As lifespans increase while median retirement savings decrease, adopting a forward-thinking approach to financial planning becomes increasingly critical. Diligent saving not only benefits us in the present but also profoundly enriches the lives of our descendants for generations to come.

In this blog post, we will explore the multifaceted benefits of prioritizing generational wealth building, from providing heirs with increased opportunities to funding innovation through green investments. We will also discuss strategies for overcoming common obstacles to saving and answer frequently asked questions on how to turn this idea into reality.

By taking purposeful action today, we can positively shape the trajectory of our families and communities for decades to come. Let’s explore how and why ensuring economic stability and prosperity for future generations should be an essential part of our financial priorities.

The Imperative of Forward-Thinking Financial Planning

Financial planning with an eye toward the future is no longer an option. It’s imperative. As lifespans increase alongside looming economic uncertainties, individuals must adopt a more proactive approach to safeguarding their financial health and that of future generations.

Although it may seem daunting, especially for those who feel they don’t make enough money, seeking assistance from reputable financial advisors or utilizing resources like those available in Alabama can provide valuable guidance and support.

With the median retirement savings so low for Baby Boomers, many will struggle to sustain themselves financially in their later years. Alabama debt relief programs can provide invaluable support in navigating financial hurdles. By prioritizing saving and investing wisely, individuals can build a financial legacy that not only supports their own needs but also lays the foundation for future generations’ success.

It also enables financial planning for families to allocate more towards green investments and generational wealth accumulation. By overcoming debt challenges, families can realize a positive impact on environmental sustainability as well as psychological benefits from saving for heirs.

The key is utilizing professional services to develop customized strategies for setting saving goals and gaining financial education to enrich futures amidst economic constraints. Reducing debt burdens opens the door to prudent savings and investments that lead to generational prosperity.

Many individuals struggle to balance short-term wants with long-term needs. The satisfaction of current expenditures often wins out over the less tangible benefits of wealth accumulation for the future. However, the cost of short-term thinking is measured in the instability and uncertainty it brings as financial means become stretched thinner and thinner.

Forward-focused financial planning flips this script, prioritizing long-term stability and prosperity over fleeting short-term satisfaction. It requires foregoing temporary delights for lasting security – a tradeoff that pays exponential dividends for both current and future generations.

Benefits for current and future generations

Forward-thinking financial planning is a win-win, strengthening financial health for today’s savers and their heirs:

- Greater savings mean less reliance on credit, more flexibility, and increased options later in life.

- Investment growth builds wealth over time, providing an inheritance or funds for retirement.

- Asset protection shields wealth from taxes or misuse and preserves it for the future.

- Family legacy planning allows values and wealth to be passed down across generations.

With foresight and discipline, individuals can transform their finances in ways that benefit multiple generations.

Economic Stability for Future Generations

When Individuals take steps to accumulate and preserve wealth, it reverberates through generations in the form of increased opportunities, financial stability, and reduced vulnerability to economic downturns for descendants.

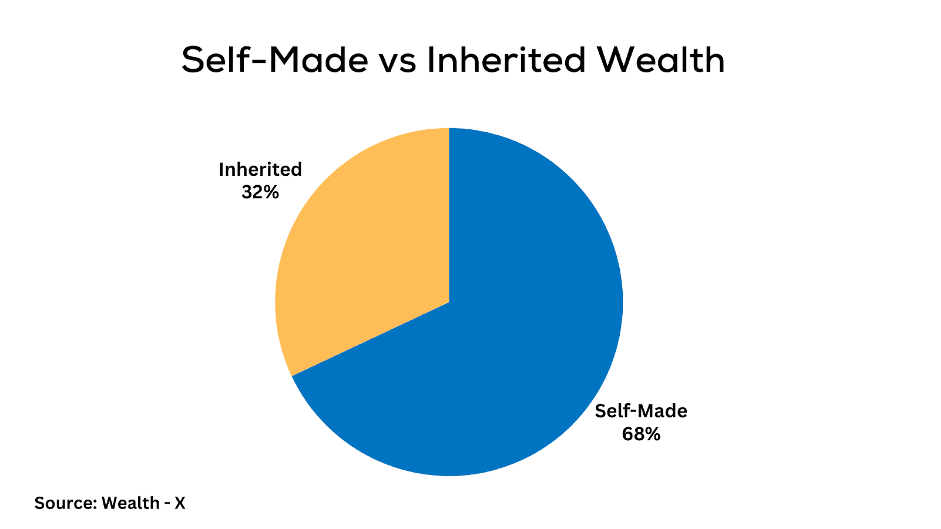

The Billionaire Census 2023

The recent Billionaire Census 2023 report by Wealth-X found that globally, 68% of billionaires are considered self-made, having built their wealth in their lifetime. The remaining 32% inherited some or all of their wealth.

This data highlights that while inherited wealth provides advantages, a majority of the wealthiest individuals actively created their financial legacies rather than purely benefiting from generational transfers.

Strategic financial planning, savvy investing, and entrepreneurship remain pathways to building substantial wealth that can confer stability across generations. With diligence and foresight, individuals have significant power to shape their financial futures.

Wealth’s impact on children’s and grandchildren’s options

Parents and grandparents who save and invest substantially enhance future generations’ horizons by providing:

- Resources to pay for higher education, reducing student loan burdens.

- Funds to start a business and pursue entrepreneurial goals.

- Greater ability to weather periods of economic uncertainty or job loss.

- A down payment for a home purchase reduces mortgage debt.

- More options to explore passions rather than just take any job for survival.

The role of inheritance

Inherited wealth serves as an economic safety net, providing recipients with advantages that mitigate crisis and hardship. For example, inheriting even a modest $10,000 nest egg can help descendants:

- Bridge gaps in income during periods of layoffs or job transitions.

- Access higher education and gain qualifications without massive student debt.

- Make a down payment on a home or vehicle rather than being trapped in predatory lending terms.

- Cover emergency costs in the event of illness or accidents.

- Avoid high-interest debt that leads to snowballing financial burdens.

The Environmental Aspect of Saving for the Future

Beyond just financial assets, true wealth takes the form of a livable planet for our heirs. Therefore, how we save and invest should align with environmental sustainability.

Green Technology Investments

Channeling savings into green technologies like renewable energy creates tangible assets for the future while also contributing to a reduction in fossil fuels. Even modest investments in rooftop solar panels or community solar projects can pay dividends through electricity bill savings and tax incentives.

Sustainable Investments And Practices

Investing in companies with measurable sustainability goals better aligns financial decisions with environmental needs. Sustainable practices in one’s own home or business, such as installing high-efficiency appliances or reducing energy usage, also model good stewardship for the next generation.

Dual Benefits

Green investments provide a powerful one-two punch:

- Financial security through holdings in profitable renewable energy companies and technology innovators.

- Environmental sustainability via reducing reliance on fossil fuels and funding innovation to combat climate change.

When individuals and families consider environmental impact and sustainability alongside traditional financial return on investments, it magnifies the value of their contributions.

The Psychological Benefits of Saving for Future Generations

The act of responsibly and effectively saving for heirs delivers profound psychological rewards in addition to tangible financial benefits.

Knowledge of providing for heirs

Parents and grandparents who save report a deep sense of satisfaction and purpose from knowing they have taken steps to provide for their descendants. The peace of mind from this knowledge is a significant if less visible benefit.

Fostering generational thinking

Too often, people operate with a short-term mindset, taking actions that satisfy immediate needs or desires without weighing long-term consequences. Saving diligently for future generations instills a sense of generational thinking – an awareness of how one’s financial decisions impact those who will inherit the future state of the family or business. This expanded perspective enhances personal fulfillment and aligns decision-making with a broader purpose of stability and continuity.

Ripple effect

At the family level, generational thinking promotes characteristics such as prudence, thrift, and stewardship. As these values are modeled and passed down, they have the capacity to inspire communities and societies also to adopt more forward-thinking mindsets and habits that lead to shared prosperity.

The Ripple Effect: Beyond Immediate Family

In addition to benefiting individual heirs and families, wealth preserved and passed down through generations can have a ripple effect that touches entire communities and societies.

Philanthropic impact

Substantial generational wealth allows for significant charitable giving that funds scholarships, hospitals, museums, community centers, and other public goods. Forbes’ 2022 ranking of top philanthropists includes many individuals and families funding worthy causes to the tune of hundreds of millions annually thanks to astute savings and investments of prior generations.

Examples of broader societal contributions

- The Walton Family Foundation has contributed over $6 billion since 1987 towards education, freshwater access, and conservation efforts.

- Brooklyn’s new UBS Arena was funded in part by a naming rights purchase by UBS bank from the estate of businessman and philanthropist James L. Dolan.

- The Ford Foundation has been a top funder of causes like the arts, sexuality research, and climate change since 1936 thanks to Henry Ford’s legacy.

Savings that enrich future generations create the capacity to also contribute to communities at large in ways that amplify positive impact.

Overcoming Challenges in Saving for Future Generations

Despite the benefits, numerous obstacles make saving difficult, from economic instability and debt to a short-term focus on wants over needs. A proactive approach helps overcome these hurdles.

1. Common obstacles

- High cost of living and stagnant wages

- Burdensome debts eating up income

- Unexpected crises derailing savings

- Lack of financial education and planning

- Focus on instant gratification over long-term goals

2. Realistic, incremental saving

The key is starting small and building momentum. Even modest, automated deposits into savings or retirement accounts create positive momentum. Slow and steady saving sets the stage for greater contributions down the road.

3. Expense prioritization mindset

Categorize expenses as essential, important, and discretionary. Limit spending on less critical items to maximize savings.

4. Seek financial guidance

Qualified financial advisors assess entire financial situations and help create customized strategies to pay down debt, budget efficiently, and invest in goal-aligned ways. Their expertise is invaluable for overcoming obstacles.

5. Acquire financial education

Individuals who learn core principles of budgeting, smart debt use, and investing are empowered to make informed choices that enable effective saving. Knowledge is key.

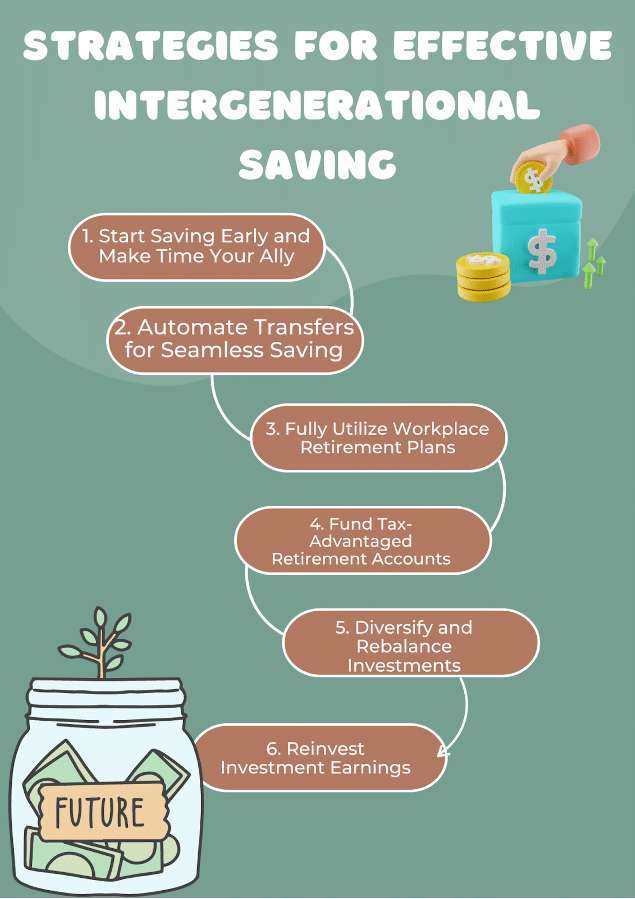

Strategies for Effective Intergenerational Saving

Implementing targeted strategies can help individuals and families build wealth to pass down across generations.

1. Start Saving Early and Make Time Your Ally

Beginning retirement contributions in your 20s allow over 40 years for compound growth before retirement. Starting in your 30s still gives 30+ years of growth. Either way, time in the market is key. Invest consistently, even if the amounts are small. Early regular contributions create an invaluable foundation. Use retirement calculators to estimate how funds can grow based on time horizons, rates of return, etc.

2. Automate Transfers for Seamless Saving

Automated monthly or biweekly transfers remove the temptation to manually move funds. Even small auto deposits of $25 or $50 add up substantially over years of compounding growth. Set it and forget it! Automation makes saving effortless once initially set up. Online banking and investment platforms make automation easy to establish and adjust.

3. Fully Utilize Workplace Retirement Plans

Enroll in 401(k)s or 403(b) plans offered by your employer. Contribute at least enough to maximize any employer matching contributions. This is free money! Contribute to HSAs or FSAs to save pre-tax dollars for healthcare costs. Participate in ESPPs when available to purchase company stock at a discount.

4. Fund Tax-Advantaged Retirement Accounts

Max out annual IRA contributions to save pre-tax or after-tax dollars depending on account types. Roll over 401(k) funds from past employers to IRAs for continued tax-deferred growth. Contribute to a Roth IRA using post-tax dollars that grow and are withdrawn tax-free.

5. Diversify and Rebalance Investments

Diversify holdings across stocks, bonds, mutual funds, real estate, etc. to minimize risk. Rebalance periodically to maintain target asset allocation percentages as values fluctuate. Diversification and rebalancing smooth out volatility over decades.

6. Reinvest Investment Earnings

Reinvest realized earnings like dividends, interest, and capital gains to further compound portfolio growth. Some mutual funds and ETFs automatically reinvest earnings. For individual stocks/bonds, manually reinvest. Opt for reinvestment rather than cash payouts to accelerate asset accumulation.

Conclusion: The Legacy of Thoughtfulness

Saving diligently to enrich the lives of future generations embodies responsibility, care, and wisdom. While requiring tradeoffs at times, the tangible and intangible rewards are immense.

Beyond just the financial boons, building familial wealth develops character traits like thrift, patience, and sacrifice that ultimately uplift communities. And funding innovation through green investments contributes to a livable planet for our descendants.

The path forward begins with a single step. Whether starting a modest automated savings plan or having an initial meeting with a financial advisor, purposeful action today lays the foundation for generational stability and fulfillment tomorrow.

Small sacrifices in the present manifest as priceless gifts for the future. Together, through foresight and discipline, we can forge a legacy of prosperity worthy of the generations to come.

Frequently Asked Questions

How much should I aim to save for future generations?

There is no one-size-fits-all goal for generational wealth transfer. The right amount depends on your financial circumstances and desired impact. As a starting point, modeling shows that consistently saving 15% of income annually from an early career stage can yield substantial wealth transfer by retirement age. Discuss options with a financial advisor to tailor a goal unique to your situation. Focus on consistency and growth over time.

Isn’t it better to spend money improving the present rather than saving for an uncertain future?

With prudent balancing, it’s possible to do both. Responsible spending still funds some wants in the present while directing adequate money toward future needs. Develop a budget that allows for some discretionary spending while maximizing savings and investment deposits. View savings as preventatively spending on the future using money now to enhance stability and opportunities for heirs down the road.

How can I start saving for future generations if I’m currently living paycheck to paycheck?

Start with small, automated deposits into a savings or investment account, even $25 per pay period accumulates substantially over the years. Evaluate expenses to identify lower-priority items to cut back on, freeing up funds for savings. Explore additional income sources to bring in more money towards savings goals. Consider meeting with a financial advisor to help strategize improved cash flow and saving capacity based on your unique situation.