Introduction

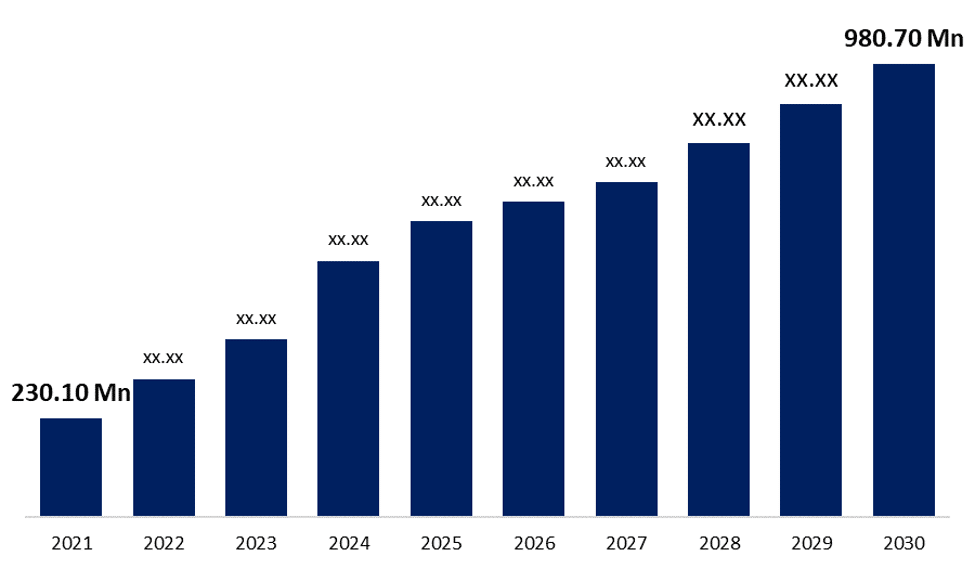

Decentralized finance (DeFi) is going to change fast. New tools, trends keep appearing every week, and even experts find themselves struggling. And now imagine how open and transparent the DeFi system could be combined with AI – one can read huge amounts of data, see patterns, and make predictions about the market movements.

If you are developing your exchange with a decentralized Exchange development company or considering DEX development services, using such trends powered by AI can help you stay ahead.

In this guide, you will have a clear understanding of why AI-driven DEXs could prove to be the next big jump in DeFi.

What Are AI-Powered DEXs?

AI-powered DEXs increase trade, security, and decision-making with artificial intelligence. These systems, like traditional DEXs, employ AI to detect fraud, automate trades, predict asset movements, and analyze market patterns.

Better order routing, improved liquidity management, and individualized trading experiences are made possible by AI integration into decentralized exchanges.

AI-Powered DEX platforms are turning into essential tools for traders looking for speed, accuracy, and smart risk mitigation, all while remaining decentralized and transparent.

Features of AI-Powered DEXs

AI-powered decentralized exchanges (DEXs) are making crypto trading smarter, faster, and safer for users. This is how AI maximizes modern DEX trade.

1. Smart Trade: AI posts best-priced deals using real-time market analysis. It minimizes slippage and latency, allowing traders to capitalize on fleeting opportunities and reduce human error.

2. Predictive Analytics: AI models are learning using past data and market trends to predict price fluctuations. Traders would be able to formulate informed investment opportunities on the basis of future predictions.

3. Personal User Experience: Based on user activity, AI will customize dashboards, trading recommendations, and instructional insights. This shows that the site is easy to navigate and allows rookie and experienced traders to interact with it.

4. Cash Flow Management: AI can change the liquidity pools and route the trades effectively. It minimizes slippage, eliminates balances, and makes the trade much easier even when there is much volume or fluctuating market conditions.

5. Gas Fee Optimization: AI finds the most cost-effective route and time for transactions. By preventing network congestion, it lowers gas expenses and speeds up trades without compromising reliability.

Use Cases of AI-Powered DEXs

AI-powered DEXs are improving market speed, efficiency, and transactions. Automation and decision-making are expanding retail and institutional trading prospects.

1. Daily Retail Trading

AI helps DEX traders understand market patterns, price volatility, and trading timing. Small investors can trade smartly with less risk and more earnings without technical knowledge.

2. Algorithmic Trading at Institutions

The purpose of AI development services in large-scale institutions on DEXs is to execute high-volume trades at a fast and accurate speed. AI algorithms can learn the market changes in real-time, minimizing slippage and making the most of volatile crypto markets.

3. Arbitrage and Liquidity Farming

The AI automatically arbitrages exchange price differences in real time. It also simplifies liquidity farming so users can acquire the maximum yield without constantly monitoring the market.

4. Fraud Detection

AI actively searches to detect suspicious transaction patterns and avoid fraudulent activities and compliance failures in transactions. This increases the confidence of traders and regulators in a decentralized trading system.

5. Portfolio Optimization

Tools based on AI can examine the performance of assets, the level of risk, and market conditions to propose the most advantageous portfolio combination. This assists traders in diversifying and attaining healthy returns in the long run.

Benefits of AI-Powered DEXs

Decentralized exchanges (DEXs) using AI are transforming the crypto trading sector by improving speed, security, and decision-making by establishing a more intelligent, safe, and efficient platform for traders worldwide.

- Trading efficiency: Automation of trade matching, price forecasting, and order execution via AI algorithms reduces delays and slippage. This will improve liquidity and speed, making trading seamless even in volatile markets.

- Greater Safety: AI identifies suspicious activity and threats in real-time, thus protecting users against scams and fraud. Users are able to trust the system without centralized control since the operations on the blockchain can be transparent.

- Cost-Effective Transactions: AI provides lower gas fees and trading routes, minimizing the cost of transactions on DEXs. It does not involve third parties, has automated most tasks, making it easy to trade, and saves on the amount spent on a single transaction.

Key Trends of AI in Decentralized Exchanges

By integrating AI in DeFi development solutions, DEXs are becoming smarter, safer, and more efficient. Whether it is possible to predict the prices or prevent fraud, the trends are defining what the trading platform will be like in the coming generations.

1. Predictive Market Analytics: Machine learning can anticipate market direction using historical data, news, and on-chain data. More accurate information helps traders make faster, more rational buy/sell decisions, reducing emotional trades and increasing profitability.

2. Fraud Detection and Security: Machine learning algorithms identify any suspicious behavior of a wallet and avoid wash trading or a carpet pull. This establishes trust among the users and eliminates the danger in the decentralized and permissionless markets.

3. AMM Optimization: AI increases the efficiency in the management of liquidity pools by changing the ratios of tokens and fees dynamically. This promotes its price stability by lowering slippage and earning higher by the liquidity providers.

4. Trading Strategies Customizations: AI can make personalized trading suggestions depending on the previous behavior of a trader, risk tolerance, and favorite assets. This customization makes trading more effective and minimizes the learning curve for new users.

Conclusion

AI-backed DEXs are not another DeFi fad whatsoever, but the next major evolution. They accelerate, secure, and make trading much smarter as they predict the market movements, detect fraud early in the trading process, and provide personal trading advice to you.

They also learn and get better after each trade, unlike traditional DEXs, so they perform better in the long run. AI is still developing, but it already affects how individuals perceive centralized trading.