There are two types of analysis in finance: technical and fundamental. The first focuses on price patterns and considers an asset’s volatility and volume to assess the possibility of price movement in a particular direction. The second, fundamental analysis, is used to appraise an asset’s intrinsic value.

Fundamental analysis in traditional finance uses formal documents such as company reports. These can be of different types: earnings reports, job hiring reports, tax reports, etc. Expanding into new markets can also be viewed as part of it, as it suggests increased production and consumer growth.

The emergence of cryptocurrencies brings their own advantages, which influence the traditional financial system as well.

On-chain analysis tracks user activity on the blockchain. We cannot know exactly how many bank customers transferred their funds yesterday to another particular bank. With crypto — yes, we can. But we don’t know who it was exactly, which is probably for the best.

Although considered a part of fundamental analysis, on-chain analysis has its own perks, and let’s move on and have a quick look over the past few weeks at Bitcoin’s blockchain activity.

There are two types of HODLers (a.k.a. holders): short-term HODLers (STHs) and long-term HODLers (LTHs).

As of now, when Bitcoin price is continuing to oscillate around $85,000, STHs’ assets in loss have peaked at 3.4 million, comparable to July 2018, the post-bull-run period. Around 90% of all the STHs who have held for at least a month are now underwater.

It is worth mentioning that STHs, due to their recent buy-ins, bear the most losses when correction phases begin, making them the most vulnerable to market disruptions.

Since Bitcoin’s latest all-time high (ATH) at $109K, its combined realized profit and loss has dropped by 85% — from $3.4 billion to approximately $508 million.

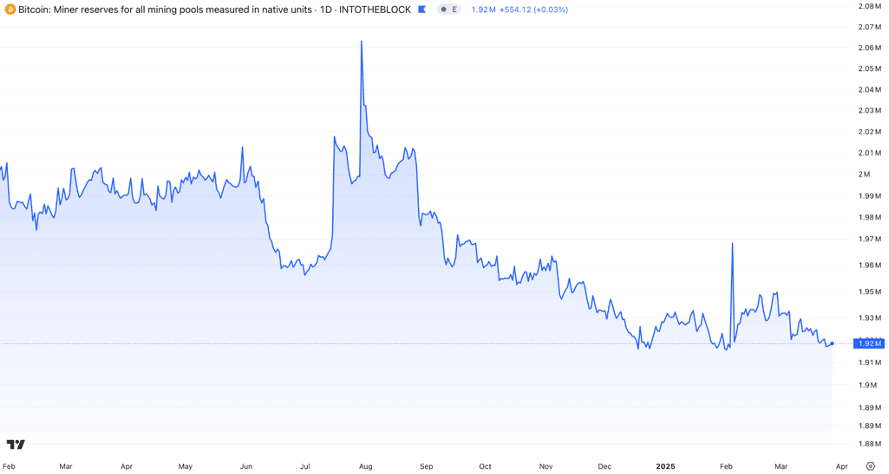

Another key metric to follow is the miner reserve.

Miners are the source of Bitcoin. As they mine, they accumulate Bitcoin in their wallets. Miners are highly sensitive to once-in-four-years halvings when their rewards are cut in half, and to electricity costs, as they consume a lot.

When the price is favorable and allows them to cover mining and maintenance costs, they distribute coins and create selling pressure. Every time Bitcoin reaches an ATH, they sell their assets.

This week, we’ve seen a small rebound in miner reserves, with more than 1,300 Bitcoin accumulated — modest but steady growth.

However, overall on-chain activity remains weak, with 900,000 active addresses compared to the February peak of 1,200,000.

The coming months will reveal whether Bitcoin and the broader crypto market will be able to attract new investors — the only way a bull phase can persist. The recent introduction of Bitcoin ETPs by BlackRock to European customers, OKX being the first crypto exchange obtaining the MiFID II license in accordance with the MiCA framework, may pave the way for increased capital inflows.

All eyes are on European markets.