Payment disputes are a common issue in construction projects and can be extremely frustrating for contractors and construction professionals alike. Resolving these payment issues can be time-consuming as well as expensive, and in several cases, things don’t get resolved without legal recourse. This is why, as a construction worker, you should know about the different legal recourse and resolutions available in Florida to resolve your contractor payment disputes.

What are the Common Dispute Resolution Methods?

First and foremost, you should have a thorough understanding of your construction contract and check the various dispute resolution clauses included in it. Oftentimes, the dispute resolution clauses can resolve your payment disputes without needing to opt for expensive methods like litigation. Some common dispute resolution methods include:

- Negotiation

- Mediation

- Arbitration

- Litigation

In this blog, we will look at the different legal recourses and resolutions available for construction workers in Florida to settle their construction payment disputes. There are various legal rights and protections available under state law to ensure that construction workers receive payment for the services they provide on a construction project, such as:

Using the Mechanic’s Lien to Resolve Payment Disputes

A mechanic’s lien is one of the most powerful tools that construction professionals can leverage to resolve their payment disputes. This is a legal recourse through which contractors, subcontractors, and suppliers can secure their payment rights by placing a lien on the property where they have provided their services.

Several do’s and don’ts must be followed to preserve lien rights, as mechanic’s liens are governed by strict statutory requirements, such as:

- Sending a Notice to Owner Florida within 45 days of beginning work or supplying materials.

- Filing the mechanic’s lien within 90 days from the last day of furnishing labor or materials.

- Serving a copy of the recorded lien on the owner within 15 days of recording.

- Enforcing the lien within one year from the filing date.

- Ensuring the lien is filed in the appropriate county.

- Filing a lien release once the lien is satisfied.

Prompt Payment for Payment Dispute Resolution

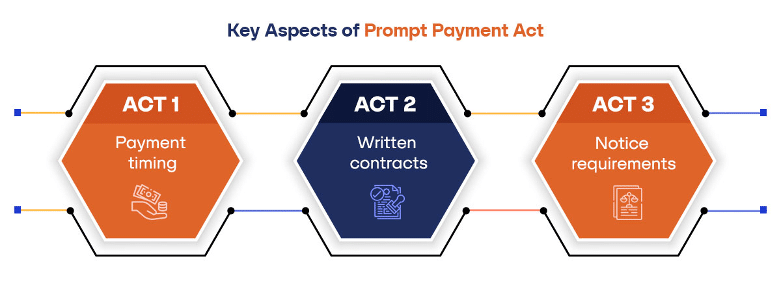

Another legal recourse is the Prompt Payment Act, which sets timelines within which contractors, subcontractors, and suppliers must be paid. Key aspects of this act include:

- Payment timing – Payments must be made within 14-30 days, depending on the parties involved and the type of payment.

- Written contracts – Clear payment terms and dispute resolution procedures must be stated in the contract.

- Notice requirements – Claimants should provide notices such as the Notice to Owner and other statutory notices to ensure compliance with the Act.

Opting for legal recourse should ideally be the last step, as it can be time-consuming and expensive. However, if you do find yourself preparing to file a lawsuit to resolve your construction payment disputes, make sure to contact your attorney early to preserve your lien rights.

At SunRay Construction Solutions, we understand how crucial it is for contractors to get paid promptly. Our team is dedicated to helping contractors, subcontractors, and suppliers secure their payment rights. Whether it’s through filing a mechanic’s lien or ensuring compliance with Florida’s complex construction laws, SunRay’s exemplary research team excels at making sure you’re always in the best possible position to get paid.

FAQs

1. What is a mechanic’s lien, and how can it help me get paid?

A mechanic’s lien is a legal tool that allows contractors, subcontractors, and suppliers to secure payment by placing a lien on the property where services or materials were provided. This ensures that payment disputes can be resolved by potentially forcing the sale of the property to satisfy the lien.

2. What are the key deadlines I need to follow to preserve my lien rights in Florida?

To preserve your lien rights in Florida, you must send a Notice to Owner within 45 days of starting work or supplying materials. The lien must be filed within 90 days of the last day of providing labor or materials, and you must serve the recorded lien on the property owner within 15 days of recording it.

3. What is the Prompt Payment Act, and how does it protect contractors?

The Prompt Payment Act ensures that contractors, subcontractors, and suppliers are paid within a specific timeframe, typically between 14 and 30 days. It also requires that written contracts clearly outline payment terms and dispute resolution procedures to avoid unnecessary delays in payment.

4. Can SunRay help me file a mechanic’s lien or ensure compliance with the Prompt Payment Act?

Yes, SunRay Construction Solutions specializes in helping contractors, subcontractors, and suppliers navigate Florida’s complex construction laws, including filing mechanic’s liens and ensuring compliance with the Prompt Payment Act.

5. What should I do if a payment dispute escalates to legal action?

If a payment dispute escalates to legal action, it is important to consult with an attorney as soon as possible. They can guide you through the process, helping preserve your lien rights and ensure that you follow the necessary steps to resolve the dispute. SunRay can assist you with lien filings and compliance to strengthen your position before legal action is required.