The construction industry in the US is a $1.9 trillion behemoth. Intertwined with many sectors, it moves entire markets and affects the national economy. However, the industry is often at the mercy of economic and meteorological developments. Nowhere is this more evident than in the state of Florida, where hurricane predictions threaten the sector with fear of material shortage.

The summer of 2022 is close to an end, but we are still in the middle of the storm season. For those living in the Southern US and Mexico, the period between June 1 and November 30 is a stressful part of an annual cycle. The last year saw 21 named storms, and it is devastating to understand that Hurricane Ida alone caused more than $60 billion in damage.

When these events take place, repair and reconstruction become a top priority. Supply chains cannot catch up with sharp spikes in demand, and contractors face material shortages and labor delays.

Hurricane predictions have become strong market signals

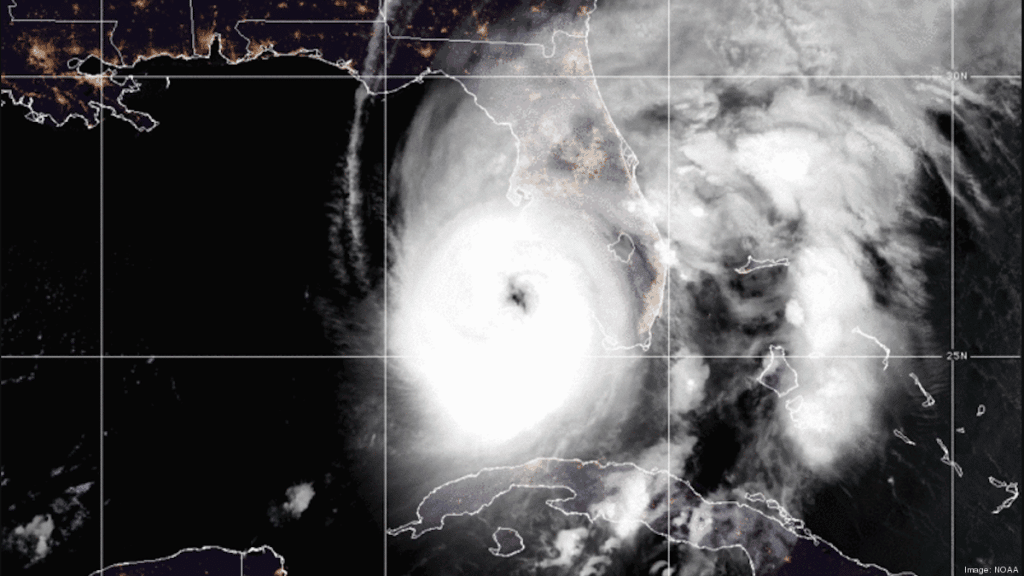

As much as the weather forecast can mitigate the material shortage, predictions of upcoming storm seasons are a problem on their own. With clear signs of such events on the horizon, the supply chain is greatly affected.

This year, in particular, there is added difficulty in restoring economic balance. With rampant international shortage and post-pandemic wounds still healing, supply chain disruptions can cause further uncertainty.

After the NOAA prediction for 2022, with 14-21 named storms, construction markets are already preparing for a material shortage.

What does a dramatic spike in demand look like?

On May 21, a deadly storm passed through Ottawa, Canada, leaving many homes needing repair. According to CBC, who spoke to a local estimator at a roofing company, more than 400 phone calls and 200 online reports have arrived in less than a week.

Such demand for labor and materials is bound to disrupt any local construction market, regardless of their agility.

Storms in the Southeast can be much more volatile, leaving entire regions cut off, with hundreds of properties damaged. Such an event can disrupt construction plans for the upcoming year, affecting the real estate market.

What does this mean for the real estate market?

Single-family housing may be experiencing a long-awaited slowdown in construction. Material shortage and price may be one factor, but it is important to note how other variables weigh in.

With the construction labor shortage at an all-time high, we need 400,000 more workers to bring the industry on a blazing trail forward.

To state the obvious, storms significantly complicate things when material prices increase monthly.

How about investing in property?

According to historical trends, despite high mortgage rates and overall economic turmoil, now is the best time to invest in real estate. As an appreciating asset with high demand and ever-decreasing supply, housing may see record-breaking prices come next summer.

Luxury homes in Florida are still in demand. Current market circumstances may even increase their popularity despite a temporary slowdown in sales and price appreciation.

As the pandemic era demonstrated, shortages and supply chain disruptions are usually good news for owners of high-value properties.

When new construction starts are not on par with industry predictions, whatever enters the market will likely sell above its listing price in a few days.

The general outlook is still positive.

While storm season threatens material shortage, current price reversal makes up for an optimistic fall season. The price for lumber, concrete, steel and other construction materials such as insulation is either in complete reversal or flirting with an imminent slowdown.

Historically, real estate price action, sales, and construction starts are predisposed to plummet during the fall. For investors, it is only natural to weather the storm.

On the other hand, deciding to invest now may prove a lucrative opportunity because supply-chain uncertainty is usually positive toward price appreciation.

With a net migration gain of 259,480 people, Florida is leading in population growth, with Texas at far second. This demographic development is bound to affect demand, despite all other market indicators. Only the sky is the limit if and when we see relief from a macroeconomic perspective. We may learn about these events in retrospect that they are only a temporary slowdown – just as we have witnessed historical charts reversing over and over, only to carve an upward trail to record highs.