Wall Street’s overall sentiment toward artificial intelligence (AI) investment has shifted to a negative tone as concerns about a potential bubble bursting have grown. The last straw was a step from Peter Thiel’s hedge fund, Thiel Macro LLC, which had completely divested from Nvidia — a decision that many viewed as a signal that AI stocks are overvalued.

In Q3 2025, Thiel Macro sold 537,742 Nvidia shares, equivalent to approximately $100 million at the time. Notably, this accounted for around 40 percent of the fund’s total equity holdings. When the quarter was over, Thiel Macro had significantly less in U.S. stocks, decreasing from approximately $212 million to just $74 million over the second and third quarters.

However, this sell-off is not an isolated case. Following Thiel, SoftBank’s Nvidia sell-off went next; the Japanese conglomerate sold its entire $5.8 billion stake in the chipmaker. In addition, renowned investor Michael Burry is reportedly taking positions against Nvidia and other AI-related stocks, thus spreading the message of an upcoming AI market correction.

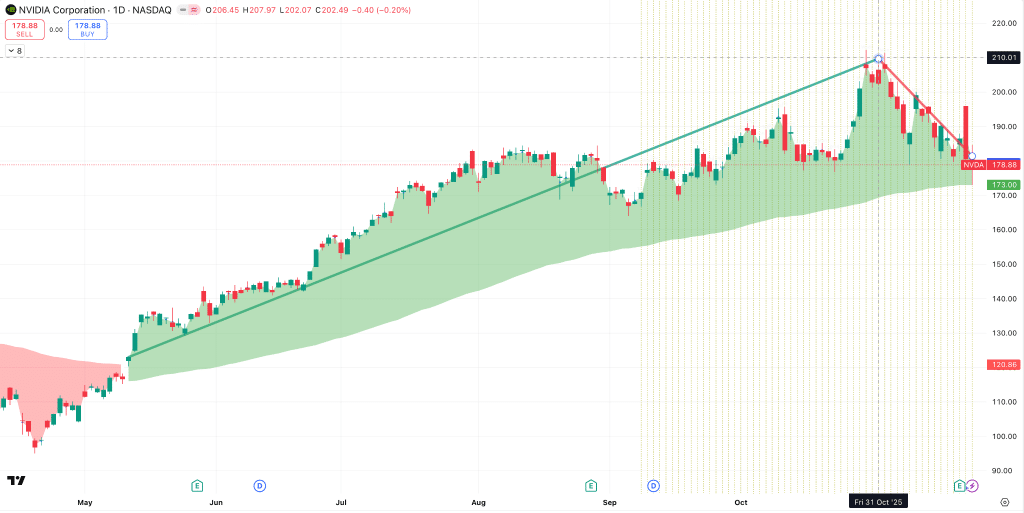

This climate of retraction has obviously affected Nvidia stock price, which has been on a rising trend since around mid-May, according to some indicators, but has dropped from $207 to $178 in two weeks.

The primary apprehension is based on the notion that a part of the AI hype is speculative capital that should be allocated in the long run to the growth of companies’ earnings. The detractors of the AI Stream maintain that the high-tech companies’ valuation ratios, such as Nvidia’s, are being inflated to high levels without corresponding, permanent cash flows.

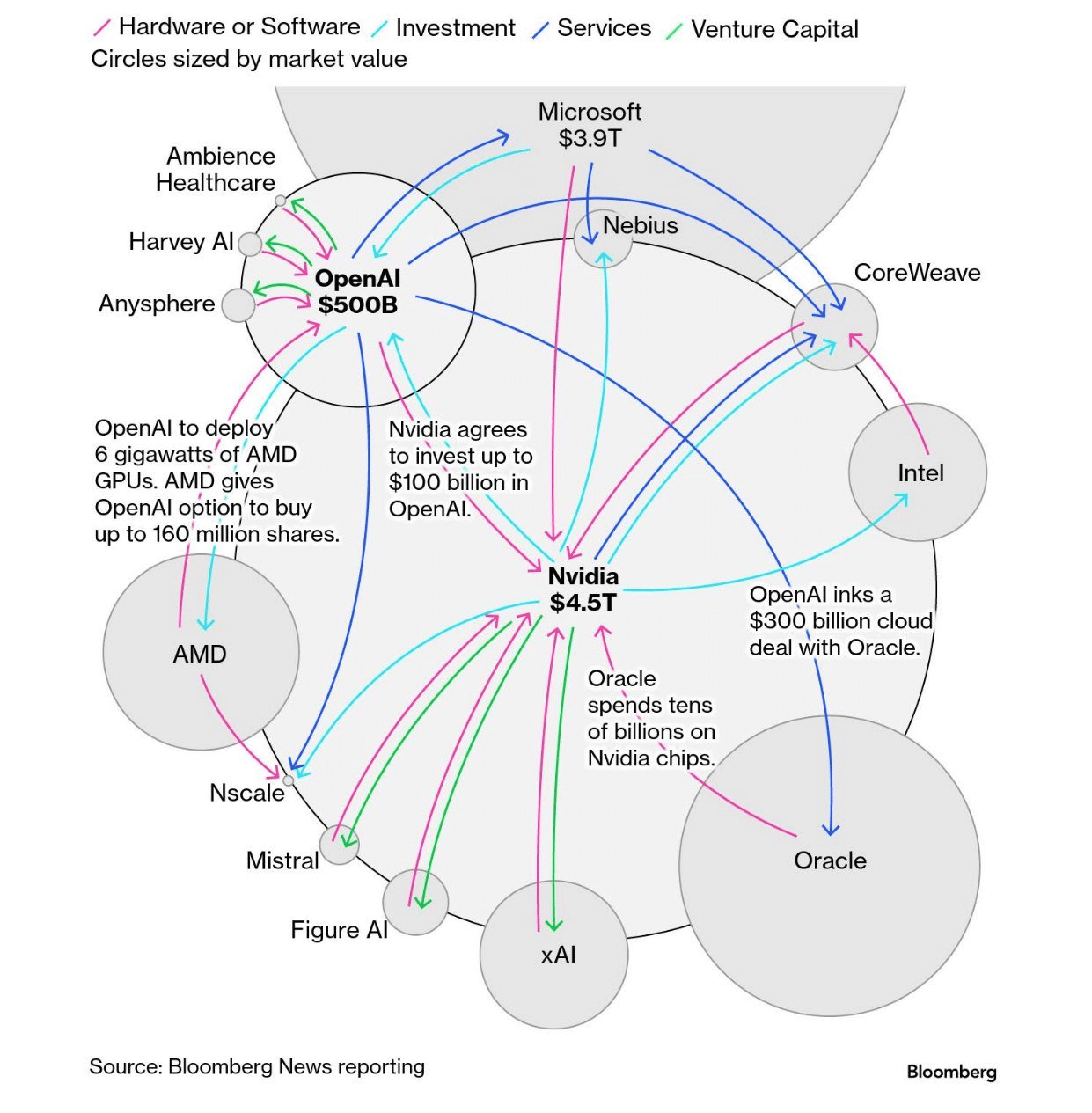

Additionally, some experts suggest that “circular deals” may be the reason for the apparent demand being exaggerated. For example, Nvidia has been involved in billion-dollar transactions in partnership with companies, where the cash later returns as GPU purchases, raising doubts about the fundamental economic aspects and the durability of such arrangements.

The change in Thiel’s investment strategy is evidence of a pessimistic viewpoint. In conjunction with the Nvidia shares sale, he also reduced his stake in Tesla by about three-quarters, which may potentially shift market sentiment toward the company and, as a result, impact Tesla stock performance as well.

On the other hand, he augmented his investments in Apple and Microsoft — companies with wider business models and less reliance on AI. This reallocation signals a fresh strategic orientation that extends beyond the tech sector to highly diversified technology companies.

When considering the overall picture, there is a mounting demand for accountability in the AI domain, which is being accompanied by these changes. Some interpret moves by Thiel and SoftBank as mere cashing in, but rather as a signal: the AI hype might have reached its peak, and the valuations could have gone beyond reality.

The future will tell whether this results in a complete “burst” of the “bubble”, but the actions of the most advanced investors are now signaling caution.