The landscape of retail trading is evolving rapidly, thanks to technology-driven platforms that enable traders to access professional-level opportunities without large capital. One significant innovation in this space is the rise of proprietary trading firms, commonly known as prop firms. These firms provide funding to skilled traders, allowing them to trade with substantial capital while sharing profits with the firm.

Historically, access to high-volume trading was limited to professional brokers or individuals with significant personal funds. Today, platforms like PropFirmPlus are changing the game by helping traders navigate the complex world of prop firms. By providing resources and structured comparisons, PropFirmPlus allows users to identify the programs best suited to their skills and trading strategies.

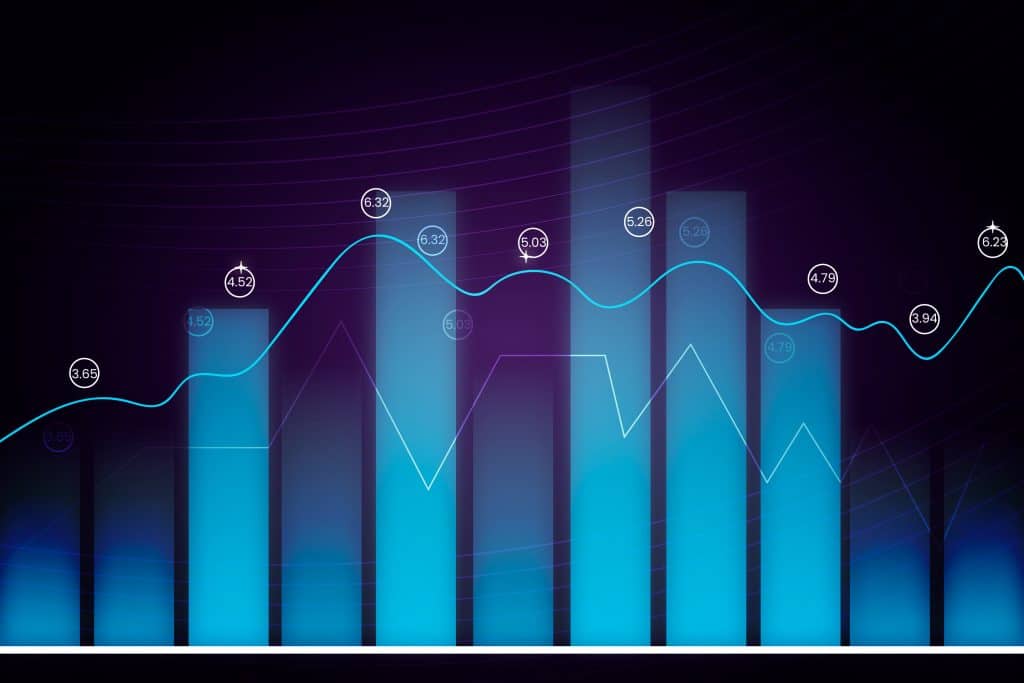

A key feature that sets modern prop trading apart is its reliance on data-driven performance evaluation. Traders are typically required to complete a challenge or evaluation phase, which assesses their risk management, profitability and trading consistency. Platforms that aggregate these results, such as PropFirmPlus, make it easier for traders to make informed decisions. This reduces the learning curve and increases the chances of long-term success.

Furthermore, technology is making the evaluation process more transparent and accessible. Digital dashboards, automated reporting and real-time analytics allow traders to track their performance closely. These tools not only empower the trader but also ensure prop firms maintain oversight, aligning incentives and reducing unnecessary risks.

For those looking to find the best opportunities in this expanding field, it’s helpful to have a central resource to compare prop trading firms. Websites that compile and standardize information on different funding programs allow traders to quickly assess which firm’s rules, profit splits and challenge requirements fit their personal trading style. By leveraging such resources, traders can save time, minimize errors and increase their chances of successfully completing prop firm programs.

The growth of prop trading is also influencing the broader financial technology sector. The need for robust platforms, secure data handling, and seamless user experiences is driving innovation across fintech. As more traders gain access to funded accounts, demand for transparent, well-structured, and reliable platforms will continue to rise.

In conclusion, the integration of technology and structured funding programs is revolutionizing retail trading. Traders now have unprecedented access to capital, educational resources and performance insights. Platforms like PropFirmPlus play a crucial role in this ecosystem by providing curated comparisons and helping traders navigate the growing landscape of prop trading firms. By staying informed and leveraging the right tools, traders can maximize their potential while mitigating risks in this dynamic market.