The artificial intelligence boom continues to set the tone in the global semiconductor industry, driving consistent revenue growth for chipmakers. In the third quarter, total revenue from sales of semiconductor components increased by 15.8% to $208.4 billion, with September alone by 25.1% to $69.5 billion, making some of the area's players the top stock gainers. This sustained growth over the past year reflects strong demand for memory and logic semiconductors that power AI training and inference.

In September, the highest revenue growth rates were recorded in the Asia-Pacific region (47.9%) and the Americas (30.6%), pushing the ES futures. The rebound in tech manufacturing also helped lift broader risk sentiment in Asian markets, contributing to gains in Dow futures, which reacted to both strong U.S. semiconductor demand and improving supply-chain indicators across the region. China, although it remains the largest semiconductor assembly and consumption center, grew by only 15%, Europe –– 6%, and Japan recorded a 10.2% decline. The U.S. market showed the most sustained momentum, with an 8.2% increase from August, indicating high domestic demand from server and data center equipment manufacturers.

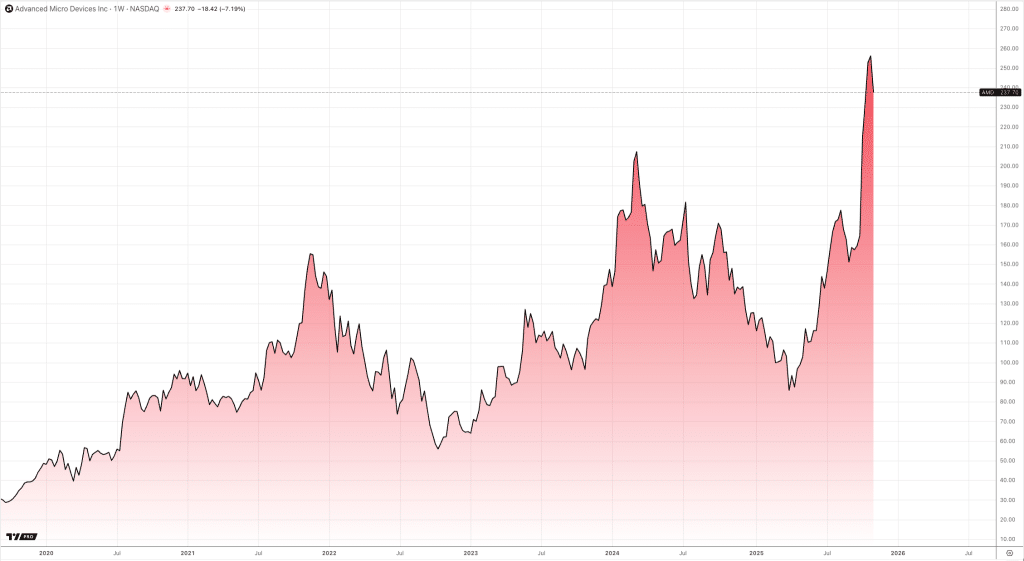

Amid these indicators, AMD strengthened its position and demonstrated impressive quarterly results. The company's revenue increased by 36% to $9.25 billion, exceeding forecasts by almost $500 million. Net income rose by 61% to $1.24 billion with earnings per share of $1.20, beating the expected $1.16. Though the fourth-quarter forecast of $9.6 billion was only slightly above market expectations, AMD continues to improve operational efficiency, showing stable profitability of 54.5%.

The key drivers were the server and client segments. The server business generated $4.3 billion in revenue, exceeding analysts' expectations and returning to an operating profit of $1.07 billion, following the prior quarter’s deficit. Growth was fueled by strong sales of fifth-generation EPYC processors and Instinct MI350 accelerators, as well as record Ryzen processor sales in the client segment, where revenue rose by 46% to $2.75 billion. The gaming business, combined with the client division, nearly tripled to $1.3 billion, boosted by higher console shipments from Microsoft and Sony ahead of the holidays.

AMD CEO Lisa Su highlighted the company’s promising outlook for the AI market. She estimates that by 2027, the company will annually receive tens of billions of dollars in AI accelerator revenue, with the total market potentially surpassing $500 billion. These expectations reflect both the company's ambitions and the profound transformation of the chip industry driven by the needs of generative AI.

Additionally, AMD is gaining a strategic advantage in the Chinese market. After a series of U.S. export restrictions on AI accelerators, the company obtained permission to supply Instinct MI308 chips to China. Although the revenue from these shipments has not yet been reflected either in financial results or forecasts, the approval itself gives AMD a strategic buffer. At the same time, Nvidia CEO Jensen Huang recently admitted that the issue with Nvidia’s China business stems not from U.S. sanctions but from weak local demand for its accelerators. Thus, AMD gains room to maneuver in a market where Nvidia is retreating.

Overall, the semiconductor industry has entered a phase of rapid growth, fueled by the structural expansion of AI demand rather than traditional recovery. Companies that adapt their product strategies quickly and maintain balanced server, client, and specialized offerings are emerging as clear winners. In this context, AMD stands out as a strong example of sustained expansion, with the dynamics of the global market confirming that a new wave of growth has already begun.