Missed phone calls quietly siphon revenue from cleaning companies. A meaningful share of inquiries happens after hours and on weekends, when many teams aren’t staffed to answer. Those calls often go unanswered or unreturned fast enough—resulting in lost jobs, wasted ad spend, unhappy prospects, and reputational damage. Drawing on data from reputable CRMs, call-tracking providers, and cleaning-industry reports, this article shows the scope of the problem, what it costs, and the concrete steps you can take to plug the leak.

This report is brought by MissedCalls.help – AI Answering Service for Small Businesses which offers free setup of AI Agent and free 14 days trial for any business owner who would like to try to switch from outdated voicemails to moder AI Receptionists.

Why cleaning companies feel it more than most

Cleaning inquiries are time-sensitive: move-out dates, office openings, event cleanups, post-construction deadlines, urgent spills, and routine service that homeowners try to book after work. If your phone rolls to voicemail at 6pm, many prospects simply tap the next provider. Call-tracking leaders consistently find that prospects won’t wait after an unanswered call. In CallRail’s latest consumer survey, 78% of people have abandoned a business after an unanswered call—a direct path to lost revenue.

What the data says (and what it implies for cleaning)

- A big chunk of calls goes unanswered.

Across SMBs and home services, ~27–28% of inbound calls go unanswered. That’s more than one in four opportunities. - Weekends are a weak spot.

Home-services data shows 18% unanswered on weekdays but ~41% on weekends—exactly when many cleaning businesses are offline. Extrapolating to cleaning, weekend/after-hours coverage is likely your largest gap. - Phone is still a primary path to booking.

Consumers repeatedly start with a call for local services; when no one answers, they convert elsewhere. CallRail finds most consumers won’t retry after a missed ring; they move on. - Job values make each missed call costly.

Typical U.S. house-cleaning visit averages ~$209 (Thumbtack), with hourly rates around $50–55/hr. Commercial visits cluster around a $414 national average ticket (wide range by facility). Even a small number of lost bookings adds up. - Cleaning demand is steady—and measurable.

Jobber’s Home Service Economic Reports track the Cleaning segment specifically (e.g., new work scheduled vs. median revenue), showing sustained consumer demand and the value of operational responsiveness.

After-hours math (conservative):

If you field 120 calls/month and miss 27% (~32 calls), and even 40% of your total volume lands evenings/weekends (common in home services), then ~13 after-hours calls are likely going unanswered monthly. Convert just 20% of those into jobs at $209 average (residential), and you’re leaking ~$550/month—~$6,600/year—from after-hours alone. Raise average job value (deep cleans, move-outs, commercial) and the annual loss climbs quickly.

The hidden costs you don’t see on the P&L

- Wasted marketing spend. Ads and SEO that trigger calls after 6pm are lost if nobody answers; acquisition costs spike. Call analytics firms repeatedly flag missed calls as “wasted ad dollars.”

- Lost lifetime value. A first one-time clean often becomes recurring service or seasonal projects; lose the first call, lose the relationship.

- Reputation & responsiveness signals. Yelp’s guidance for local services stresses fast response; slower shops lose urgency-driven jobs. BrightLocal’s research shows consumers reward businesses that communicate promptly and visibly.

Why the problem peaks after hours & weekends

- Customer behavior: Homeowners shop after work; facility managers often plan weekend service; emergencies don’t respect office hours.

- Operational reality: Lean admin teams, techs in the field, and “we’ll call back Monday” habits collide with today’s “answer-now” expectations.

- Data availability: Tools you already use can pinpoint the gap. CallRail’s Unanswered Calls reports show missed calls by hour and weekday, so you can quantify exactly how much of the problem is after hours.

What leading platforms & associations reveal about the cleaning market

- Jobber tracks cleaning-segment performance across 200k+ home-service pros—use their reports to benchmark seasonal demand and revenue trends for cleaning.

- ISSA (industry association) publishes snapshots and trend analyses (e.g., Q1-2025 market snapshot) that reflect broader cleaning demand and technology adoption—relevant when planning capacity and coverage.

- Call analytics (CallRail/CallSource) quantify missed call rates, by hour/day, and document consumer behavior after unanswered calls—vital to sizing your specific weekend/after-hours hole.

- Marketplaces (Thumbtack/Angi) publish current pricing ranges, useful for revenue assumptions in your missed-call calculator (residential and commercial).

Your 7-step plan to stop the leak

- Cover after hours (and weekends).

Add 24/7 answering—AI receptionist or live service—so calls never die in voicemail. Many cleaning teams recover missed bookings immediately by answering outside 9–5. (Tools like MissedCalls.help or answering services in the cleaning vertical can do this without adding headcount.) - Route smartly when you’re busy.

Use call-routing/IVR to triage emergencies vs. quotes; forward overflow to on-call admins. Report by hour to align coverage with demand peaks. - Automate callbacks & alerts.

Missed call? Trigger instant alert + text back (“We saw your call—how can we help?”). CallSource/CallRail workflows and alerts help reclaim missed opportunities. - Offer booking beyond the phone.

Add online booking tied to real availability (ZenMaid, MaidCentral), and enable call-to-text for quick quotes—most consumers find texting faster and more convenient. - Set expectations in your voicemail & site.

State response windows (“We reply within 20 minutes 8am–10pm”); Yelp’s guidance shows faster responses win urgent jobs. - Track the right metrics.

Monitor: calls by hour/day, % missed after 6pm, median response time, booking rate from missed-call callbacks, revenue per booking. Jobber’s reports + your call-tracking data make this straightforward. - Tie it to dollars.

Use your average job value (e.g., $209 residential; $414 commercial) and conversion rate to quantify the cost of missed after-hours calls—and the ROI of fixing them.

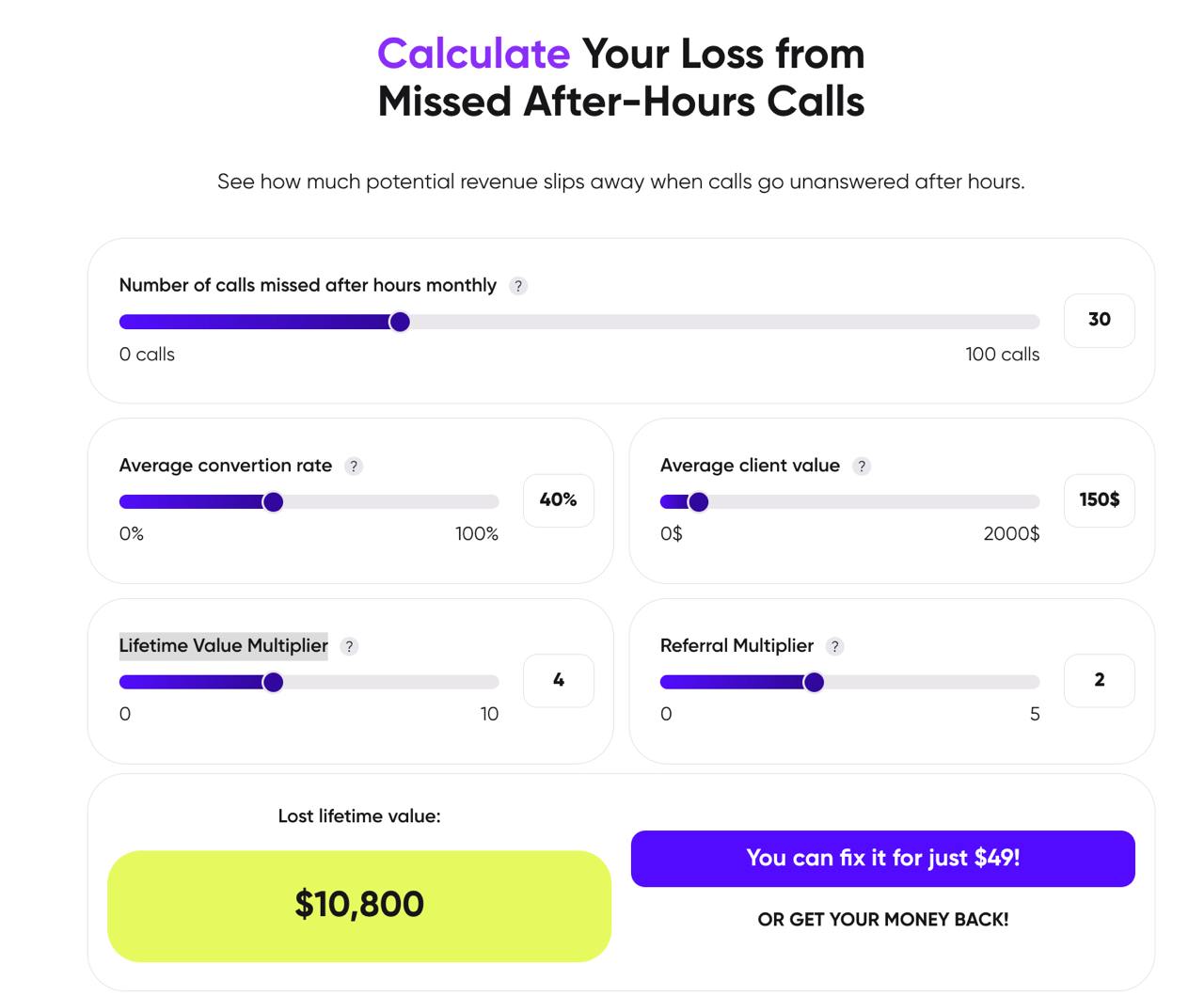

Quick calculator (plug in your numbers)

- Monthly missed after-hours calls: 30

- Conversion rate (won if answered): 40%

- Average ticket: $150

- Estimated monthly revenue lost: missed calls × conversion × ticket

- Annualized loss: monthly loss × 12

Even small numbers (e.g., 30 missed after-hours calls × 40% × $150) = $1800/month → $21,600/year—from evenings/weekends alone. Scale up for deep cleans, move-outs, or commercial jobs, and the impact multiplies.

You can play with this missed calls impact calculator on MissedCalls.help website:

Bottom line

Cleaning companies don’t lose the market to bigger budgets or fancier equipment; they lose it to unanswered calls at the moments customers are ready to book. The data shows a persistent 25–30% missed-call problem across local services, with weekends and after-hours driving the worst gaps. Put simple coverage, routing, and messaging in place—and use your call reports to prove the ROI—and you’ll convert more quotes, protect your ad spend, and build a reputation for responsiveness that keeps customers coming back.

Sources & further reading

- CallRail research & reporting on missed calls and consumer behavior.

- Housecall Pro (citing Invoca) on missed calls in home services.

- Invoca data on home-services missed call and weekend patterns; Jobber’s Home Service Economic Reports for cleaning segment trends.

- ISSA market snapshots & trends for the cleaning industry.

- Thumbtack price guides for residential & commercial cleaning.

- Yelp business resources on response time; BrightLocal research on local responsiveness and consumer behavior.