Table of Contents

- Understanding Medicare Supplement Plans

- Overview of Medigap Plans

- Key Differences Between Plans

- Factors to Consider When Choosing a Plan

- Enrollment Periods and Eligibility

- Comparing Costs and Benefits

- Recent Changes and Updates

- Conclusion

Understanding Medicare Supplement Plans

Many individuals approaching retirement find that Original Medicare does not cover every health expense. Medicare Supplement Insurance, known as Medigap, helps fill these coverage gaps by addressing costs like copayments, coinsurance, and deductibles. To explore your options, you can review different Medicare Supplement Plans designed to suit a variety of healthcare needs and budgets.

These plans play a vital role in limiting your out-of-pocket medical expenses. By supplementing your existing coverage, Medigap ensures that you are better protected against unexpected medical bills. Understanding how each plan works will help you navigate the standardized options available in your state. Each plan’s benefits are consistent, but your premium can vary depending on the insurer.

Overview of Medigap Plans

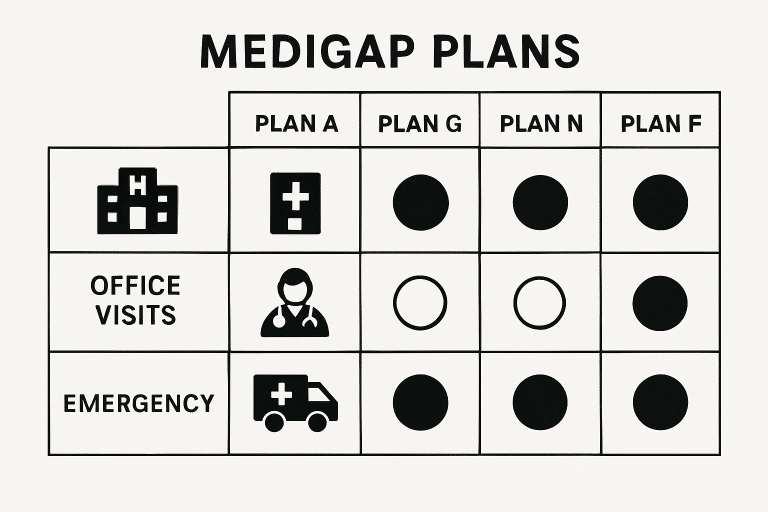

Medigap policies are standardized across most states and are identified by the letters A through N. These plans each offer a different mix of benefits, but the core coverage under the same letter is consistent, no matter which private insurance company issues the policy. For example, Plan G is often chosen for its comprehensive protection, except for the Medicare Part B deductible. Meanwhile, Plan N offers similar benefits but includes cost-sharing for office and emergency visits, making it a suitable alternative for those willing to pay occasional copayments.

Other popular plans include Plan F, which is no longer available to new enrollees but remains a robust option for those who became eligible before 2020. Each plan also comes with its own rules and exceptions, especially regarding additional benefits such as coverage for skilled nursing facilities and emergency foreign travel. Understanding these differences is crucial before making your decision.

Key Differences Between Plans

- Coverage Levels: Each plan covers different services to varying extents. For example, some plans offer higher coverage for hospital costs, skilled nursing facility care, and even limited coverage for emergencies abroad.

- Premium Costs: Premiums can vary not only by the plan you select but also by the company offering the plan. For this reason, individuals are advised to compare costs for identical lettered plans from various insurers.

- Out-of-Pocket Limits: Unlike most Medigap plans, Plans K and L include annual out-of-pocket limits. Once you reach this limit, the plan covers all additional expenses for the rest of the calendar year, giving you peace of mind if you experience high medical costs.

Factors to Consider When Choosing a Plan

Selecting the right Medigap plan requires you to assess several personal and financial factors:

- Health Care Needs: Review your current health status and medical history. Consider whether you anticipate frequent doctor appointments, specialist visits, or hospital stays.

- Budget: Balance the potential savings on health services against the monthly premium. Also, evaluate possible increases as you age.

- Provider Preferences: Confirm that your preferred healthcare providers accept the Medigap plan you are considering. Flexibility is essential, and not all plans offer the same choice of doctors or hospitals.

Resources from reputable health organizations, such as Kiplinger’s guide to Medigap, provide a helpful breakdown of plan options and can aid your decision-making.

Enrollment Periods and Eligibility

Timing matters when enrolling in Medigap. The six-month Medigap Open Enrollment Period begins the first month you are both 65 or older and enrolled in Medicare Part B. During this time, you cannot be denied coverage or charged higher premiums because of your health history. If you apply outside of this window, insurers may require medical underwriting and could potentially reject your application or inflate your premium. It’s critical to mark your calendar and take advantage of this guaranteed-issue period.

Remember that eligibility requirements can vary by state and insurance provider, so check your local regulations before enrolling.

Comparing Costs and Benefits

Although the benefits of each Medigap plan are standardized, monthly premiums can vary widely depending on the insurer, your location, age, and whether you qualify for discounts. Some companies offer reduced premiums for women, non-smokers, or those who pay annually. It is wise to consult resources like the official Medicare Supplement Guide for an unbiased overview.

Comparing plans across companies ensures that you find the best combination of affordability and coverage. Avoid choosing solely based on the initial low premium. Instead, check the details of each plan and ask about potential future rate increases.

Recent Changes and Updates

Legislation over the past few years has influenced how Medigap works, especially regarding prescription drug coverage and spending limits. For example, the Inflation Reduction Act set a $2,100 out-of-pocket cost cap for Part D plans, beginning in 2026. Such changes require seniors and their families to stay informed about current and upcoming policies, as these updates may affect the affordability and structure of both Medigap and Medicare coverage.

Staying current with ongoing Medicare reforms helps you avoid unexpected expenses and ensures your selected Medigap plan continues to meet your healthcare needs. Major health publications, such as Kiplinger’s guide to Medicare costs in 2026, can provide timely analyses of policy changes.

Conclusion

The right Medicare Supplement plan balances comprehensive medical protection with affordable premiums and convenient provider access. Take time to understand what each plan provides and compare costs between reputable insurers in your region. By reviewing coverage details, staying up to date on legislative changes, and enrolling during the optimal window, you will secure the peace of mind and support you need as you transition into retirement.