Every couple dreams of capturing their wedding day in beautiful photos. These pictures tell the story of love, family, and promises for life. But in Singapore, wedding photography can cost more than expected. From pre-wedding shoots to album printing, the total can quickly go beyond your budget.

If you are planning your big day and want to manage costs wisely, understanding how a wedding loan works can help. Let’s look at how smart financial planning and help from a licensed moneylender in Singapore can make your dream wedding photos possible without financial stress.

Understanding the Real Cost of Wedding Photography

Wedding photography is more than just taking pictures. It often includes engagement shoots, makeup, outfit rentals, photo editing, and printed albums.

In Singapore, a full wedding photography package can range from $1,500 to $6,000, depending on style and photographer experience (The Wedding Vow, 2024). For couples who also want a pre-wedding shoot abroad, the cost can go even higher.

Here’s a quick breakdown:

| Photography Type | Average Cost (SGD) |

| Local pre-wedding shoot | $1,500 – $2,500 |

| Actual day photography | $2,000 – $4,000 |

| Overseas shoot | $4,000 – $8,000 |

| Album and editing | $500 – $1,000 |

It’s easy to see why couples feel the pinch. Even with careful savings, other wedding expenses like venue, catering, and attire can make it hard to cover everything at once.

Why Many Couples Consider a Wedding Loan

A wedding loan is a type of personal loan made for couples who want to manage wedding costs without using all their savings. It allows you to spread out payments into smaller, fixed amounts.

In Singapore, many couples apply for such loans to pay for photography, decoration, or travel. Choosing a licensed moneylender ensures the process is safe and follows government rules set by the Ministry of Law.

Here’s why it can help:

- You avoid draining your emergency savings.

- You can secure the services you love before prices rise.

- You gain flexible repayment options that fit your budget.

According to Cash Mart Singapore, many couples use personal loans for short-term needs such as photography and wedding planning. This allows them to enjoy their special day while keeping financial control.

How a Licensed Moneylender in Singapore Works

Not all lenders are the same. It’s important to work only with a licensed moneylender. These are financial companies approved by Singapore’s Registry of Moneylenders. They follow strict rules to make sure borrowers are protected from unfair practices.

A licensed moneylender:

- Show all loan details clearly before you sign.

- Caps interest rates and fees as per the law.

- Explains repayment terms in plain language.

You can check if a lender is licensed by visiting rom.mlaw.gov.sg, the official government website.

Cash Mart Singapore is one of the licensed lenders that offer personal loans for various needs, including weddings. They keep the process simple and transparent, which helps couples plan better.

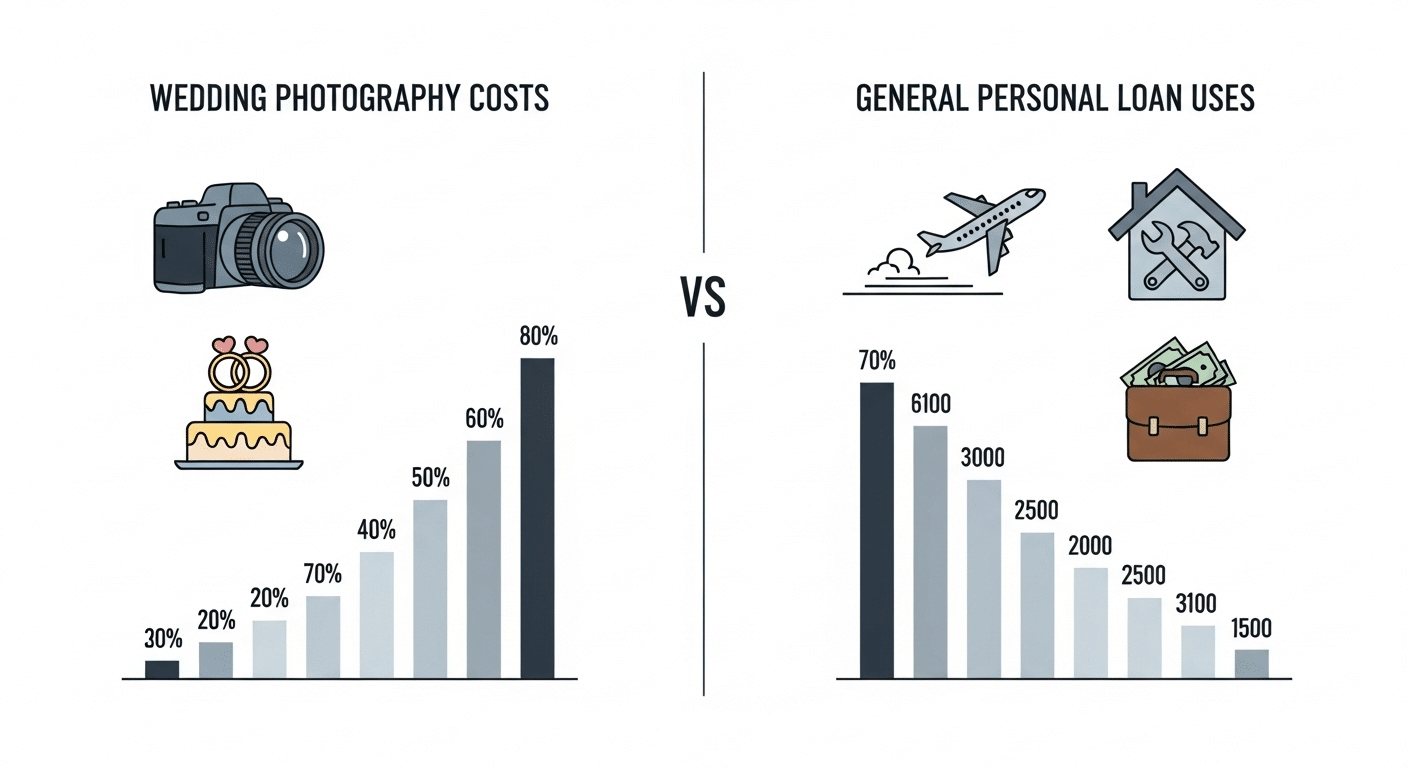

Wedding Loan vs. Personal Loan: What’s the Difference?

While a wedding loan and a personal loan sound different, they are quite similar in structure. Both allow you to borrow a set amount and repay it over time. The main difference is in purpose.

| Feature | Wedding Loan | Personal Loan |

| Purpose | For wedding-related expenses | For any personal need |

| Loan Amount | Based on estimated wedding cost | Depends on income and credit |

| Repayment Term | Short to medium term | Short to long term |

| Example Use | Photography, dress, venue | Renovation, travel, education |

Some couples prefer personal loans since they can use part of it for the honeymoon or future home. What matters most is choosing a repayment plan that matches your comfort level.

Smart Ways to Manage Your Wedding Photography Budget

Even with a loan, being smart about spending helps you stay stress-free. Here are simple tips:

- Compare packages – Talk to different photographers. Ask what is included, such as albums, prints, or digital copies.

- Book early – Many studios give discounts for early bookings.

- Go for local spots – Singapore has beautiful locations like Fort Canning, Botanic Gardens, and East Coast Park for photoshoots.

- Choose digital albums – Save on printing costs by keeping digital versions.

- Track all expenses – Keep a list of payments and due dates to avoid surprises.

Cash Mart Singapore often reminds clients that proper planning helps prevent overspending and the need for last-minute borrowing.

What to Check Before Applying for a Wedding Loan

Before signing any loan contract, always check these key details:

- Interest rate: Make sure it is clearly stated and within legal limits.

- Repayment period: Choose a term that fits your income level.

- Hidden fees: Ask if there are late charges or early repayment fees.

- Eligibility: Some lenders may require proof of income or age verification.

Being informed helps you borrow with confidence. A good lender will take time to explain everything in simple terms, not rush you into signing.

Why Cash Mart Singapore is Often a Trusted Choice

Cash Mart Singapore has served the local community for years as a licensed moneylender. They are known for transparent terms, quick approvals, and flexible loan options. Couples can explore different financing plans without worrying about hidden charges.

Their website also provides guides on personal finance topics, helping borrowers make better money choices.

Capture Memories Without Breaking the Bank

Wedding photos are more than pictures, they are memories that last forever. While costs can add up quickly, financial planning gives you control and peace of mind.

By understanding how wedding loans and personal loans work, you can create the wedding you dream of without heavy stress. Working with a licensed moneylender in Singapore like Cash Mart Singapore ensures you borrow safely and wisely.

Your love story deserves to be remembered beautifully and with the right plan, it can be done within your means.