Introduction: The Enduring Role of Stablecoins in the Digital Economy

Stablecoins have quietly become one of the most important parts of the digital finance world. Unlike cryptocurrencies like Bitcoin or Ethereum, which are known for their dramatic price swings, stablecoins are built to stay—well—stable. That makes them incredibly useful. They help users move money around quickly, provide a steady base in volatile markets, and act as a bridge between traditional currencies and the crypto universe.

Among all stablecoins, Tether (USDT) stands out as the most widely used and traded. Since launching in 2014, it has dominated the space in terms of liquidity, availability, and adoption.

In this report, we’ll take a close look at Tether’s price outlook for 2025 and tackle the key question: Will USDT go up next year? To answer that, we’ll explore how USDT works, what the current market looks like, what kinds of regulations might affect it, and what risks are involved. The goal is to offer a well-rounded view of where USDT could be headed—and what that means for crypto investors, traders, and the ecosystem as a whole.

What Is USDT and How It Works

Launched in 2014 by Tether Limited, Tether (USDT) is a stablecoin built to maintain a 1:1 value with the U.S. dollar. It was created to offer crypto users a reliable alternative to the wild price swings seen in coins like Bitcoin and Ethereum. What sets USDT apart is its promise of stability—each token is meant to be backed by real-world assets, such as cash and cash equivalents.

At the heart of this system is a reserve-backed model. According to Tether Limited, every USDT token in circulation is fully supported by assets held in reserve. These typically include cash, short-term securities, and other liquid financial instruments. The mechanism works through two main processes: minting and redemption. When someone deposits U.S. dollars with Tether, new USDT tokens are created and released into circulation. On the flip side, when users redeem their USDT, the tokens are destroyed—or “burned”—and the equivalent amount in fiat currency is returned. This method is designed to keep the total supply of USDT aligned with its underlying reserves, ensuring the crucial 1:1 peg remains intact.

What also makes USDT so widely used is its flexibility across multiple blockchains. Originally launched on Bitcoin’s Omni Layer, Tether has since expanded to major platforms like Ethereum, Tron, Binance Smart Chain, Solana, and Algorand. This broad compatibility allows USDT to offer faster, cheaper transactions and better integration with DeFi protocols—helping it stay relevant in a fast-evolving market.

But Tether’s impact goes beyond just price stability. It plays a key role in boosting market liquidity, acting as a safe haven during crypto volatility, and enabling efficient cross-border payments. Thanks to its adaptability and continuous innovation, USDT has become a cornerstone of the digital asset ecosystem—and its presence isn’t fading anytime soon.

Understanding USDT’s Price Stability: Why Growth Isn’t the Goal?

Tether (USDT) is purpose-built to maintain a steady 1:1 value with the U.S. dollar. Its main mission isn’t to increase in price but to provide price stability. Unlike cryptocurrencies such as Bitcoin or Ethereum, which many buy hoping for price gains, USDT is designed to be a reliable store of value—a safe harbor amid the market’s ups and downs.

Because of this, any sustained price rise above $1 would actually go against what USDT is meant to do. Stablecoins like USDT aren’t tools for speculation or profit through rising prices; their value comes from minimizing fluctuations and offering predictability in volatile markets. So, expecting USDT’s price to climb significantly misunderstands its core function.

That said, on rare occasions, USDT has temporarily drifted from its dollar peg during moments of extreme market stress or liquidity crunches—for example, it briefly traded around $0.95 in May 2022. But these instances don’t last long. Thanks to savvy traders and market mechanisms, prices quickly bounce back. Arbitrageurs step in to buy undervalued tokens or sell when prices edge above $1, restoring balance.

This self-correcting dynamic ensures USDT stays tightly linked to the dollar. If it ever stays above $1 for an extended period, it wouldn’t signal growth potential but rather a deeper imbalance—reinforcing the fact that USDT’s purpose is transactional stability, not investment returns.

Is It Worth Holding USDT for Profit?

Holding Tether (USDT) isn’t about hoping the price will go up—it’s about using a stable, reliable asset in an often unpredictable crypto market. USDT acts like a safe haven for investors during times of high volatility, letting them protect their capital without the hassle and delays that come with converting back to traditional currencies.

Even though USDT isn’t designed to grow in value, there are ways to earn indirectly by holding it. For example, many investors put their USDT into interest-bearing accounts on centralized exchanges or decentralized finance (DeFi) platforms, generating returns over time. Plus, occasional small price swings around the $1 peg create arbitrage opportunities—clever traders can profit from these short-term market quirks.

Beyond serving as a stable store of value, USDT plays a crucial role in helping traders move and rebalance more volatile cryptocurrencies. In this way, it’s not just a tool for hedging risk but also a foundation for earning yield and liquidity in the broader crypto economy. That practical utility is what makes USDT such an important part of decentralized finance today.

What Investors Should Know

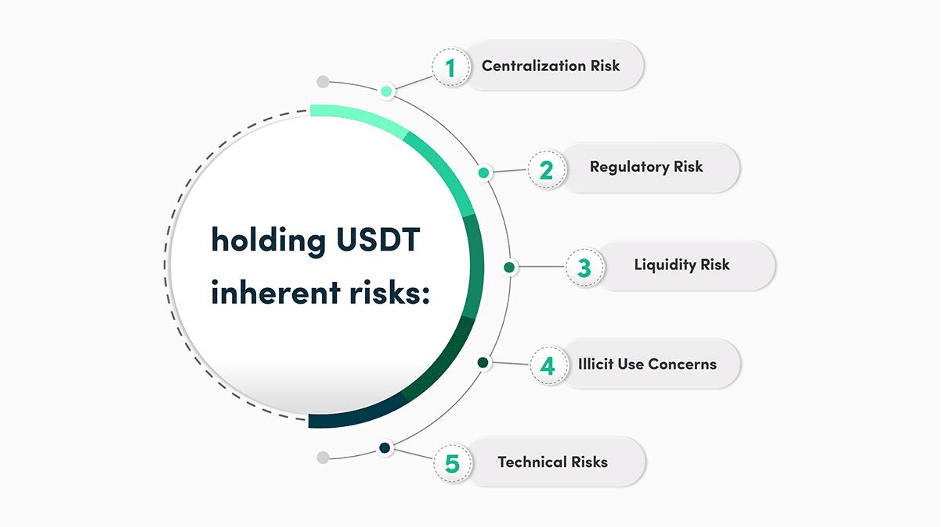

Investing in Tether (USDT) comes with both clear advantages and important risks. While USDT offers price stability, high liquidity, and widespread use across exchanges and DeFi platforms, it also involves certain challenges related to centralization, regulatory oversight, and technical vulnerabilities. Before investing, it’s crucial to understand these factors:

1. Reserve Transparency and Audits

Tether says every USDT token is backed by reserves, mostly in liquid assets like U.S. Treasury bills. As of March 2025, about 81.5% of these reserves (around $149.3 billion) were held in cash, cash equivalents, or short-term deposits. Instead of full audits, Tether publishes attestation reports from BDO Italia to show that assets cover liabilities. While this isn’t perfect transparency, it aims to address past concerns and ongoing regulatory scrutiny.

2. Regulatory Landscape

USDT is facing increasing regulation worldwide. For example, the EU’s Markets in Crypto-Assets (MiCA) framework and the U.S. GENIUS Act impose strict rules on stablecoins, requiring full asset backing and licensing. Tether has expressed criticism of some MiCA provisions and is reportedly working on a new stablecoin compliant with U.S. laws. These evolving rules may result in region-specific versions of stablecoins and create some complexity—but also bring clearer legal paths forward.

3. Counterparty Risk

Because USDT is managed centrally by Tether Limited, investors face counterparty risk—their tokens’ value depends on Tether’s ability to honor redemptions. Past incidents, such as a $41 million fine from the CFTC in 2021 and a brief loss of peg during the 2023 banking crisis, highlight this vulnerability. Centralization allows Tether to respond quickly to issues and adapt to regulations, but it also clashes with the decentralized ideals many crypto users value, requiring a degree of trust in the company.

4. Technical and Security Risks

USDT operates on multiple blockchains, which exposes it to risks like smart contract bugs, hacks, and network congestion. Tether’s smart contracts have features that let them pause transactions, blacklist certain addresses, or upgrade code—giving the company more control but reducing decentralization. Additionally, users must be cautious about fake USDT tokens circulating in the market. This balance between decentralized infrastructure and centralized control is at the heart of USDT’s design—and its risk profile.

And finally Will USDT Go Up?

When we talk about Tether (USDT), it’s important to keep in mind what it’s actually designed for: being a stablecoin. Think of USDT as a digital version of the U.S. dollar, meant to always hold a steady 1:1 value with it. Its main job isn’t to get more expensive over time, but to provide a reliable way to exchange value and keep your money safe in the often unpredictable world of cryptocurrency.

So, if you ever notice USDT trading consistently above $1, that’s actually a red flag. It goes against the entire purpose of the coin and might signal deeper problems or instability in the market.

Now, sometimes you might see USDT’s price wobble a little—going just below or above that $1 mark. These moments, called “de-pegging” events, usually happen during times of market stress or when there’s a temporary mismatch between supply and demand. But here’s the good news: these fluctuations are almost always short-lived. Smart traders, known as arbitrageurs, quickly jump in to buy low or sell high, pushing the price back to where it belongs.

That’s why asking whether USDT will go up misses the whole point. The real value for investors lies not in price gains but in its rock-solid stability, ease of trading, and crucial role as a foundation for managing risk and engaging with decentralized finance

FAQs

Is USDT safe to hold?

USDT is generally considered safe due to its dollar peg, transparent reserve attestations, and high liquidity, but it carries risks related to centralization, regulatory changes, and technical vulnerabilities that investors should carefully consider.

Can USDT reach $2?

No, USDT is designed to maintain a stable value of $1 and is not intended or expected to reach $2.

Is USDT a good investment?

USDT is not a growth-oriented investment but rather a stability-focused asset used for preserving value, managing risk, and facilitating crypto trading; it’s best viewed as a tool rather than a means for generating returns.