As the year draws to a close, trading and investing often center around strategies designed to rebalance portfolios, capitalize on year-end trends, or maximize annual profits. Here are some key strategies to consider for year-end trading and investing:

Tax-Loss harvesting

Tax-loss harvesting involves selling investments that have declined in value to offset gains from other investments in your portfolio. If you have made significant profits earlier in the year, then you can sell underperforming or suboptimal assets to reduce your taxable capital gains. This strategy can help lower your overall tax liability, minimizing the amount you owe at the end of the year.

Rebalancing your portfolio

Rebalancing involves adjusting your asset allocation to align with your target investment strategy. For instance, if your portfolio was initially 60% stocks and 40% bonds but over a year it has shifted to 70/30 due to stock gains, you may consider selling some stocks and buying bonds to restore the original balance. Rebalancing helps manage risk and prevents overexposure to a single asset class.

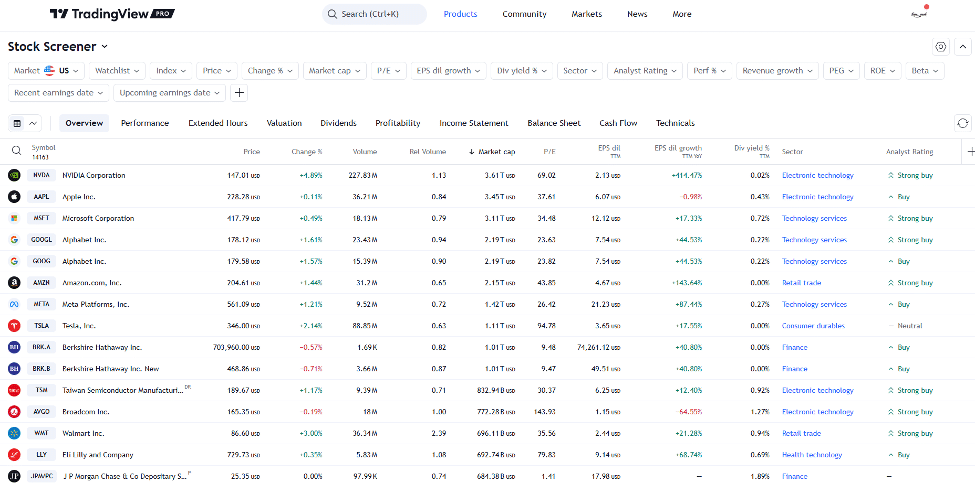

Targeting dividend stocks for year-end gains

Dividend stocks can provide consistent income, making them an appealing option for year-end investment. Focus on high-quality companies with a strong track record of stable dividends and solid financial health. Tools like stock screeners can simplify the search. Dividend income can offer a steady cash flow, which you can reinvest to benefit from compounding over time.

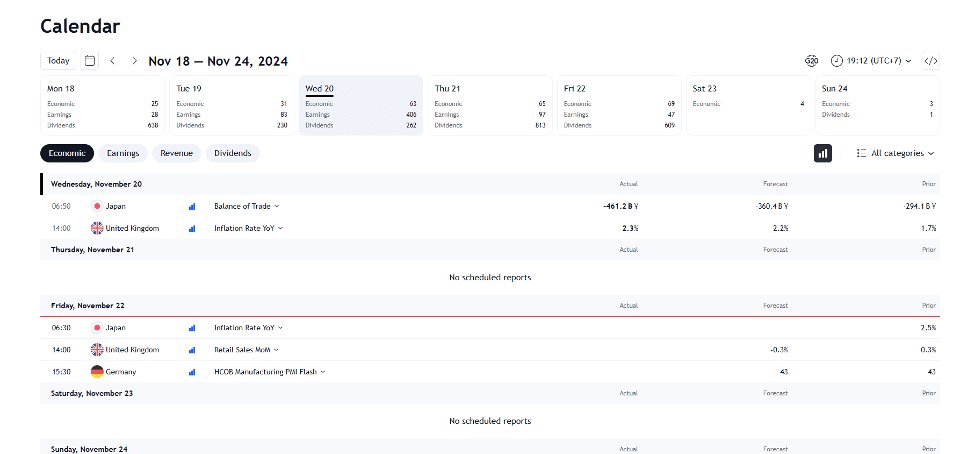

Evaluating market trends and key economic indicators

By analyzing market trends and key economic indicators, investors can adjust their portfolios to prepare for potential market conditions in the coming year. Consider factors such as inflation, interest rates, and other economic trends that might influence your investments. Resources like the economic data calendar can help you stay informed about relevant data and upcoming releases.

Setting goals for the New Year

As the year wraps up, it’s important to define your investment goals and targets for the next year. Having a clear, realistic plan helps guide your investment decisions. Take into account global economic conditions and potential developments to ensure your targets are achievable and well-informed.

By implementing these strategies, you can position your portfolio effectively for year-end opportunities while laying the groundwork for success in the coming year. Maintaining consistency with proven investment strategies and staying adaptable to market changes will further enhance your chances of achieving your financial goals.

Good luck!