Extended Producer Responsibility (EPR) has moved far beyond its origins as an environmental policy theory. As 2025 approaches, EPR has become a hard compliance requirement that directly determines whether companies can place products on the market. Governments across the world are no longer relying on voluntary recycling commitments. Instead, they are enforcing full financial and operational responsibility for products from design through end-of-life. This shift reflects a broader global alignment toward stricter waste governance, with packaging and consumer goods at the center of regulatory attention.

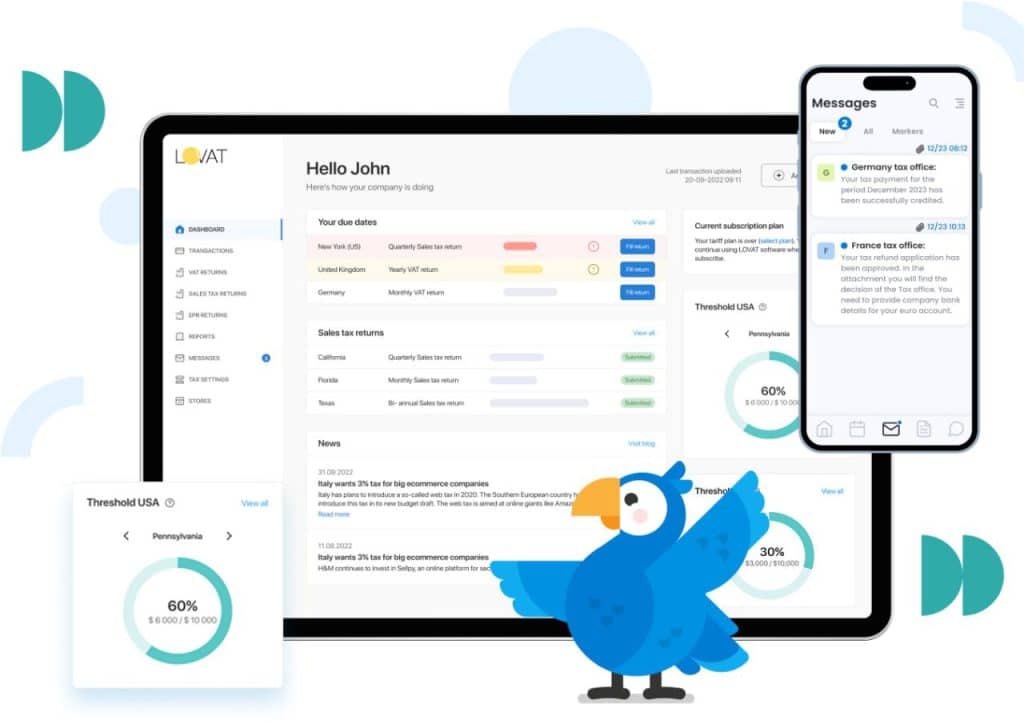

For many international manufacturers, partners such as Lovat have become essential in navigating this transition. As EPR systems expand in scope and enforcement, companies increasingly depend on external expertise to manage EPR registration, EPR reporting, local representation, and connected obligations such as vatcompliance. What was once a back-office sustainability issue is now a strategic business function tied to market access.

A global shift away from linear economic models

The traditional linear economic model is being dismantled by coordinated legislative reforms. Producers are now expected to fund recycling systems, redesign packaging for recoverability, and provide detailed material data to regulators. While Europe pioneered many of these concepts, momentum has shifted globally, with major economies adopting their own versions of EPR frameworks. The result is a fragmented but converging regulatory landscape where global strategies must be adapted locally.

EPR is no longer limited to recycling targets. Modern systems increasingly include eco-design requirements, modulated fees based on material choice, mandatory recycled content, and digital traceability. For packaging producers, this means that material selection, labeling accuracy, and data quality directly influence compliance costs and enforcement risk.

Packaging EPR as a driver of compliance complexity

Packaging remains the most regulated EPR category worldwide. Governments use packaging EPR to fund recycling infrastructure while simultaneously forcing upstream design changes. Producers must now engage with Producer Responsibility Organizations (PROs), submit verified data, and undergo audits. Passive compliance is no longer sufficient. Companies must actively manage ongoing EPR reporting obligations and ensure consistency across markets.

Converging paths in four major economies

Although EPR systems differ by jurisdiction, the regulatory direction is increasingly aligned across Canada, Australia, India, and China.

Canada is entering a decisive phase as provinces shift fully from municipally funded recycling to producer-led systems. By late 2025, brand owners will carry the full net cost of packaging waste management, supported by harmonization efforts across provinces. Accurate data management and timely reporting are now central to compliance.

Australia is moving away from its historically voluntary model toward enforceable mandates. The failure of voluntary measures to meet national packaging targets has prompted stricter rules, requiring proof of recyclability and stronger design-for-recovery standards. Producers should expect expanded reporting duties and more state-level enforcement.

India stands out for its digital-first EPR framework. A centralized portal, QR-code tracking, recycled content mandates, and a formal credit trading system make India one of the most data-intensive EPR regimes globally. Importers and brand owners face equal liability, making local expertise and an EPR Authorised Representative critical for foreign companies.

China integrates EPR into its broader industrial and resource security strategy. Excessive packaging limits, design-for-disassembly requirements, and digital product tracking are now tied directly to market regulation. Non-compliant products risk removal from both physical and online marketplaces.

What this means for manufacturers

For businesses operating across multiple jurisdictions, EPR compliance now affects product design, supply chains, pricing, and long-term planning. Companies must centralize packaging data, forecast fee exposure, and design products that meet the strictest common regulatory standards. Managing EPR alongside tax and customs obligations also makes alignment with vatcompliance processes increasingly important.

Looking beyond 2025

As EPR frameworks mature, the focus will shift from implementation to enforcement. Digital reporting, real-time audits, and expanding product categories are likely to define the next phase. Companies that treat EPR as a strategic function rather than a regulatory afterthought will be better positioned to maintain market access and control compliance costs.

Conclusion

Extended Producer Responsibility has become a defining feature of global market access. As governments tighten rules and expand enforcement, producers must align design, data, and compliance strategies across borders. In this environment, effective EPR management is no longer optional. It is a prerequisite for doing business in a rapidly regulated global economy.