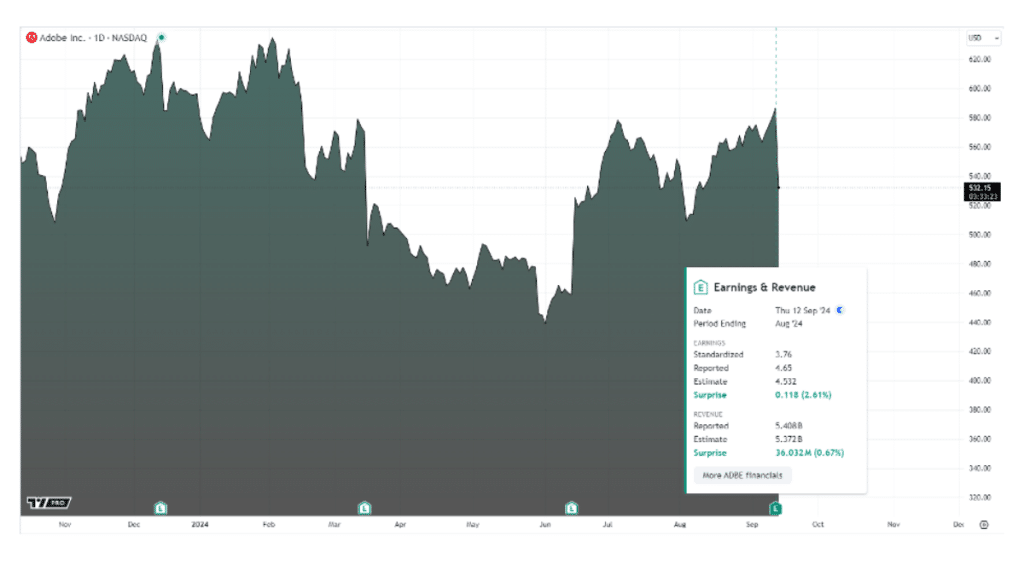

Adobe’s recent announcement of a weak fourth-quarter outlook led to a sharp 9.2% drop in its stock, drawing significant attention from investors and analysts. With artificial intelligence playing a central role in the tech sector, this development has prompted scrutiny of the company’s financial health and prospects, including the potential impact of innovative solutions like the new Adobe Firefly Video Model.

The primary reason for the share stems from investors disappointment in Adobe’s financial performance, which fell short of expectations. Analysts predicted more substantial results, given the rising demand for Adobe’s solutions, especially amid accelerating digital transformation across industries. However, the company tempered its forecasts, citing challenges in its distribution strategy and uncertainty due to changing consumer demand in the current economic situation.

Another factor influencing Adobe’s outlook is the rising demand for artificial intelligence solutions. In recent years, more and more companies, including Adobe, have been integrating AI into their products. Despite Adobe’s best efforts to adapt to these changes, the pace of AI technology adoption may not be meeting market expectations, contributing to the company’s lowered forecasts.

Investors and analysts also counted on steady revenue growth, driven by subscription-based services like Adobe Creative Cloud. However, analysts may have underestimated the impact of macroeconomic factors on consumer demand, as competitive pressures, as well as difficulties in attracting new customers and retaining existing ones, hindered this growth.

Considering the above factors, it is not surprising that the 9.2% drop attracted the attention of not only Adobe investors but also of the broader market, including key stock indices like the Dow Jones Index, even though Adobe is not a constituent. The tech sector, including major players like AMD, was also affected. Weak forecasts from a prominent company like Adobe can reverberate across the industry.

In response to these challenges, Adobe introduced the Firefly Video Model. This generative AI tool is designed to simplify and accelerate video content creation, opening new opportunities for users and media production companies. Preliminary insights suggest that the Firefly Video Model is part of Adobe’s AI strategy, which can help the company stay competitive and potentially attract new customers. If Adobe successfully integrates this tool and demonstrates its value, it could bolster its market position and regain investors’ trust.

In the long term, successfully implementing and developing AI-based solutions can improve the company’s financial performance and significantly change the entire industry’s landscape, which can become convenient for algorithms and automated trading. Many analysts believe that companies that can adapt to new technologies and offer innovative solutions will have competitive advantages.

In addition, incorporating Adobe Firefly into an existing product suite can increase subscription revenue and make advanced technology accessible to businesses of all sizes. This change can help Adobe recover its market capitalization and cope with the difficulties posed by slowing demand and economic uncertainty.

Adobe’s weak fourth-quarter outlook is rooted in market uncertainties and heightened competition, particularly in AI. While investors remain cautious, innovations like the Adobe Firefly Video Model offer hope for recovery. As Adobe continues to roll out its forecasts and new products, the tech industry will be watching closely, especially as interest in AI continues to surge.