Amongst the various terms associated with modern-day securities trading, demat accounts and trading accounts are arguably the most prominent. Both types of accounts are integral to the process of purchasing, selling, and storing securities in a dematerialized format. You can open a trading account and demat account online and follow some easy tips to keep the accounts safe. In this article, we shall discuss ten important tips to keep your demat account safe, particularly if you are a first-time investor.

Tips to Ensure Your Demat Account’s Safety

There are several measures you can take to ensure the safety of your demat account and trading account. Let us discuss some such measures.

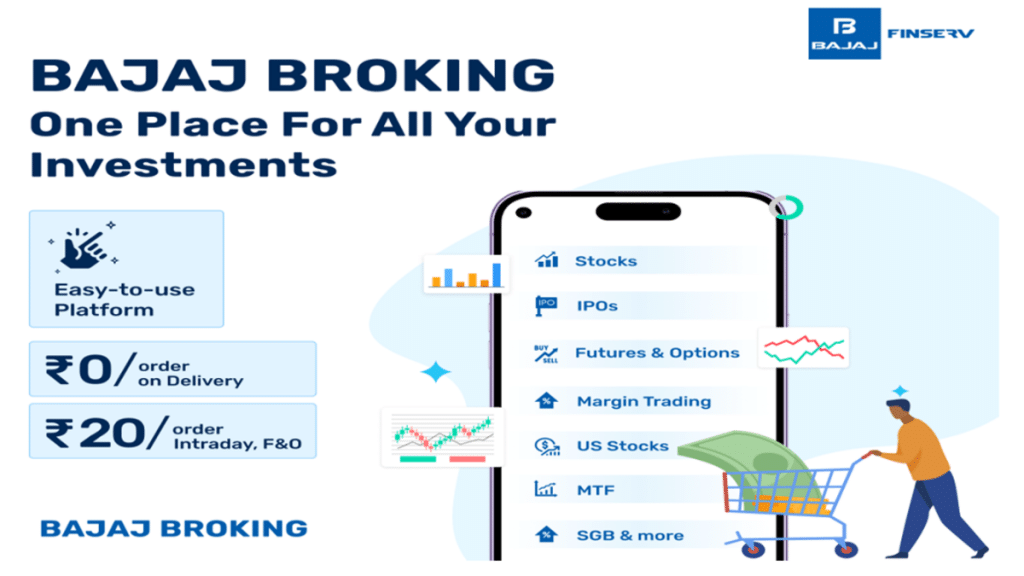

- Carefully select the broker or depository participant for your demat account: When you decide to open a trading account and demat account, you must conduct adequate research to select a stockbroker or depository participant. Choosing a reliable partner like Bajaj Broking can provide you with enhanced security features and a seamless user experience. Ensure you verify their past performance, security measures, and compliance adherence.

- Check the features of the demat account and trading account: It is important to choose a demat account and trading account after assessing the features of the account and ascertaining whether they are in line with your investment requirements. You can compare the demat and trading account offerings by various stockbrokers before making your selection.

- Peruse the cost structure for the account: Before you open a trading account and demat account, you must study the schedule of charges for both accounts. Factors such as the brokerage model deployed by the broker, including Bajaj Broking’s transparent fee structure, and the quantum of charges like Annual Maintenance Charges, can be key elements to consider in your selection.

- Set a strong password for the account: Once you have opened your trading account and demat account, you must immediately set a strong password for the accounts. You can also add to the security of the account by enabling Two Factor Authentication. It is important to change the password on a regular basis.

- Keep your demat account credentials private: You must ensure that your demat account and trading account credentials remain confidential. Sharing the aforementioned information is not advisable since it can compromise the safety of the account and the holdings therein.

- Use secure networks and platforms to access the account: It is pivotal to access your demat account and trading account on a regular basis and check the portfolio and transaction activity. Always use the official platform of the broker, such as the Bajaj Broking trading app or website, to ensure data security and privacy.

- Check your demat account statements: Your depository participant shall share your demat account statements on a periodic basis. You must ensure that you peruse those statements, locate discrepancies (if any) and report them.

- Keep your personal information updated: In order to receive timely updates for your demat account and trading account, you must keep your correspondence details updated in the account profile and in the stockbroker or DP’s database. You must ensure that alerts and notifications for the accounts are active.

- Report emails and messages received from suspicious sources: If you receive any suspicious email or message pertaining to your demat account and trading account, you must report it without any delay. Furthermore, you must refrain from opening the links mentioned in such emails or messages.

- Do not leave idle funds in your trading account for a long time: If you are not planning to place orders through your trading account, you must transfer the funds in the account to your bank account or wallet. Leaving idle funds in your trading account for a prolonged period is not advisable.

The bottom-line

By following these tips, you can enhance the safety of your demat and trading accounts. Partnering with a trusted broker such as Bajaj Broking ensures robust security and reliable services, making your investing journey smoother and safer. Remember to never share account-related information with third parties.