The “cup and handle” pattern is a popular technical indicator used by traders to identify potential buying opportunities in stocks.

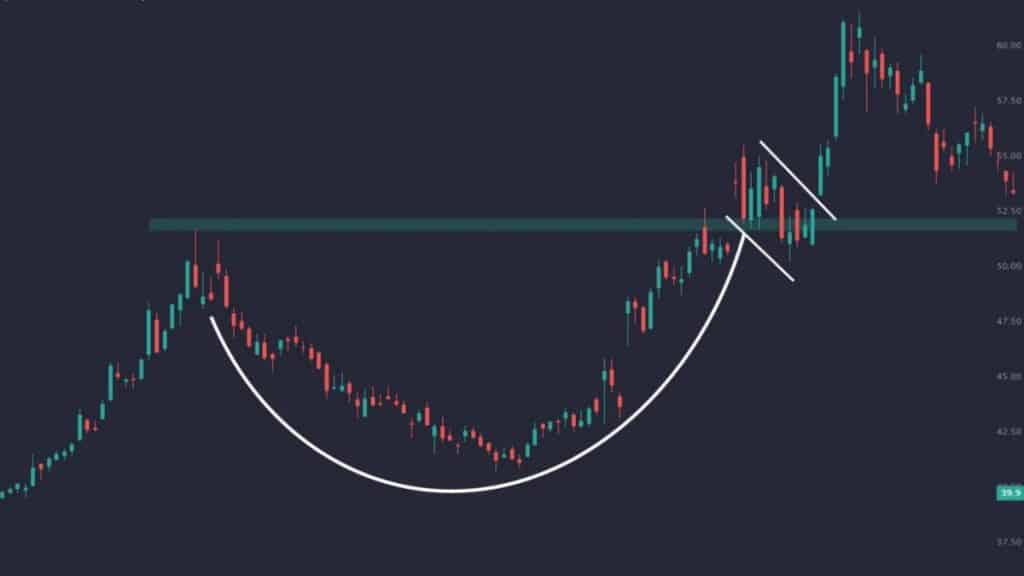

This pattern gets its name from the distinctive shape it forms on a stock’s price chart, resembling a cup with a handle.

Recognizing cup and handle stocks can help traders pinpoint when a stock is likely to continue its upward trend after a period of consolidation.

Understanding this pattern, along with the trading strategies associated with it, is crucial for those looking to capitalize on potential breakouts in the market.

In this guide, we’ll explore how to identify the pattern and provide insights on effectively trading it.

What is a Cup and Handle Pattern in Stock Trading?

Transitioning from a broad understanding of technical analysis, the pattern identified as the Cup and Handle emerges as a pivotal theme in stock market transactions.

This pattern suggests a positive ongoing trend where costs have paused before continuing their upward trajectory.

It visually mirrors a tea cup complete with a handle, showing intervals of stability followed by a rising movement.

Investors detect this formation on market graphs to pinpoint possible investment opportunities. The “cup” takes shape when there’s a dip in price followed by a recovery back to the original starting point, creating a rounded bottom.

The “handle” shows up with a minor drop after the cup, suggesting investors are securing gains but not enough to significantly lower prices. As costs ascend from the handle, investors frequently view it as an opportune moment to invest.

Key Characteristics of a Strong Cup and Handle Formation

Comprehending the cup and handle pattern is crucial for traders aiming to identify positive continuation patterns.

This chart pattern signifies a pause in an upward trend before it continues, presenting a trade opportunity. Here are the key components of a solid cup and handle formation:

- U-shaped Cup: The cup portion of the pattern should exhibit a U shape, not a V, implying a slow rather than abrupt downturn and recovery. This shape indicates that sellers slowly leave their positions and buyers start to join, pushing the price upward again.

- Cup Depth: Ideally, the depth of the cup should range between one-third and one-half of the previous upward trend. A less deep cup might not offer enough consolidation to form a solid breakout.

- Handle Formation: Following the cup formation, the price will experience a slight retreat forming a handle. This handle typically develops in the upper half of the cup and gently slopes downward.

- Volume: Volume holds a significant role during both the cup and handle formation. Volume should decrease as prices drop in forming the cup, slightly increase at its bottom, and then decrease once more during the formation of the handle.

- Length: The entire cup and handle pattern typically takes shape over 1 to 6 months for daily charts but can extend longer in weekly or monthly ones.

- Breakout Point: A vital trait is when prices break free from the handle portion with noticeable volume; this validates that traders might witness a continuing upward trend resuming.

- Pullback Availability: Occasionally, after breaking free from the handle, prices may slightly pull back to test support levels before truly ascending. This retest can present another purchasing opportunity.

Comprehending these components aids traders in distinguishing genuine trading opportunities from false signals in stock chart patterns using technical analysis instruments like trend lines and volume analysis.

How to Identify a Cup and Handle Pattern on a Stock Chart

Recognizing a Cup and Handle pattern in stock graphing indicates a possibility of continued bullish behavior.

This pattern provides meaningful understanding for novice and experienced traders aiming to identify potential trading prospects.

- Identify a bottom that mirrors the form of a cup. This configuration takes shape over several months, displaying a slow reduction succeeded by a steady return to its initial level.

- Locate the handle being shaped on the right side of the cup. It should appear as a minor downward movement in prices, not going below half the depth of the cup.

- Examine the volume during both the cup’s and handle’s creation. It’s common to see the volume lessen as the cup forms and escalate when prices start to ascend from the cup’s base.

- Look at the duration of a minimum of 7 weeks for the whole pattern to progress, the cup generally takes longer in comparison to the handle.

- Observe for a breakout above the top trend line of the handle with heightened volume, suggesting prospective entry points for traders.

- Apply technical analysis mechanisms like moving averages or trend lines to affirm the stock is in an upward trend before the pattern development, boosting credibility.

- Verify that no part of the handle drops below half of the cup’s depth. Handles going deeper could imply weaker patterns and less probable breakouts.

- Detect consolidation within the handle as it’s routine; this amassing builds market psychology prepping for an increase in price movement post-breakout.

- Cross-verify with additional technical indicators such as MACD or RSI to verify strength or weakness within this chart pattern before making trading decisions.

- Lastly, make certain that there are no bearish signals surfacing from other market indicators that might undermine what appears to be a developing Cup and Handle pattern.

How to Trade the Cup and Handle Pattern

To trade the cup and handle pattern, identify entry points, place stop-loss orders strategically, and set profit targets. Consider volume analysis, be aware of false breakouts, and manage risk effectively when trading cup and handle stocks.

Entry Points

When searching for entry points when trading the cup and handle pattern, consider the following:

- Look for a consolidation period with the price forming the “cup” pattern, followed by the “handle” formation.

- Wait for the price to break out above the resistance level formed by the handle’s upper boundary, indicating a potential bullish signal.

- Validate the breakout by observing increasing volume, signaling strong buying interest.

- Consider entering a long position as soon as the breakout occurs, ensuring adherence to risk management practices.

- Use trend lines to identify potential entry points within the handle formation for better precision in timing entry into trades.

Stop-Loss Placement

When trading the Cup and Handle pattern, it’s important to implement effective stop-loss placement to minimize the potential downside and safeguard your capital.

By implementing these guidelines for effective stop-loss placement when trading Cup and Handle stocks, you can enhance risk management capabilities and optimize trading outcomes in both bullish and bearish market environments.

Profit Targets

After establishing your stop-loss, it’s essential to set profit objectives to maintain a disciplined trading approach.

Remember, adapting profit targets based on evolving market conditions is a crucial aspect of a successful trading strategy.

Common Mistakes Traders Make When Trading Cup and Handle Stocks

While promising, this formation comes with its fair share of challenges. Let’s explore some common missteps traders make when dealing with cup and handle stocks.

- Neglecting Volume Analysis: Failure to consider the trading volume during the formation of the pattern may lead to inaccurate signals. Significant price movements accompanied by high volumes validate the pattern’s strength.

- Overlooking False Breakouts: Failing to account for false breakouts, wherein the price briefly moves beyond the handle before reversing, can result in premature trade entries or exits.

- Ignoring Risk Management: Not implementing appropriate stop-loss orders and profit targets could expose traders to substantial losses or missed opportunities for gains.

- Misinterpreting Price Action: Incorrectly identifying cup and handle patterns due to subjective interpretation of price movements without considering the pattern’s specific characteristics.

- Disregarding Market Conditions: Failing to assess broader market trends and conditions may lead to trading against prevailing market sentiment, reducing the pattern’s reliability.

- Solely Depending on Chart Patterns: Relying solely on cup and handle patterns while ignoring other technical indicators may lead to missed signals and inaccurate analysis.

- Inadequate Entry Point Evaluation: Focusing only on entry points without considering optimal entry levels based on trend confirmation and risk-reward ratios can impact overall profitability.

- Impatience in Trading: Hasty decision-making without waiting for confirmed breakout signals could result in premature entries or exits, leading to missed opportunities or increased risk exposure.

Can a Cup and Handle Pattern Occur in Both Bullish and Bearish Markets?

A Cup and Handle pattern can occur in both favorable and unfavorable markets. In a favorable market, the formation signals a continuation of the current uptrend.

Conversely, in an unfavorable market, it may indicate a potential reversal or brief pause in the downtrend.

The key lies in analyzing the context of the pattern within the broader market trend and using additional technical indicators to confirm trading decisions.

Traders need to adapt their strategy when dealing with this pattern depending on whether they are operating in a favorable or unfavorable market.

Understanding how to interpret and act upon these formations within different market conditions is crucial for successful trading strategies.

How Reliable is the Cup and Handle Pattern for Predicting Stock Price Breakouts?

The Cup and Handle pattern is generally considered reliable for predicting stock price breakouts.

A study conducted by the Market Technicians Association found that this pattern has a success rate of around 65% in identifying bullish continuation patterns.

When combined with volume analysis and other indicators, the reliability of the Cup and Handle pattern becomes even stronger, providing traders with valuable insights into potential trading opportunities.

Additionally, historical data shows that when this pattern forms after an extended uptrend in price movement, it often signifies a strong buying interest, making it a useful tool for both beginner and advanced traders to consider when developing their trading strategies.

Final Thoughts

In conclusion, mastering the cup and handle pattern provides valuable insight into stock trading. Understanding its characteristics and applying effective trading strategies can offer significant trading opportunities.

Whether in favorable or challenging markets, this pattern’s reliability in predicting price breakouts makes it a valuable tool for traders at all levels.

Embracing this pattern could be crucial in enhancing one’s technical analysis skills and maximizing potential gains from market movements.