After several decades of dominating global finance and trade, the U.S. economy is beginning to show signs of fragility caused by a number of deep-rooted threats. Recent growth projections for 2025 and 2026 have been revised downward to 1.4% and 1.5%, respectively — an unmistakable sign of a weakening economic pulse. Additionally, the risk of recession is now estimated at 45%, a level that’s setting off alarms for markets, investors and policymakers.

Much of this instability stems from persistent trade tensions, fueling widespread uncertainty.

American consumer spending, the main source of U.S. growth, shows signs of slowing. At the same time, businesses are cutting back on investment due to rising costs and unpredictable tax policies. This cautious stance from the private sector underscores just how shaky the economic climate is.

Donald Trump’s first 100 days in the Oval Office have been marked by a flurry of executive orders, announcements, and protectionist measures — including tariffs — that have had a considerable impact. Indeed, these measures have initially provoked a surge in imports as companies tried to get ahead of expected tariffs, and they’ve also sparked retaliatory moves from major economic players. American exporters have taken a hit, affecting the country’s trade balance in many sectors.

The International Monetary Fund (IMF) has already expressed concerns that a prolonged economic slowdown driven by these hostile policies could destabilise the global economy. Additionally, China has gradually been shifting parts of its financial reserves into gold and cryptocurrencies to reduce its reliance on the U.S. dollar. This move eroded confidence in the United States’ global economic leadership.

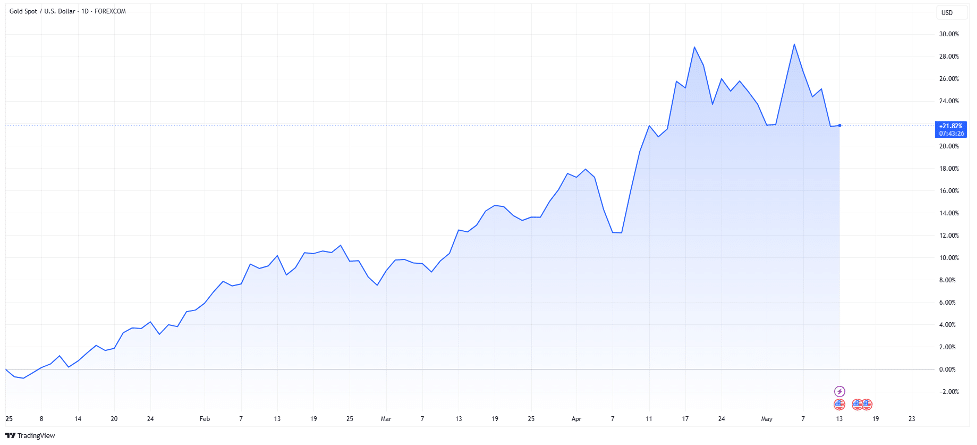

In this climate, gold is gaining ground and consolidating its position as a virtually indispensable safe-haven asset. The price of gold has risen by 22% since January 2025.

The fading trust in the dollar as a reliable store of value has only fueled this modern-day ‘gold rush’.

Rapid and coordinated action from U.S. policymakers is crucial to addressing these multiple challenges. Without decisive steps to restore confidence and stimulate investment, the country risks a recession that could drag the entire global economy down with it. The clock is ticking, and the economic credibility of the United States hangs in the balance.