It is everyone’s wish to have a standard trading account with a 100k funded account. The trader can get this done through FundingPips Prop trading firms because it has some of the best evaluation forms and strict but fairly propelled rules that can make this milestone a reality. In this guide, we are going to look at how to use FundingPips, how best to increase the chances of success, and how to use a 100k funded trading account to grow sustainably.

Why Prop Trading is the Path to Growth

What is Prop Trading?

Proprietary trading firms are companies that offer people with talent capital and also supply capital for trading, and in return are funded by a proportion of the profit earned. It also helps traders to expand their business easily without being forced to contribute their own cash.

Prop trading with FundingPips has these advantages.

– Large Account Sizes: FundingPips provides account sizes up to $100,000.

– Minimal Risk: Affiliates also can do trading and investing without any personal money with institutional grade capital at their fingertips.

– Flexibility: On FundingPips, traders are offered as many trading periods as they can handle to provide flexibility in working.

– Supportive Rules: Hence, full guidance standards including; profit objectives, drawdown extents, and adaptable earn-out formulas are helpful to the traders.

Overview of the FundingPips 100k Funded Trading Program

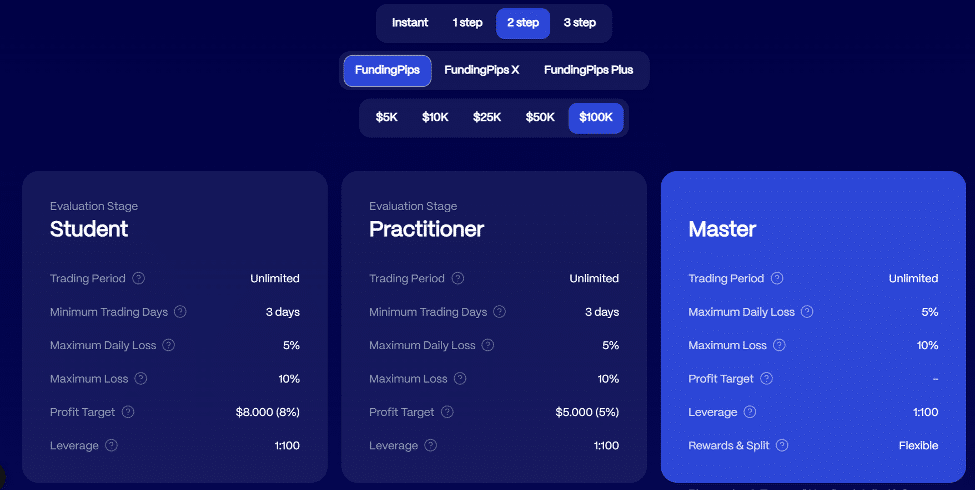

FundingPips appraises its traders within a Two-Step Challenge that include various levels of trading with different targets of profits and risk levels.

Evaluation Stage 1: The Student Plan

– Trading Period: Unrestricted – no time frame would have to be achieved to the targets.

– Minimum Trading Days: 3 days – fast enough to give an initial check out the situation.

– Maximum Daily Loss: 5% of account value.

– Maximum Loss: 10% of account value.

– Profit Target: $8,000 (8%).

– Leverage: In diversified situations, a leverage ratio of 1:100 is enough for free floating.

This plan will suit the trader who seeks to demonstrate his or her ability under relatively lenient circumstances.

Evaluation Stage 2: The Practitioner Plan

– Trading Period: Unlimited.

– Minimum Trading Days: 3 days.

– Maximum Daily Loss: 5% of account value.

– Maximum Loss: 10% of account value.

– Profit Target: $5,000 (5%).

– Leverage: 1:100 – applicable while determining the right size of positions on a strategic basis.

The Practitioner Plan suits those Traders who are comfortable with a slightly lower target in profitability but have a good showing in consistency.

Evaluation Stage 3: The Master Plan

– Trading Period: Unlimited.

– Maximum Daily Loss: 5% of account value.

– Maximum Loss: 10% of account value.

– Profit Target: None – this phase is characterized by slow, gradual, consistent profits.

– Leverage: 1:100.

– Rewards and Split: Variabilities in the detailed practice of profit sharing.

This stage moves traders to real accounts, providing hourly real money payouts for moreover steady incomes and better profit-making options.

Evaluating managerial performance has long been an important issue, which has raised a lot of questions in relation to different stages that may be distinguished in the process of evaluation. Managerial evaluation has multiple steps, which are considered below. The three main steps are the following:

How to Succeed in the Evaluation Stages

Whereas, each plan admits no departure from set guidelines, especially the daily losing limit of 5%, or the total maximum drawdown of 10%. These are important thresholds that should not be crossed if the organization is to pass the evaluation stages.

Develop Winning Trading Plan

– Risk Management: Maintain individual transactions’ sizes at 1-2% of total account capital.

– Profit Targets: Make trades that fall within the Student and Practitioner plans 8% or 5% targets of the Investment Account.

– Entry and Exit Criteria: This can be complemented by keeping clear entry and exit instructions in order to avoid the arbitrary nature of the market.

Leverage 1:100 Wisely

With 1:100 it means that forty times can be managed with a smaller amount of capital, 200 times – with even a smaller one. Nonetheless, over leveraging leads to violation of the acceptable loss limits. Abide by rational risk only and never allow your emotions to dictate the outcomes of your investment.

Focus on Quality Over Quantity

Interact only with probable high return trade. The fact that FundingPips has an open trading time also gives traders no reason to rush and make profits. Poetize precision over volume.

Best Trading Tools for Success

Companies Which FundingPips Supports on its Trading Platforms

1. Match Trader: Popular for its quick execution and reliability in terms of analysis.

2. cTrader: Great for technical and modifiable structures for line-of-work.

3. TradeLocker: A platform that can be used by beginners and at the same time is packed with features that would allow users to accomplish the main tasks.

Trading Analytics Tools

– MyFXBook: It would be handy to work it as a means of controlling outcomes and adjusting measures.

– Edgewonk: A complete and daily record of the trades that will be used for enhanced analysis.

How to Create Sustainable Business Having a Trade of 100k Account Funded

Getting from Training-Evaluation to Live Trading

When you pass the evaluation, expect to be handling a real $100,000 Master Plan account. It means that entrepreneurs should not try to get higher profits, but always care about steady improvements of these indicators.

Scaling Up Your Account

Slowly add up the lot sizes for each trading position as your new confidence level builds up. It is advised that you set aside some portion of your profits to act as a hedge against the losses.

Maintaining Risk Discipline

Remember, never violate 5% daily loss and 10% drawdown rules even if one becomes funded. This makes you exist and leaves you playing the game.

Flexible Profit Sharing

The payouts provided once a week or once a month enable traders to gain profits frequently thus motivate traders and provide steady income.

I present helpful tips on the things you need to do to make FundingPips work for you:

1. Start with the Plan that Matches Your Skills:

New users can choose the Practitioner Plan, which targets lower profit, while advanced users can take the Student Plan or go directly to the Master Plan.

2. Stick to Your Strategy:

Don’t tend to step off your plan, especially when anger or passion is present. It can also assist in keeping a record of somewhere and being able to make ourselves suitable accountable which could be by journaling.

3. Take Advantage of the Unlimited Trading Period:

Since there are no time constraints as with swing trading, one has to wait for the perfect conditions and trade calmly.

4. Use Technology to Your Advantage:

cTrader and tools like Edgewonk allow you to iron out those small details which should help keep them on track.

Conclusion

Managing and achieving a successful trading account is a successful and enjoyable experience for traders if they are ready to work hard while their funded trading accounts $100000. Two step challenge offered by FundingPips for their traders is easy to comprehend, have no limit on the trading time and come in different plans to make sure you succeed. One can summarize that by taking the necessary control of the risks, using sophisticated tools, and keeping discipline, one always gets the fullest result out of the funded account.

FAQs

1. What characterizes the differences of the Student Plan to the Practitioner Plan?

Another important thing to mention is the profit target. The Student Plan includes an 8% profit target, the Practitioner Plan – 5%, therefore the latter is even more suitable for careful traders.

2. What do I lose if I mess up the daily loss line?

The permitted amount of loss per day is 5%, and the total loss as of now – 10% of the initial amount; exceeding it leads to elimination from the evaluation stage.

3. Is FundingPips good for newbies?

Yes, they are easy to use for amateurs due to the flexibility of their plans, no limit on the number of trading periods, and easy to navigate platforms.

4. Once the evaluation criteria are met, how are revenues or profit split?

The revenue can be split in any way and can be the weekly or monthly payment, which is offered under the Master Plan.

5. What is the benefit of the infinite trading time?

It takes a lot of tension away, so the traders are able to control and be accurate instead of giving it everything because they need to meet their quotas.