Introduction

Media buying and marketing professionals are always on the lookout for reliable and convenient payment tools that enable them to maximize their budgets and boost their return on investment. Virtual cards are gaining popularity due to their ease of use and security.

Modern virtual cards, supported by Visa and Mastercard payment systems, offer a seamless and secure way to manage advertising budgets.

In this article, we will rank the most cost-effective payment tools for advertising. We will explore how these tools help optimize advertising expenses through favorable fee structures, unique BINs and other advantages.

1. PSTNET

Financial Platform PSTNET offers virtual multi-currency Visa and MasterCard cards that cater to all business needs, whether it’s for paying for digital products, online shopping, or advertising campaigns.

Users worldwide praise the service, recognizing PSTNET as the provider of the best credit card for ad spend.

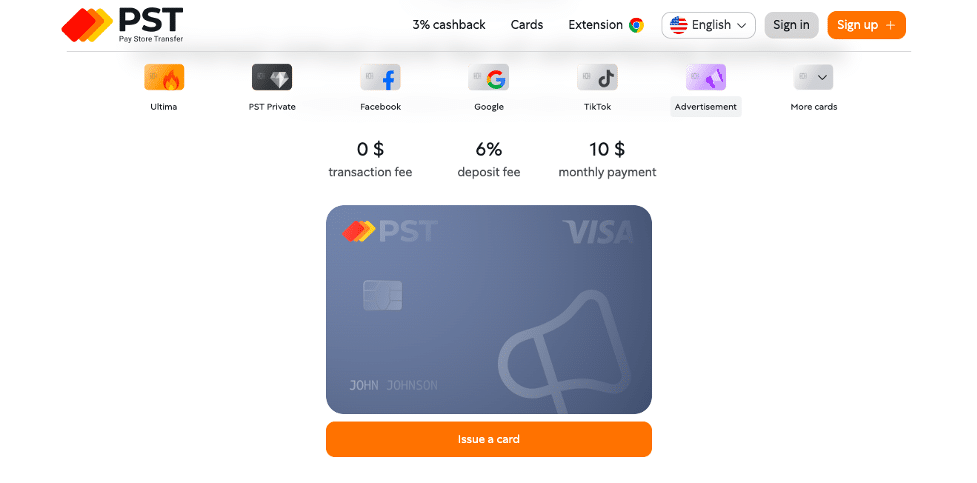

Specialized Cards for Media Buying

PSTNET provides segmented cards specifically designed for media buying on platforms like Facebook, TikTok, Google Ads, and Microsoft Ads. These cards are convenient for both individual and team use, allowing for easy control and optimization of ad spend.

Each card comes with unique benefits, including team functionality, BIN lookup and many other advantageous features.

Team Functionality

- Role Distribution and Limit Setting:

Allows control over access and spending for each team member.

- Financial Transaction Reports:

Ensures transparency and ease in bookkeeping.

25+ Unique BINs

- Minimized Risk of Payment Blocks:

Utilizing numerous unique BINs from US and European banks reduces the likelihood of blockages.

- BIN Lookup:

The service’s website offers a BIN checker. By entering the first 6 digits of the card, users can instantly access all necessary card information, from the issuing bank to the percentage of declined payments.

Key Features

PSTNET stands out with several key features that make it an ideal choice for businesses:

- 0% Transaction Fees: No fees for transactions, withdrawals, or payment rejections.

- 0% Fees for Blocked or Frozen Card Operations: All operations remain free in case of card blockage.

- Diverse Balance Replenishment Methods: Cards can be topped up via cryptocurrencies (USDT TRC20, BTC, and others), SWIFT and SEPA bank transfers, as well as Visa and MasterCard.

- Unlimited Card Issuance: No limit on the number of cards issued, which is particularly useful for large companies.

- Instant Registration and Card Issuance: Registration takes just 1-2 minutes, it can be completed using a Google account, Telegram, WhatsApp, Apple ID, or email. Active cards are available immediately afterward.

- First Card Available Without Verification: No need for complex identity verification procedures to start.

- 3D-Secure Technology Support: Provides extra protection for online payments.

- USDT Withdrawal Option: Offers convenience and flexibility in managing cryptocurrency assets.

24/7 Customer Support

PSTNET’s support service is available 24/7:

- Contact Options: Reach managers via Telegram bot, email or other convenient methods for quick resolution of any issues.

- Telegram Bot for Notifications and Support: Notifies users of all transactions and provides fast access to customer support.

Special Offers

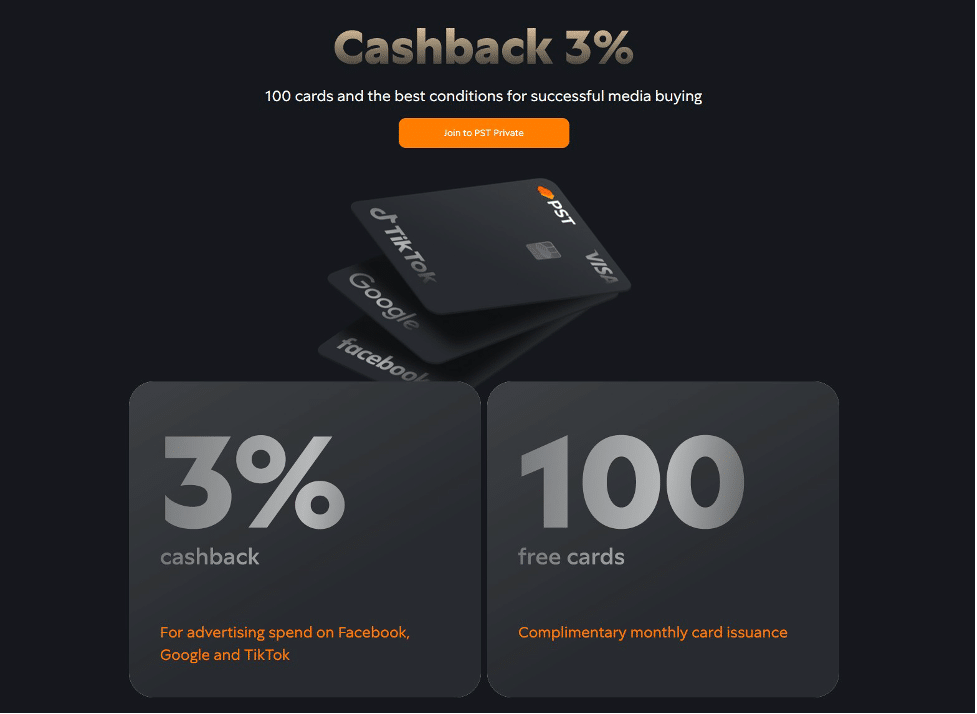

PSTNET also features the PST Private program for media buyers and partners, offering:

- 3% Cashback

- 3% Balance Top-Up Commission

- Up to 100 Free Cards Issued Monthly

No need to verify advertising expenses to participate in the program.

2. AnyBill (Abcard.io)

Financial Platform AnyBill (or AbCard) offers a wide range of virtual multi-currency cards that support payment systems like Visa, MasterCard and UnionPay. These cards are ideal for paying for advertising services on platforms such as Facebook Ads, Google Ads, TikTok Ads and Microsoft Ads.

Each virtual card comes with unique benefits, including team functionality and many other key features.

Team Functionality

- Role Distribution:

Assign roles to each team member, enabling better control over financial operations.

- Detailed Monitoring:

Real-time reports for each card, buyer or the entire team.

Trusted BINs

The AnyBill platform uses verified BINs (Bank Identification Numbers) from the UK, ensuring high transaction success rates. In the personal account, there are three types of BINs available.

Key Features

- Fees: 0% Transaction Fees, but there is a fee for canceled transactions. The final amount depends on the percentage of the decline rate relative to all transactions in the last 7 days.

- Balance Replenishment Methods: Cards can be topped up via cryptocurrencies or Visa, MasterCard.

- Card Issuance Limits: The platform imposes no restrictions on the number of cards that can be issued.

- Registration: The registration process on AnyBill takes only 1-2 minutes and does not require verification for the first card.

- Additional Verification: Required only for increasing limits and obtaining additional cards. Users need to provide their Telegram, Skype, company size, and average monthly expenses.

Technical Support

AnyBill’s support service is available 24/7 via Telegram.

3. Capitalist

Capitalist offers virtual multi-currency cards supported by Visa and MasterCard payment systems. These cards allow payments worldwide, including for advertising campaigns on platforms like Facebook Ads, Google Ads, TikTok and others. After registering on the platform and issuing a card, users can quickly and securely top up their virtual cards through the Capitalist platform.

Team Functionality

- Role Distribution and Limit Setting:

Capitalist virtual cards support role assignment and limit setting for teamwork.

- Mass Payments and Account Top-Ups:

These cards can be used for bulk payments and topping up advertising platform accounts.

Unique BINs

Capitalist provides cards with unique BINs from various US and European banks, reducing the risk of payment blocks and increasing transaction reliability.

Key Features

- Fees: 0% for transactions, canceled payments, and operations on blocked cards. Balance top-up fees range from 3% to 4.7%.

- Balance Replenishment Methods: SWIFT, SEPA, bank cards, cryptocurrencies (USDT, BTC, and others).

- Card Issuance Limits: Up to 5 cards per user with limits ranging from 2500 to 7500 EUR per day.

- Quick Registration: Registering on the platform takes a few minutes. After registration, users can immediately start issuing cards.

- Identity Verification: Necessary to increase limits and issue additional cards. The verification process includes providing personal information and some documents.

- Multi-Level Security System: Capitalist uses a multi-level transaction protection system, including 3D-Secure technology, ensuring a high level of security and fraud

- Fund Withdrawal: Funds from virtual cards can be withdrawn back to the Capitalist account.

24/7 Customer Support

Capitalist’s support service is available 24/7 via Telegram, email and other communication channels like VK.

4. Yeezypay

Yeezypay offers virtual multi-currency cards supported by Visa and MasterCard payment systems, allowing for convenient payment of advertising campaigns on popular platforms.

Unique BINs

Yeezypay uses unique Bank Identification Numbers (BINs) from various banks in the UK and US, offering a choice of 5 different BIN types.

Key Features

- Currency Exchange: A 1% fee for exchanging USDT to USD

- Balance Top-Up: Up to a 10% fee for topping up the balance.

- Balance Replenishment Methods: The platform accepts balance top-ups through USDT TRC-20 and ERC-20. By arrangement, funds can also be added via other methods like Wire Transfer. The minimum deposit amount is $500, with a 5% fee.

- Quick Registration via Telegram Bot: Users can register through a Telegram bot. After registration, they can top up their crypto wallet and start issuing cards immediately.

- Mandatory Verification: The identity verification process includes providing necessary documents and information, enhancing security and allowing users to increase card usage limits. This process is mandatory for users who wish to access all platform features.

- Flexible Withdrawal Options: Funds from Yeezypay virtual cards can be withdrawn back to the platform account or converted into cryptocurrencies.

24/7 Customer Support

Yeezypay’s support service is available around the clock via Telegram and email, ensuring prompt assistance and support at any time.

5. Mybrocard

Mybrocard offers virtual multi-currency cards supported by Visa and MasterCard payment systems. These cards can be used to pay for advertising on various online platforms, such as Facebook Ads.

Team Functionality

Mybrocard provides functionalities for team collaboration. Users can easily distribute roles and control all expenses, with all card operations reflected in the owner’s personal account.

20+ BINs

- Multiple BIN Types:

The platform supports several types of BINs for Visa and MasterCard cards.

- BIN Usage Tips:

The website includes a section with advice on which BIN to use for specific purposes.

Key Features

- Flexible Fee System: $0 Maintenance Fees and Top-Up Balance.

- International Transactions: 1% + $0.30 per transaction

- Fixed Fee for Declined Transactions: 0.5%

- Multiple Balance Replenishment Methods: Cards can be topped up via bank Transfer (SEPA/SWIFT) or cryptocurrencies. Balance top-up fees vary depending on the method used.

- Versatile Withdrawal Options: Funds can be withdrawn in various currencies, including cryptocurrencies.

- Simple Registration Process: Registering on Mybrocard is straightforward and takes only a few minutes. Users can register using their Google, Facebook, or email accounts.

- Identity Verification Required for Higher Limits and Additional Features: Full verification is needed to increase limits and access additional features. This process takes up to 24 hours on business days. Users need to show their documents on camera for verification.

24/7 Technical Support

Mybrocard’s support service is available around the clock through various communication channels. Users highly appreciate the promptness of the technical support team.

Conclusion

Choosing the right payment tool can significantly simplify and optimize the process of paying for advertising campaigns. Virtual cards like PSTNET, AnyBill, Capitalist, YeezyPay and Capitalist offer numerous benefits, including flexibility, security, and convenient financial management. They are ideal for advertising payments.

The services discussed in this article provide unique features such as minimal fees, a wide range of balance top-up options, and high levels of security.

By exploring our ranking of advantageous payment tools for advertising payments, you can select the most suitable option for your needs and achieve new heights in your professional endeavors. Virtual cards not only streamline the payment process but also offer a high level of control over financial transactions, allowing you to maximize the efficiency of your advertising budget and achieve your goals.