I know the feeling—you made great money this year, but when you look at your tax returns after all those write-offs, your “net income” looks tiny. For us self-employed folks, freelancers, and gig workers, applying for a mortgage usually feels like walking into a trap. In fact, recent industry data suggests that nearly 63% of gig economy workers have faced mortgage rejection at least once due to “volatile income.”

It’s frustrating to be labeled “risky” when you know you can afford the payments. That’s why I want to talk about Bluerate AI Agent. It’s not just another search engine. It’s an intelligent tool specifically designed to bridge the gap between complex income profiles and the Loan Officers who actually understand them.

Introduction of Bluerate AI Agent

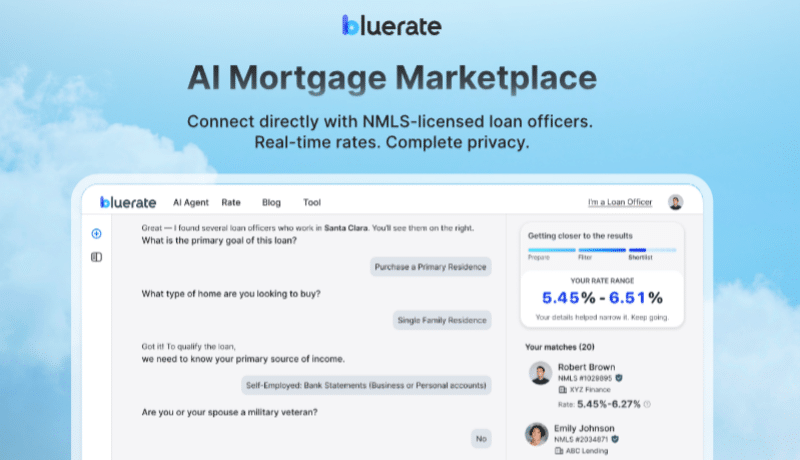

So, what exactly is this platform? Bluerate is a specialized Mortgage Marketplace that connects borrowers directly with NMLS-verified Loan Officers (LOs). Now, Bluerate has integrated a powerful AI Agent developed by Zeitro to completely overhaul how we shop for loans.

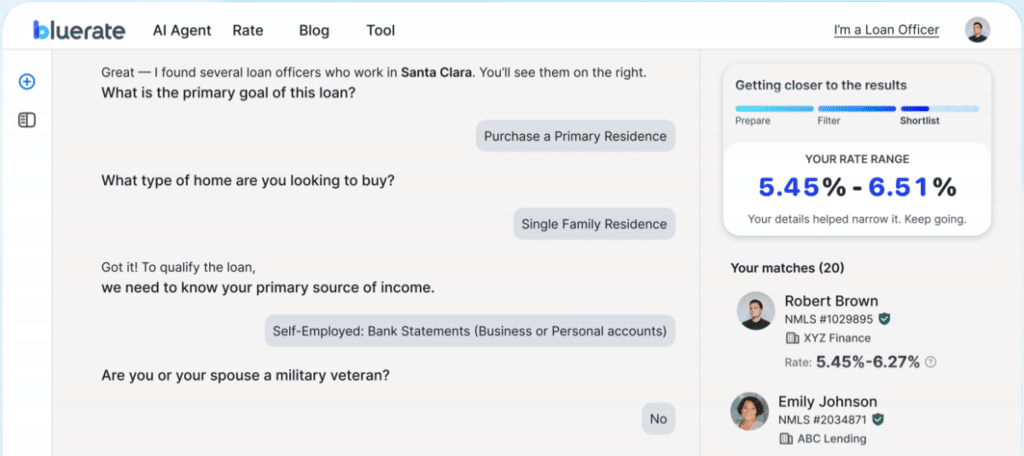

Think of the Bluerate AI Agent as a 24/7 digital mortgage broker that lives in your browser. Instead of making you fill out static forms that go nowhere, it uses advanced Large Language Models (LLMs) to hold a natural conversation with you. It doesn’t just list random lenders. It connects with a real-time Loan Origination System (LOS) to run a “Prepare-Filter-Shortlist” process. This means it analyzes your financial data on the fly to match you with professionals who are proven experts in your specific situation, whether that’s a 1099 income, an LLC, or a Non-QM loan need.

Why Is It Hard for Self-Employed to Find Loan Officers?

If you have tried to get a loan from a big bank, you know the struggle is real. The core issue isn’t that we don’t have money. It’s that traditional underwriting algorithms are built for W-2 employees with steady, bi-weekly paychecks.

When you run your own business, you legally write off expenses to lower your tax bill. But to a standard bank algorithm, that lower “net income” looks like poverty. This discrepancy leads to a high rejection rate because most generalist Loan Officers don’t know how to calculate “add-backs” or use bank statement analysis correctly.

Furthermore, finding a specialist is a nightmare. You might spend weeks cold-calling brokers, asking, “Do you do Non-QM loans?” only to be ghosted or handed off to someone inexperienced. It is a fragmented market where the experts are hard to find, and the “easy” online forms usually just result in your phone exploding with spam calls from aggressive telemarketers who can’t actually help you.

Benefits for Self-Employed

Using the Bluerate AI Agent completely flipped the script for my search. Instead of begging for approval, the platform empowers you with data. Here are the five key benefits I found specifically for self-employed borrowers:

Expert Answers for Your Scenario

The AI acts like a preliminary underwriter. You can ask complex questions like, “I have 2 years of LLC income, but my net income is low due to write-offs. Can I apply?” The AI understands “Bank Statement Loans” and 1099 profiles. It instantly guides you toward Non-QM options where lenders look at your cash flow rather than just your tax return bottom line, saving you from applying for loans you’d inevitably be rejected for.

Autonomous Connection with Non-QM Experts

This is the biggest time-saver. Bluerate uses a proprietary Match Score to pair you with Loan Officers who specifically highlight “Self-Employed” or “Non-QM” as their expertise. You aren’t getting a random salesperson. You get a shortlist of vetted pros who know how to handle an LLC or gig-economy income.

Real-Time, Personalized Rates

Most sites show you “teaser rates” that assume a perfect 800 credit score and W-2 income. Bluerate is different. By inputting your specific numbers (like credit score and estimated DTI), it generates personalized real-time rates from over mainstream lenders. You can see exactly what a Non-QM loan interest rate looks like for your situation before you even talk to a human.

Seamless Prequalification & Tracking

Because the AI connects to an LOS, the tech is impressive. You can get pre-qualified online up to 2.5x faster than traditional methods. It even allows you to export your data in standard industry formats (FNM 3.4). Once you choose an LO, you can track the entire loan origination process, from application to close, right on the dashboard, ensuring transparency at every step.

No More Spam Calls

Privacy is a huge deal here. Bluerate is SOC 2 Type II certified and prioritizes “Privacy First.” You can shop, compare rates, and get matched anonymously. Your contact info is only shared when you decide to click the “Contact” button on a specific Loan Officer’s profile. No more fielding 20 calls a day just because you wanted to check a rate.

How Does Bluerate AI Agent Work?

Getting started is surprisingly frictionless. You don’t even need a credit card. Here is the simple workflow:

- Start the Chat: Just head to the homepage and click the “Chat with AI” button.

- The Basics: The Agent will ask for your location (since real estate is local) and your primary goal.

- Interactive Q&A: This is where it gets cool. You answer a few questions about your income type (e.g., “Self-Employed”) and finances. The AI calculates things like your Debt-to-Income (DTI) ratio in real-time.

- Get Results: Within minutes, you receive a “Shortlist” of recommended Loan Officers and customized rate quotes. You can view their profiles and choose to message them directly on the platform.

FAQs About Bluerate AI Agent

Q1. Is Bluerate AI Agent free to use? Yes, it is completely free for borrowers. Whether you are a first-time homebuyer or a seasoned investor, you can use the AI to ask questions, check rates, and find Loan Officers without paying a cent. There are no hidden subscription fees.

Q2. Will it leak my privacy? Absolutely not. Bluerate takes a radical “Privacy First” stance. They are SOC 2 Type II certified, which means their security is bank-grade. Unlike many other comparison sites, they do not sell your data to lead aggregators. Your information stays encrypted and is only shared with the specific Loan Officer you choose to contact.

Q3. Should I log in to use Bluerate AI Agent? You don’t have to. You can chat with the AI, search for LOs, and compare rates anonymously. However, if you want to track your loan progress, upload documents securely, or message LOs through the dashboard, registering a free account is highly recommended for the best experience.

Conclusion

The era of “blind mortgage shopping” and fearing rejection just because you are self-employed is over. Bluerate AI Agent replaces the uncertainty of the old way with transparency, speed, and precision.

If you are tired of explaining your tax returns to confused bank tellers, I highly recommend trying this tool. It’s free, it’s private, and it connects you with the experts who actually want your business. Stop guessing if you qualify—start a chat with Bluerate today and find your perfect Loan Officer in minutes.