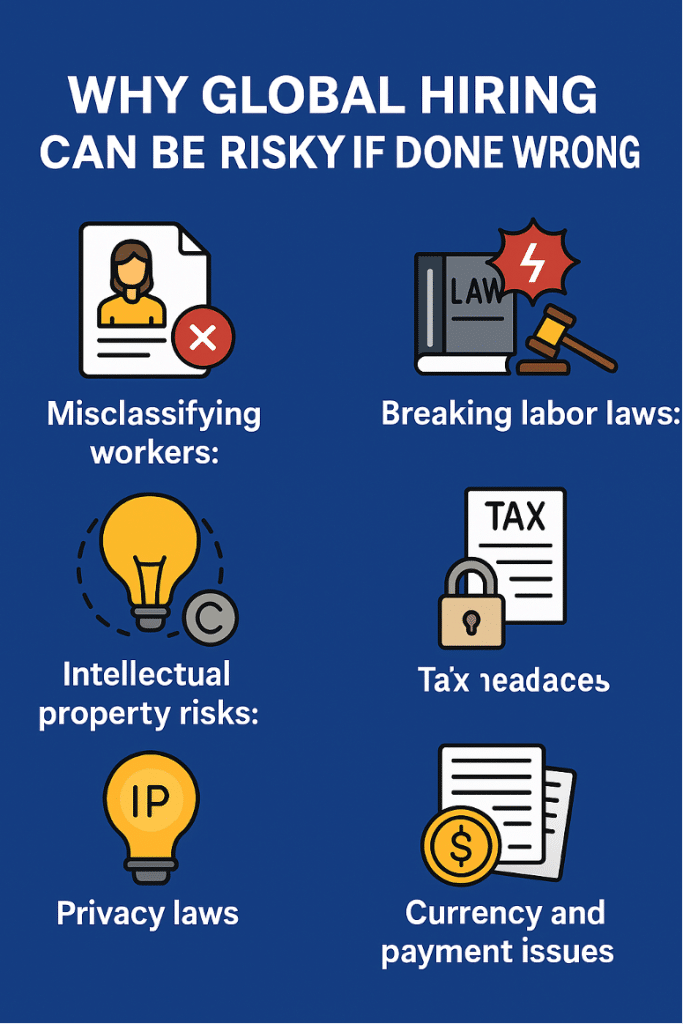

Why Global Hiring Can Be Risky If Done Wrong

For many businesses, the first mistake is assuming that hiring someone abroad is as simple as paying them as a freelancer. Unfortunately, that’s rarely the case.

Here are some of the key risks you need to know about:

- Misclassifying workers: Many businesses treat full-time remote workers as independent contractors. But in many countries, if someone works like an employee — fixed hours, under your control, doing core business tasks — the local government may legally see them as an employee. This can result in back taxes, penalties, and legal trouble.

- Breaking labor laws: Every country has its own rules about working hours, minimum wage, paid leave, termination rights, and more. Ignoring these laws — even by accident — can get you in hot water.

- Tax headaches: When you hire internationally, you might need to pay taxes, withhold social contributions, or even register your company in another country. If you don’t, you could end up with a big tax bill or fines.

- Intellectual property risks: Without the right contracts, you might not even legally own the work your remote team creates. That’s a nightmare scenario for many businesses.

- Privacy laws: Many countries (like those in the EU) have strict rules about how you collect and store employee data. Breaking these laws can lead to big fines.

- Currency and payment issues: Fluctuating exchange rates, hidden fees, and delays can create payment problems — frustrating your remote team and damaging trust.

The good news? With some planning and the right approach, you can hire globally and avoid these risks.

Common Mistakes Businesses Make (and How to Avoid Them)

Let’s talk about some of the most frequent mistakes companies make when hiring remote workers internationally — and what you can do differently.

1. Treating Everyone as a Contractor

This is probably the most common mistake.

Just because you label someone a “contractor” doesn’t mean they actually are one in the eyes of the law.

If you set their hours, provide their tools, and control how they do their work, many countries will legally consider them an employee — and you could be responsible for taxes, benefits, and more.

✅ What to do instead:

Decide upfront whether the role is truly independent or more like an employee. If it’s the latter, consider hiring them through an Employer of Record (EOR) or setting up a legal entity.

2. Using Generic Contracts

Many companies use the same generic contract for all remote workers — or worse, no contract at all.

This can leave you exposed if disputes arise or if the worker claims employment rights.

✅ What to do instead:

Draft contracts that are specific to the worker’s country and the nature of your relationship. Include clear terms about intellectual property, confidentiality, termination, and compliance with local laws.

3. Ignoring Local Taxes and Benefits

Some countries require you to withhold taxes or pay into social security or health funds — even if your worker is remote. Failing to do this can lead to fines.

✅ What to do instead:

Understand what taxes and benefits apply in the worker’s country. If you’re unsure, consult a local expert or use a global payroll service.

4. Overlooking Permanent Establishment Risk

If you hire workers in another country, you might inadvertently create a “permanent establishment” — a taxable presence — in that country. This could subject your company to corporate taxes there.

✅ What to do instead:

Limit business activities in that country and get advice if you plan to hire multiple employees or managers there.

5. Not Protecting Your Intellectual Property

Without proper agreements, the work your remote team creates may legally belong to them, not you.

✅ What to do instead:

Include clear IP assignment clauses in your contracts to ensure you own what your team produces.

How to Hire Internationally — The Right Way

Now that we’ve covered the risks and mistakes, here’s a step-by-step guide to hiring remote workers across borders safely and effectively.

Step 1: Do Your Homework

Before you even start recruiting, research:

- What are the local labor laws?

- Are there restrictions on hiring foreign companies?

- What taxes and benefits are required?

- Are there cultural or logistical considerations?

This helps you avoid surprises later.

Step 2: Choose the Right Engagement Model

You generally have three options:

- Hire as a contractor: Best for short-term or project-based work. Make sure they’re genuinely independent.

- Hire through an Employer of Record (EOR): A third-party service that legally employs the worker in their country while you manage them day-to-day. They handle compliance, payroll, and taxes.

- Set up your own legal entity: More complex and costly, but gives you full control. Usually only makes sense if you plan to hire many employees in one country.

Step 3: Draft a Country-Specific Contract

Don’t rely on a one-size-fits-all template.

Your contract should:

- Clearly define the role and responsibilities.

- Include confidentiality and IP ownership clauses.

- Outline payment terms and benefits.

- Respect local laws (e.g., notice periods, working hours).

Step 4: Protect Your Intellectual Property

Make sure your contract specifies that all work created belongs to your company. This is crucial for software, designs, inventions, and any creative output.

Step 5: Stay on Top of Taxes and Contributions

Understand what taxes need to be withheld and what social benefits you’re required to pay. Even if you’re hiring a contractor, some countries have obligations you must meet.

Step 6: Respect Data Privacy

If you collect, store, or share employee data, make sure you comply with privacy laws like GDPR in the EU or similar regulations elsewhere. Only collect what you need and keep it secure.

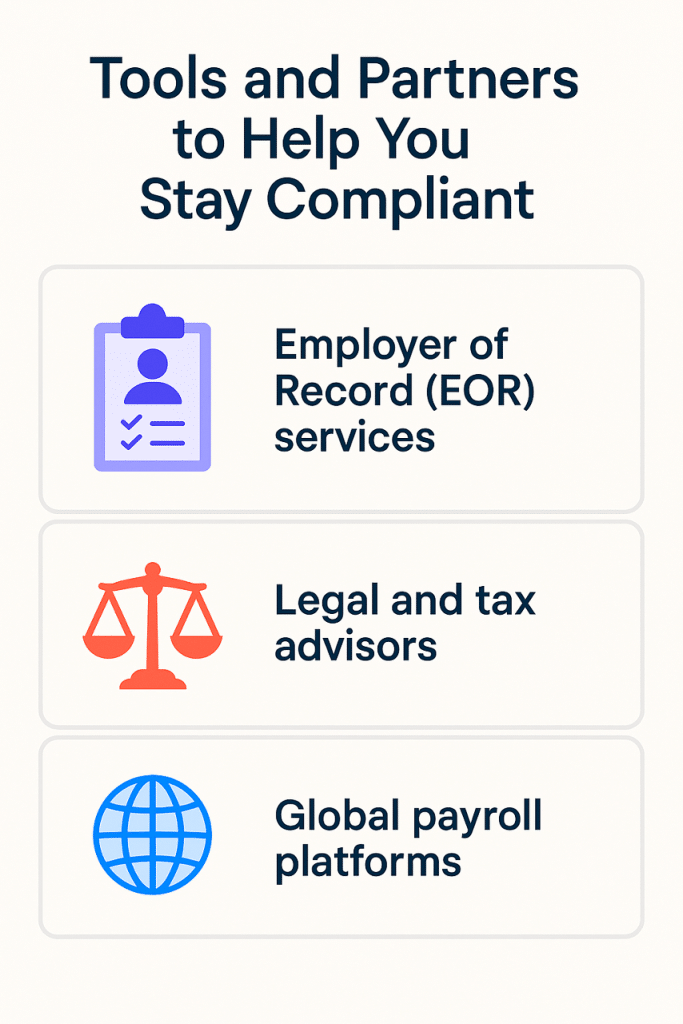

Tools and Partners to Help You Stay Compliant

Thankfully, you don’t have to do all of this on your own.

Here are some types of partners and tools that can help:

- Employer of Record (EOR) services: Companies like Deel, Remote, and Oyster take care of compliance, payroll, and benefits — so you can focus on managing the person, not the paperwork.

- Legal and tax advisors: Especially useful if you’re hiring in a complex jurisdiction or planning to set up a legal entity.

- Global payroll platforms: Automate payments, withhold taxes correctly, and keep records.

When choosing a partner, compare costs, coverage, and their understanding of your target countries.

Real-World Examples

To make it more concrete, here are two quick stories:

The Pitfall

A US startup hired three full-time “contractors” in France. They worked fixed hours, only for this company, with no real independence. After two years, one worker sued for employment benefits — and won. The startup had to pay thousands in back pay, taxes, and penalties.

The Success

An e-commerce business wanted to expand into South America. They used an Employer of Record to hire a team in Colombia. The EOR handled contracts, taxes, and compliance. The company scaled quickly without worrying about legal issues.

Actionable Checklist: Before You Hire Internationally

✔ Define the role and determine if it’s contractor or employee.

✔ Research the country’s labor laws, taxes, and benefits.

✔ Choose the right engagement model (contractor, EOR, or entity).

✔ Draft a locally compliant contract with IP and confidentiality clauses.

✔ Set up proper payroll and tax processes.

✔ Protect and secure employee data.

✔ Consider professional help or a trusted partner.

✔ Keep good records and review compliance regularly.

Conclusion

Hiring remote workers internationally can be a fantastic way to grow your business, bring in diverse talent, and stay competitive.

But cutting corners or assuming it’s “just like hiring at home” can lead to serious — and expensive — mistakes.

By understanding the risks and taking proactive steps, you can build a strong, compliant, and happy global team.

Do your homework, use the right contracts, and don’t hesitate to lean on experts and tools to help you navigate this matter.

Because when done right, hiring globally isn’t just safe — it’s a huge advantage.

If you’re ready to build your international team or have questions about compliance, feel free to reach out or share your experiences in the comments below. Together, we can make global hiring easier and smarter for everyone.