Small factories don’t get much love in headlines, but they’re the quiet engine under the hood of American manufacturing. They’re scrappy, fast on their feet, and stubborn in a good way. While the giants chase scale with bloated org charts and layers of middle managers, these smaller players are out here getting things done, keeping cash flow strong, and shipping products while everyone else is tied up in meetings.

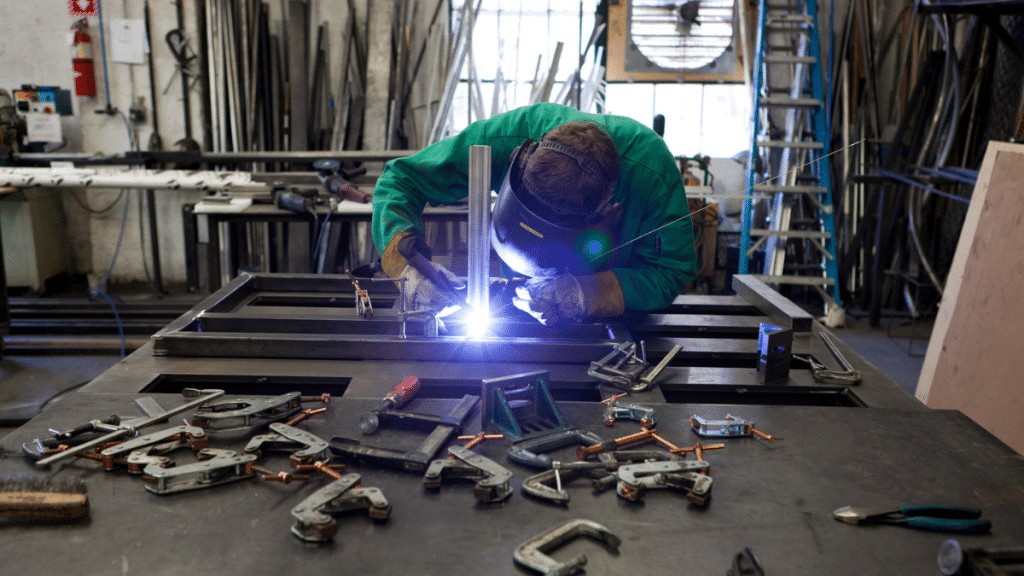

It’s not always pretty. Some of these shops are in converted barns or old cinderblock buildings that have seen better days. The owners wear a few too many hats and probably haven’t taken a vacation since the Bush administration. But they’re still standing, and in many cases, they’re growing in ways the big players envy, all without leaning on hype or debt-fueled expansions they can’t afford.

Staying Nimble When The Big Guys Can’t Turn The Ship

A Fortune 500 manufacturer can’t pivot fast. They have committees, protocols, and press releases to draft before making a move. Meanwhile, a small plastics shop in Ohio can shift from one customer to another within days, reroute supply chains, and adjust prices with a phone call. This agility matters when disruptions hit, whether it’s a raw materials shortage or a sudden regulatory change that catches everyone else flat-footed.

They’re also unafraid to try direct-to-customer sales when distributors get too greedy, or test out niche products for small but profitable markets. For a small factory, a new revenue stream that adds just $200,000 a year can transform the bottom line. The giants can’t see numbers that small as worth the effort, so they ignore these opportunities. That’s where the smaller shops thrive.

How Small Shops Are Using Technology Without Losing Their Soul

There’s a sweet spot between adopting new tech and drowning in it. Small factories are finding it. They’re not the types to hire a consultant just to feel like they’re “innovating.” Instead, they look for a system that makes sense, test it quietly, and keep what works.

One shop might invest in a used CNC machine, pairing it with a simple sensor system that tracks uptime. Another might use a low-cost cloud-based inventory tool instead of an expensive ERP suite. They’re cautious, but not afraid. And it’s working, because it supports business growth strategies instead of becoming another management headache.

A few have even jumped ahead of the curve with machine learning tools for predictive maintenance, but they’re not doing it for the press release. They’re doing it because downtime costs them real money they can’t hide behind a padded quarterly report.

Turning Accounting Into An Advantage

Here’s where it gets surprisingly interesting: manufacturing accounting is becoming a competitive edge for these small players. It’s not about creative bookkeeping or tax dodging. It’s about knowing exactly how much it costs to make each part, how long it takes, and where cash flow gets stuck.

Small factories often have the owner or a sharp, long-time bookkeeper watching numbers like a hawk, tracking labor down to the minute and knowing which orders are worth taking and which should be declined, even if it means saying no to a big-name client. They know which supplier terms are non-negotiable and which can be leaned on during a tough month.

This kind of hands-on accounting makes it possible to undercut larger competitors on price while still keeping a healthy margin, especially when the big players’ overhead quietly eats them alive. It’s not romantic or headline-friendly, but it’s how small factories outlast flashier competitors who lose track of what it really costs to keep the lights on.

Building Relationships, Not Just Supply Chains

A small factory’s supplier relationships are personal. The owner of a tool-and-die shop knows the steel supplier’s rep by name and calls him directly if a delivery is delayed. If there’s a problem, they fix it over coffee or a quick call, not a months-long arbitration process.

This trust goes both ways. During supply chain chaos, some suppliers prioritize these smaller clients because they know they pay on time, aren’t jerks to deal with, and actually pick up the phone. It’s a quieter way of doing business, but it builds resilience that a big procurement department can’t always match.

This extends to customers too. Small factories keep clients because they’re responsive, flexible, and invested in getting things right the first time. While big manufacturers rely on contracts and scale, small shops rely on relationships that can weather a storm when the economy gets weird.

When Small Means Strong

There’s a myth that getting bigger is the only path to success in manufacturing. Sure, some small shops grow into regional powerhouses. But many don’t want to, and that’s not a failure. For a lot of these owners, steady profits, loyal customers, and a business that supports their workers and community is the real win.

They’re hiring, training, and retaining workers without the hollow promises of trendy perks. They’re investing in smart upgrades, not flashy expansions. They’re tracking costs, not chasing hype. In a world where manufacturing headlines are dominated by billion-dollar investments, robot automation spectacles, and glossy ESG commitments, these small factories are out here actually making things—and making money doing it.

What Stays Standing

When economic cycles hit hard, the small factories that know their numbers, keep their promises, and move quickly often stay standing while bigger players scramble to restructure. It’s not glamorous, and it rarely makes the cover of a business magazine, but it’s real.

They’re not trying to take over the world. They’re trying to run a good business, support the people who work there, and keep the machines humming. That’s how they quietly outsmart the big guys—and how they’ll keep doing it for a long time to come.