Key Takeaways

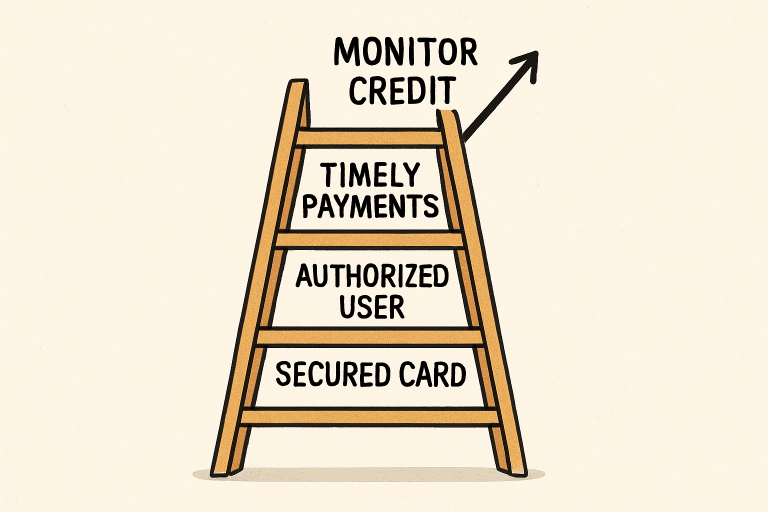

- Establishing a solid credit history is essential for financial opportunities.

- Responsible credit usage and timely payments boost creditworthiness.

- Monitoring and protecting your credit is essential for maintaining long-term financial health.

Understanding the Importance of Credit

Credit influences nearly every major financial decision in life, from buying a home to securing an auto loan or even renting an apartment. With a strong credit history, you can access lower interest rates, higher credit limits, and more favorable loan terms. In today’s world, credit has grown increasingly important, and having good credit is often considered a cornerstone of financial wellness. Most people do not realize that even employers and landlords may also check your credit as part of their decision-making process, connecting your score directly with your day-to-day opportunities. Leveraging effective credit-building techniques can make a significant difference in your financial journey. For instance, one trusted resource to explore options for building credit is Coast Tradelines, which provides solutions and guidance to help you take control of your credit profile, whether you’re just starting out or recovering from financial setbacks.

Conversely, having little or poor credit can be a barrier to essential financial needs. If your credit is weak, you may face high borrowing costs or find it nearly impossible to qualify for certain loans. Even basic services, such as utilities or cell phone contracts, can be harder to secure or come with higher upfront costs. In some cases, people are even required to put down deposits to access services due to a lack of credit history. That’s why investing time and energy into building your credit is not just smart—it’s necessary for creating stable financial ground.

Starting with a Secured Credit Card

If you’re looking to establish or improve your credit for the first time, a secured credit card is a reliable entry point. These cards require a refundable deposit, which typically serves as your credit limit and offers protection to lenders while giving you a chance to prove your reliability. The deposit amount usually starts as low as a few hundred dollars, making secured cards accessible to most people, even those with no credit or bad credit history. As you use the card for everyday purchases and pay off the balance consistently, you create a credit history that lenders will review in the future. What’s crucial is ensuring your secured card reports to all three major credit bureaus, so your responsible usage is reflected in your credit reports. Over time, your positive habits become part of your credit profile, setting you up for more favorable financing opportunities down the road.

Responsible use over several months to a year can pave the way for an upgrade to an unsecured credit card, boosting your credit opportunities even further. Transitioning from secured to unsecured credit is an important step, as unsecured cards usually come with higher spending limits and better perks. Once you make the switch, your record of reliability continues to help your score grow.

Becoming an Authorized User

Another proven method to jumpstart your credit journey is becoming an authorized user on the credit card of someone you trust, such as a parent, sibling, or partner. With this approach, the positive payment history—and sometimes the account age—of the primary cardholder can be added to your credit report. This can be incredibly helpful if you are new to credit or need to recover from past mistakes. As an authorized user, you aren’t responsible for payments, but you benefit from the account’s credit activity and established history. This can lead to a quick and notable boost to your credit profile.

However, caution is required. Choose someone with excellent credit habits and open communication to avoid potential pitfalls, as any missteps on their part can negatively impact your credit as well. It is also essential to discuss the arrangement beforehand to ensure that being added as an authorized user will indeed be reflected on your credit report, as not all credit card issuers report authorized user activity in the same way. Done thoughtfully, this is a powerful, low-risk strategy for improving your credit score quickly.

Making Timely Payments

Your payment history is the single most impactful factor in determining your credit score. Even one missed or late payment can lower your score and remain on your credit report for up to seven years—impacting your borrowing options for a significant period. Establishing a system for ensuring all of your bills are paid on time is essential for your credit health. Automating payments, setting up calendar reminders, and regularly reviewing upcoming bills are innovative strategies to avoid missed payments. Sometimes, contacting lenders early if you anticipate trouble can help avoid fees or negative marks on your record.

Prioritizing on-time payments helps establish you as a reliable borrower in the eyes of lenders. Consistent payment behavior is a clear sign that you are able to manage your financial responsibilities, making you more attractive to future creditors. Over time, a flawless payment record has a compounding effect, steadily building your score and your reputation as a trustworthy borrower.

Monitoring Your Credit Report

Staying vigilant about your credit report is key to maintaining your credit health. Your credit report is a summary of your borrowing and payment activity, and mistakes or fraudulent information can pose severe challenges. Consumers are entitled to a free annual credit report from each of the three major credit bureaus, which makes it easier to spot errors, unfamiliar accounts, or signs of fraud. As CNBC Select highlights in their guide on what to look for when you review your credit report, regularly reviewing your reports helps you take early action if something looks off.

Swiftly disputing inaccuracies prevents minor issues from becoming major obstacles down the road. If you find an error, gather supporting documents and file a dispute with the relevant credit bureau. Credit bureaus are legally required to investigate and update inaccurate entries, usually within 30 days. This process can directly protect your credit standing, allowing you to focus on continued growth and financial success.

Keeping Credit Utilization Low

Credit utilization—how much credit you’re using compared to your total available limit—affects a significant portion of your credit score. Managing your utilization ratio is crucial; experts recommend keeping this ratio below 30%, with lower being generally better. For example, if your total credit limit is $3,000, aim to keep your total balance below $900. High balances signal to lenders that you may be overextended financially, which can make it more challenging to qualify for new loans or credit. This is because high utilization rates are often interpreted as signs of financial stress or reckless spending habits.

Paying off your balance in full each month and strategically spreading purchases across multiple cards can help you manage this percentage effectively. Setting up alerts to notify you when you’re approaching the 30% mark on any card can help you make adjustments before your statement is generated. Simple steps like these, implemented consistently, will clearly show up as positive behavior in your credit report over time.

Being Cautious with New Credit Applications

Applying for new credit results in a hard inquiry on your report, which may cause a slight drop in your credit score. While one inquiry has a minor effect, several applications in a short timeframe can signal to lenders that you are experiencing financial trouble. Too many hard inquiries can make lenders wary, potentially leading them to decline your application or offer less favorable terms. To avoid unnecessary hits to your score, research options ahead of time and target your applications strategically.

Space out applications and only apply when there’s a real need. If you’re comparison shopping, do it within a short span—credit scoring models often count multiple inquiries for the same type of credit (like a mortgage or auto loan) as a single inquiry if they occur within a brief window. This careful approach protects your score as it grows.

Educating Yourself on Financial Wellness

Building lasting credit health goes hand-in-hand with improving your financial literacy. Understanding credit terms, interest rates, and debt reduction strategies can make a tangible difference. Taking time to learn about how credit works, what factors influence your score, and the consequences of various actions helps you take control over your financial destiny rather than leaving it up to chance. With greater confidence, you can make informed choices and avoid common pitfalls that trap others in cycles of debt.

Free and reputable resources, such as those offered by the Consumer Financial Protection Bureau, provide essential guides and tools for both beginners and those looking to perfect their credit management techniques. The information you gain will pay off for years to come, helping you strengthen all aspects of your financial life.

Conclusion: Creating a Strong Credit Foundation

Strategically building your credit opens the door to numerous opportunities and financial flexibility in life. By focusing on the fundamentals—using credit responsibly, making timely payments, monitoring your reports, and staying informed—your credit profile will become an asset. No matter where you start, there are clear steps to take control of your financial legacy and pave the way for a secure and prosperous future. The habits you create today, paired with ongoing education, put you on the path to enjoying lower interest rates, better loan approvals, and greater peace of mind in your financial decisions.