As tech continues to reshape entire industries, artificial intelligence (AI) is setting new benchmarks in the financial sector. This isn’t about robots taking over Wall Street but about integrating AI to make financial advice accessible and personalized. From managing assets to offering tailored investment strategies, AI is becoming an essential part of financial planning, enhancing accuracy and efficiency. As we delve into the transformative impact of AI in finance, let’s explore how it’s not just changing the game—it’s making it easier for everyone to play.

The Surge of AI in Financial Services

AI’s integration into financial services isn’t just a trend; it’s a revolution. By automating complex tasks, AI allows financial professionals to focus on calculated decision-making instead of mundane data analysis. Whether it’s calculating risk assessments or processing transactions, AI systems can handle large volumes of data at incredible speeds. This boosts productivity and it also enhances the accuracy of financial forecasts, making it a game changer for financial firms around the globe.

Personalization at Scale

One of AI’s biggest advantages is how it can personalize services at a massive scale. In the world of finance, this means delivering customized investment advice to clients based on their unique financial goals, risk tolerance, and investment history. AI algorithms interpret large amounts of data to identify patterns and predict market trends, enabling them to provide personalized recommendations that were once only possible through direct human interaction. As AI continues to learn as well as adapt, the level of personalization it offers is only set to increase, making it an indispensable tool for financial advisors.

Revolutionizing Financial Advice with AI Advisors

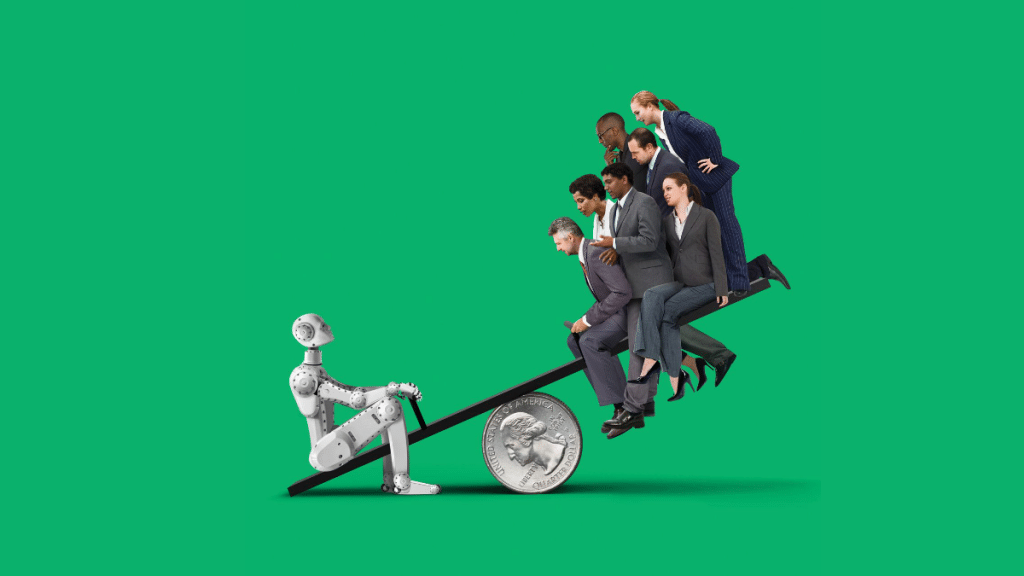

An AI financial advisor is a digital tool that leverages artificial intelligence to offer personalized financial guidance and advice. These AI advisors are transforming the way we think about financial planning. By continuously analyzing market data and a client’s financial status, these digital advisors can make swift, data-driven decisions. This is not about replacing human advisors but enhancing their capabilities to offer superior financial advice. The accuracy and efficiency of AI advisors allow them to perform what was once thought impossible—delivering high-quality, personalized financial planning services to the masses. This democratization of financial advice makes high-level financial planning accessible to all, breaking the barriers that once made it an exclusive service for the wealthy.

The Role of AI in Talent Acquisition

When it comes to talent acquisition, AI is proving to be an invaluable ally. An AI recruiting tool effectively streamlines the hiring process, from sorting through applications to identifying the best candidates for a position. This tool leverages machine learning algorithms to scan resumes and evaluate candidates based on skills, experience, and potential cultural fit. By automating these initial stages, organizations can focus their human resources on engaging with potential hires rather than on time-consuming screening processes. This not only speeds up hiring but also significantly improves the quality of candidates moving forward in the process, ensuring that businesses are built with the best possible teams.

Enhancing Customer Interactions with AI

AI is also revolutionizing customer service within the financial sector. Through the use of chatbots and virtual assistants, banks and financial institutions are providing 24/7 customer service that is both efficient and cost-effective. These AI-driven systems are equipped to handle a wide range of customer inquiries, from basic account information to more complex financial queries. By resolving common issues without human intervention, AI allows firms to allocate human resources to more complex customer needs, enhancing overall customer satisfaction and engagement.

AI in Risk Management

Risk management is another critical area where AI is making significant inroads. By utilizing predictive analytics, AI systems can anticipate potential risks and suggest mitigation strategies. This capability is crucial in financial planning and investment, where understanding and managing risk can mean the difference between profit and loss. AI’s ability to quickly analyze past performance and predict future outcomes enables financial experts to make more informed decisions, safeguarding assets against potential market volatility.

Navigating the AI Revolution in Finance

The integration of AI into finance is not just a passing trend but a substantial shift towards more efficient, personalized, and accessible financial services. As we embrace this technology, it is also our responsibility to navigate its challenges and ensure that its benefits are realized ethically and sustainably. Embracing AI in finance means not just keeping up with the times but staying ahead—preparing for a future where financial advice is smarter, more precise, and available to everyone.