The growing interest in cryptocurrencies over recent years has increasingly developed in conjunction with the artificial intelligence boom, turning digital assets from a niche financial instrument into an element of the global technological infrastructure. The crypto market is gradually losing its status of a parallel reality for investors and increasingly depends on the same factors as the AI sector. Access to capital, trust in long-term monetization, and the ecosystems’ ability to withstand scaling without losing sustainability. It is at this intersection that new risks form, from cybersecurity to ecology and geopolitics.

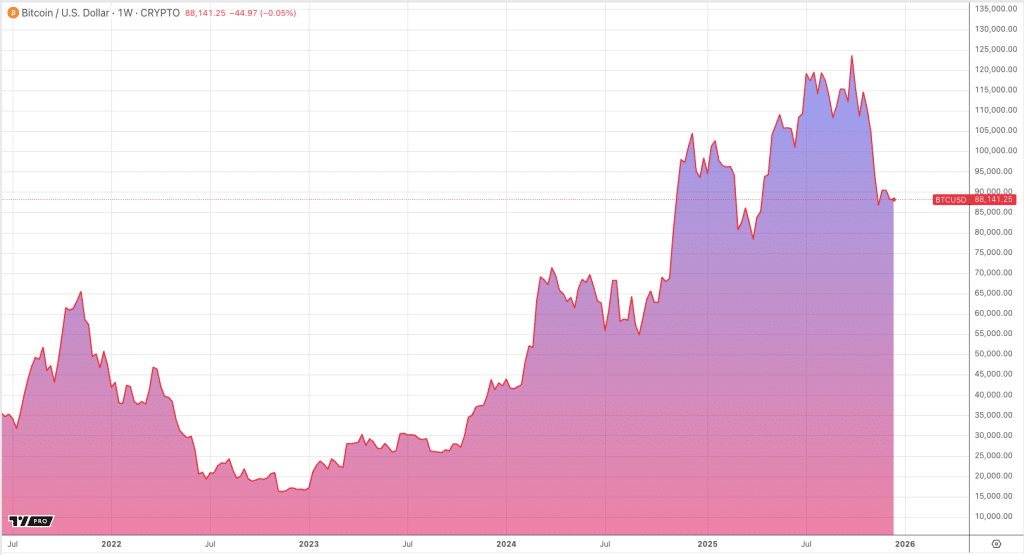

Financial markets are becoming increasingly sensitive to these signals. Growing hack reports, rising energy consumption, and possible regulatory pressure are leading to higher volatility in the cryptocurrency market, where investors are increasingly taking profits amid deteriorating news. The same sentiment is spilling over into broader asset classes — for example, pressure on the technology sector is periodically reflected in the dynamics of ES futures. This becomes an indicator of declining risk appetite among institutional players, particularly when narratives about crypto and AI converge.

Thus, in 2025, hackers linked to North Korea stole a record $2 billion worth of cryptocurrency, which is more than 50% higher than the amount stolen the previous year. These funds account for the bulk of the $3.4 billion stolen from crypto companies since the beginning of the year. Cryptocurrency thefts have long become a systemic source of financing for the DPRK, with the largest episode, the Bybit exchange hack, valued at $1.5 billion, becoming the largest digital theft in history and immediately affecting the market. XRP USD showed heightened volatility as investors reassessed counterparty risk and regulatory exposure across major crypto assets. Despite the decrease in the number of attacks, their effectiveness has advanced dramatically. North Korean groups rely on sophisticated money laundering schemes and the insertion of IT specialists directly into crypto services.

At the same time, pressure from the “physical world” is growing. A study by VU Amsterdam indicates that by 2025, the global energy consumption of AI systems could reach 23 GW, and water consumption could exceed 764 billion liters per year, surpassing the total energy consumption of Bitcoin mining in 2024. The ecological footprint of AI infrastructure, according to researchers, could result in carbon dioxide emissions of 50-80 million tons annually, which exceeds those of some developed countries. These figures have already prompted policy initiatives in the United States, from requests for transparency of energy consumption to radical proposals for a temporary moratorium on the construction of new AI data centers.

In this context, the attempts of large electronics manufacturers to bring cryptocurrency closer to the mass consumer appear ambiguous. Xiaomi has announced that, starting next year, it will ship smartphones outside of China and the United States with a pre-installed Sei Wallet and support for the Sei blockchain. By doing this, the company aims to simplify access to Web3 and crypto payments, enabling payments in tens of thousands of Xiaomi retail stores using stablecoins. However, the risks are clearly visible. The imposition of default crypto applications may displease users, as well as enhance regulatory scrutiny in countries where attitudes toward digital assets remain cautious.

Taken together, these events highlight a key shift. The market is gradually shifting from a phase of unconditional optimism to a stage of sober reassessment. Cryptocurrencies and AI are still perceived as the technologies of the future. Still, investors, regulators, and society are increasingly wondering about the cost of this future, whether it is cyber risks, environmental pressures or systemic consequences for global capital markets.