Managing your receipts can be a daunting thing in today’s world. Whether you are a small business owner or manage your personal finances, accumulating paper receipts often leads to unnecessary chaos and stress. Enter the world of receipt scanning software, digital tools that are changing how we track our spending. These applications transform physical receipts into easily manageable digital files, making expense management more efficient, faster, and simpler than ever before. By leveraging receipt scanning software, you can stay on top of your bookkeeping and streamline the process of managing business finances, saving time and reducing headaches.

Read on to learn how receipt scanners can help you organize spending, increase tax deductions, and save time!

It’s time to say Goodbye to these papers.

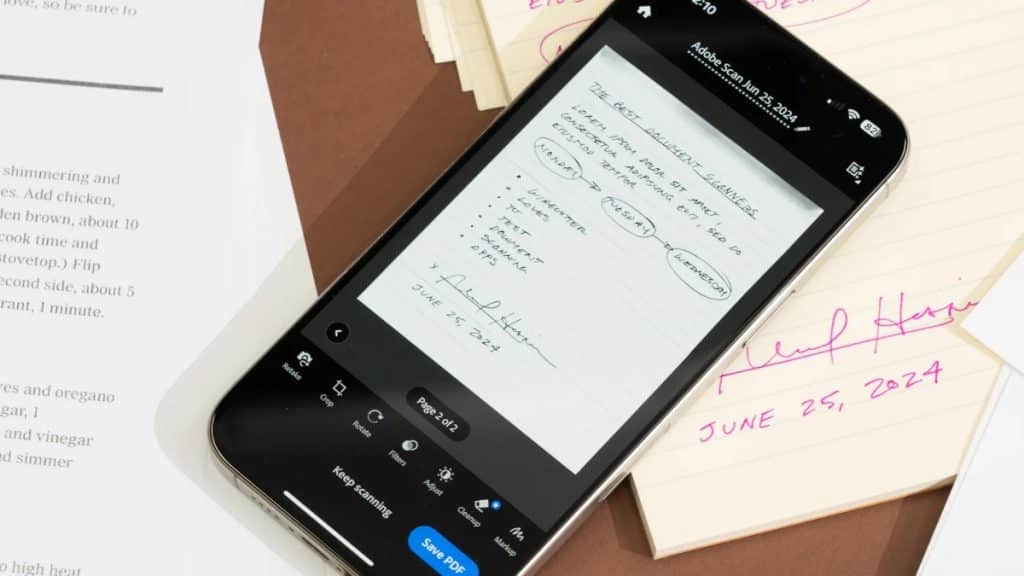

Think about how often you lose a receipt or receive one that’s illegible because the ink is missing. It’s frustrating, especially for processing tax deductions or commercial negligence claims. Receipt scanner apps put an end to this inconvenience by letting you record receipts with your smartphone camera, categorizing and storing them for your future needs.

Why do you need receipt scanning software?

Easy Organization

Tracking expenses manually is time-consuming and can easily lead to mistakes. With receipt scanning software, each transaction is automatically catgeorised and organized.

It makes managing your expenses easier, whether you’re managing household expenses or tracking business expenses. Imagine saving time by gathering and searching everything in one app!

Optimized Tax deductions

Don’t miss out on valuable tax deductions due to lost or faded receipts. With all your expenses digitally captured and categorized, you’ll have a comprehensive record come tax season. This can lead to more accurate reporting, no missed receipts and hence higher deductions, putting more money back in your pocket.

Precise data entry

When you manually enter your receipt’s data, it is time-consuming and prone to small yet significant errors. Modern receipt scanning software leverages advanced Optical Character Recognition (OCR) technology to automatically extract and digitize receipts’ information. This automation drastically reduces the likelihood of mistakes while significantly speeding up the data entry process, ensuring both accuracy and efficiency in managing your financial records.

This allows you to concentrate on other crucial work and tasks.

Who benefits most from using receipt scanning software?

While receipt scanning software can benefit almost everyone, certain groups find it particularly valuable:

● Small Business Owners: Easily track business-related expenses without drowning in paperwork.

● Freelancers: Manage multiple income sources and categorize business expenses for accurate tax reporting.

● Frequent Travelers: Quickly scan and save receipts for airfare, hotels, and dining expenses while on the go.

● Accounting Professionals: Streamline client expense management and improve accuracy in financial reporting.

● Remote Workers: Efficiently manage and submit expense reports for reimbursement, regardless of location.

How can you save money with receipt scanning software?

Receipt scanning software isn’t just a time-saving tool, but it can also help you save money in surprising ways:

Avoid late fees: An organized system means you’ll be less likely to overlook recurring bills or payments.

Optimize your budget: Many receipt scanners come with budget features, to help you track your spending and adjust your spending habits.

Reduce accounting costs: By reducing manual data entry, you’ll reduce the hours your accountant spends organizing your receipts. This can help reduce fees.

Key Features to look for

The receipt management tools available on the market vary. Consider these features to find the most suitable software for you.

- Mobile App Functionality: Ensure the software has a user-friendly mobile app for capturing receipts on the go.

- OCR Accuracy: Look for software with high-quality OCR technology for accurate data extraction.

- Integration Capabilities: Check if the software integrates with your existing accounting or bookkeeping tools.

- Customizable Categories: Ensure you can create custom expense categories that align with your business needs.

- Reporting Features: Look for robust reporting capabilities to gain insights into your spending patterns.

- Data Security: Prioritize solutions that offer strong encryption and secure cloud storage.

Choosing the best process optimization tool:

It is always important to choose software that meets your business needs. Fortunately, there are many options available. Here are some of the most popular options in 2024:

- Expensify

User-friendly interface and robust reporting features. This is suitable for small business owners and individuals.

- Zoho Expense

It provides seamless integration with other tools—a comprehensive solution to manage finances.

- Shoeboxed

It is an easy way to convert and categorize receipts digitally. Highly recommended for those who seek an easy interface and simplicity.

Final Thoughts and Suggestions

In today’s fast-paced business environment, efficiency is vital to success. Receipt scanning software offers small business owners a powerful tool to streamline financial management, save time, and increase tax deductions. By automating the tedious task of expense tracking, you free up valuable time to focus on what really matters – growing your business.

Don’t let manual receipt management hold your business back. Embrace the power of receipt tracking apps to automate your finance management today. Your future self (and your accountant) will thank you.