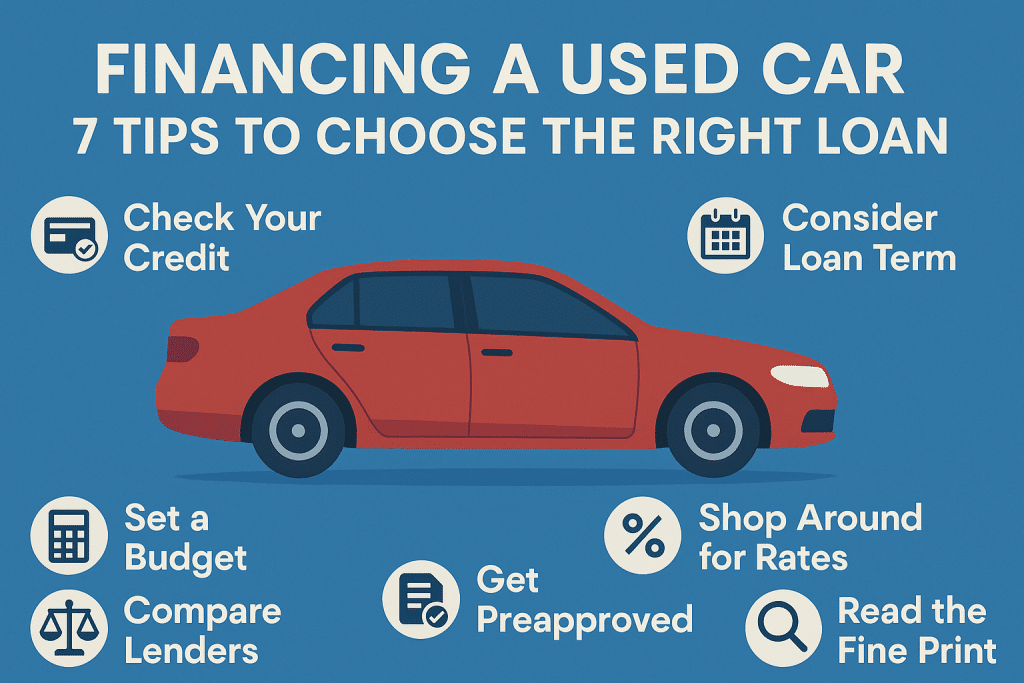

A used car often makes financial sense for buyers who want value without paying the premium of a brand-new vehicle. However, purchasing a second-hand car still requires careful financial planning. For many, the best way to manage the cost is by taking a loan. Choosing the right loan for your used car is not just about getting approval. It is about finding a structure that supports your budget and financial goals. Here are seven practical used car loan tips to help you make the right choice.

1. Review and Compare Interest Rates

Interest rates are one of the most important factors when applying for any loan. Even a small variation in the rate can affect your monthly installments and total repayment amount. Always compare rates from different lenders, including banks, non-banking financial institutions, and digital loan providers. If you’re planning to finance a pre-owned vehicle, evaluating the used car loan interest rate is critical to avoid overpaying. Find out whether the rate is flat or reducing, and make your calculations accordingly.

2. Understand the Loan-to-Value Ratio

The loan-to-value (LTV) ratio tells you what percentage of the car’s value the lender is willing to finance. Some lenders may offer up to the full market value, and in some cases even more, depending on your creditworthiness and income stability. A higher LTV means a lower upfront payment, which can ease your immediate financial burden. However, it is important to ensure the valuation of the vehicle is accurate and not inflated.

3. Look for Simple Documentation

A smooth and hassle-free application process can save both time and effort. Choose a lender that offers easy documentation requirements. In most cases, you will need identity proof, address proof, recent bank statements, income documents, and basic vehicle papers. Some lenders also allow digital uploads, which speed up the approval process and reduce the need for physical visits.

4. Check Disbursal Time

Quick disbursal can be useful when the car deal is time-sensitive. Several lenders now provide instant or same-day approval, depending on your eligibility. While speed is a benefit, do not let it rush your decision. Take a moment to read the loan terms, including repayment conditions, processing fees, and penalties before signing.

5. Select a Suitable Loan Tenure

Used car loans usually come with tenures ranging from twelve to eighty-four months. A shorter loan term results in higher monthly payments but lowers your overall interest cost. A longer tenure makes monthly installments easier to manage, though the total repayment amount will increase. Choose a loan term based on your current income, future plans, and how long you intend to use the vehicle.

6. Borrow Only What You Need

Loan amounts for used cars can vary widely, depending on the vehicle’s age, brand, and your income. Some lenders may offer loans from as low as ₹1 lakh to higher limits for premium cars. Resist the temptation to borrow more than necessary. A modest loan keeps your EMI affordable and helps you close the loan earlier without affecting your finances.

7. Ensure Transparency in Terms

Before finalising, read all terms carefully. Understand the full cost, including interest rate, processing fee, prepayment rules, and penalties. A good loan should come with no hidden charges and offer clarity at every stage.

Conclusion

Financing a used car is more than just signing a loan agreement. It involves thoughtful selection based on interest rates, tenure, eligibility, and overall affordability. With these financing used car tips in mind, you can choose a used car loan that suits your needs while keeping your finances stable and stress-free.