Boeing (NYSE:BA) is one of the world’s largest manufacturers of aviation and defense equipment, and its stocks are traditionally seen as indicators of the industry’s and the global economy’s health. However, recent scandals have damaged the company’s reputation, leading to a significant drop in its stock value.

The shares have lost more than 30% in value since the beginning of 2024. The erosion of investor and public trust began in 2019 following two fatal crashes involving the 737 MAX in Indonesia and Ethiopia, resulting in 346 fatalities. This triggered a global grounding of the aircraft and a halt in its production. Subsequently, Boeing faced scrutiny over aircraft certification and allegations of lax safety oversight.

The consequences for Boeing’s stock were immediate and severe, with prices plummeting and investments appearing increasingly risky. Analysts and investors questioned whether Boeing could overcome the crisis and recover its former standing. Additional pressure on the company’s shares was also exerted by global economic turbulence caused by the COVID-19 pandemic in 2020, which severely impacted the aviation industry as a whole.

The ongoing streak of troubles was replenished with another one when a 787 Dreamliner experienced mid-flight damage, causing temporary loss of control for the pilot. Despite successful landing, the root cause remains unclear.

Boeing worked intensively to address design flaws and update the flight control system of the 737 MAX, leading to its eventual return to service after nearly two years of grounding. However, further issues emerged, such as a part of an Alaska Airlines 737 Max aircraft detaching shortly after takeoff due to improperly inserted bolts. A panel that plugged a space left for an extra emergency door blew out midair. Pilots were forced to make an emergency landing.

In early March, 50 people were injured due to abrupt maneuvering of a Boeing 787, and a Boeing 777 lost a wheel during takeoff. Additionally, the recent death of John Barnett, a former Boeing engineer who testified against the company, adds to the turmoil.

Boeing faces potential losses in the billions due to ongoing scandals, new lawsuits, and fines. The company’s woes are compounded by findings from the US National Transportation Safety Board revealing problems in production and assembly line management.

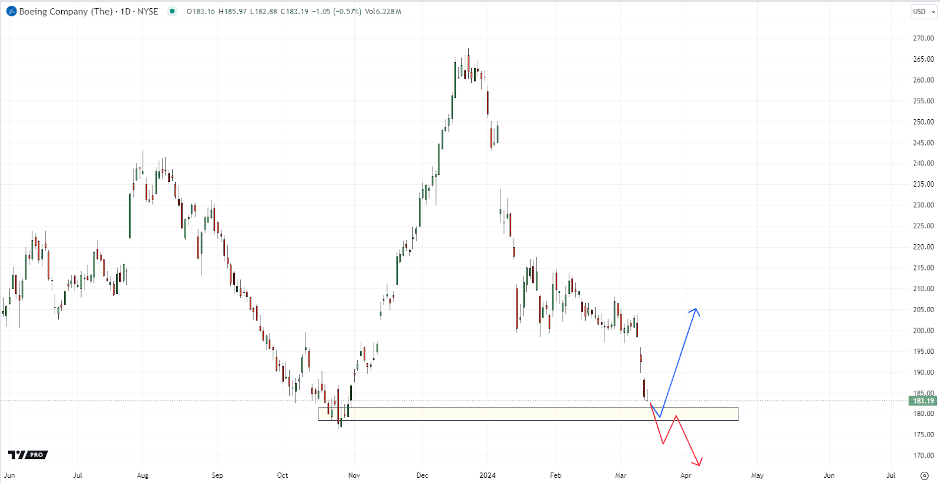

Traders should focus more on technical aspects, including support and resistance indicators. Investors may expect a test of support around $180, with potential for price recovery to historical resistance levels rather than immediate growth.

Boeing’s recovery hinges on various factors, including demand for new aircraft, resolution of certification and safety issues, and broader economic trends in the aviation industry. Reputation management and corporate culture renewal are crucial aspects.

Although Boeing confronts formidable obstacles, history offers examples of companies emerging strengthened from crises. Time will reveal whether Boeing possesses the requisite resources and strategic foresight to navigate current challenges and reclaim its leadership in the aircraft industry.