Struggling to manage your finances amidst the unpredictable interest rates of credit cards? You’re not alone. Many individuals find themselves trapped in a financial roulette, with their budgets at the mercy of fluctuating credit card charges.

However, there may be a more stable solution – personal loans. These financing options offer fixed interest rates and set repayment timelines, providing the predictability you need to plan your financial future effectively.

Whether you’re looking to consolidate debt, finance a significant purchase, or simply achieve greater control over your expenses, exploring the advantages of personal loans could be the key to finding the financial stability you deserve. This article will dive into the compelling reasons why personal loans may be the superior choice over the volatile world of credit cards.

The Pitfalls of Relying Solely on Credit Cards

The variable nature of credit card interest rates can be a significant source of financial stress and uncertainty. With rates that can skyrocket without warning, your monthly payments can fluctuate unpredictably, making it challenging to manage your budget effectively. This instability can lead to a vicious cycle of accruing debt and paying exorbitant interest charges, ultimately hindering your ability to achieve your long-term financial goals.

The constant need to stay on top of changing credit card rates and the potential for unexpected fee increases can make it incredibly difficult to plan your finances with confidence, leaving you at the mercy of an ever-changing financial landscape.

Personal Loans: A Stable Alternative

In contrast to credit cards, personal loans offer a more stable and reliable financial solution. With a fixed interest rate and a clear repayment timeline, you can enjoy the comfort of predictable monthly payments, allowing you to confidently plan your finances.

This predictability can be a game-changer in long-term financial planning, as it enables you to allocate your resources strategically and focus on achieving your financial objectives. One of the first steps in taking advantage of this stability is to get a pre-qualified for a personal loan.

Doing so can give you a clearer understanding of the terms you might be eligible for, including interest rates and repayment periods, without affecting your credit score. This knowledge can be incredibly valuable as you consider consolidating multiple high-interest debts into a single, lower-interest loan. By getting prequalified, you’re not only streamlining your finances but also paving the way for more effective debt management and savings on interest costs.

Personal loans can be an effective tool for debt consolidation, potentially saving you money on interest costs by combining multiple high-interest debts into a single, lower-interest loan. This streamlined approach can provide you with better control over your finances and simplify your monthly payments.

When to Choose a Personal Loan?

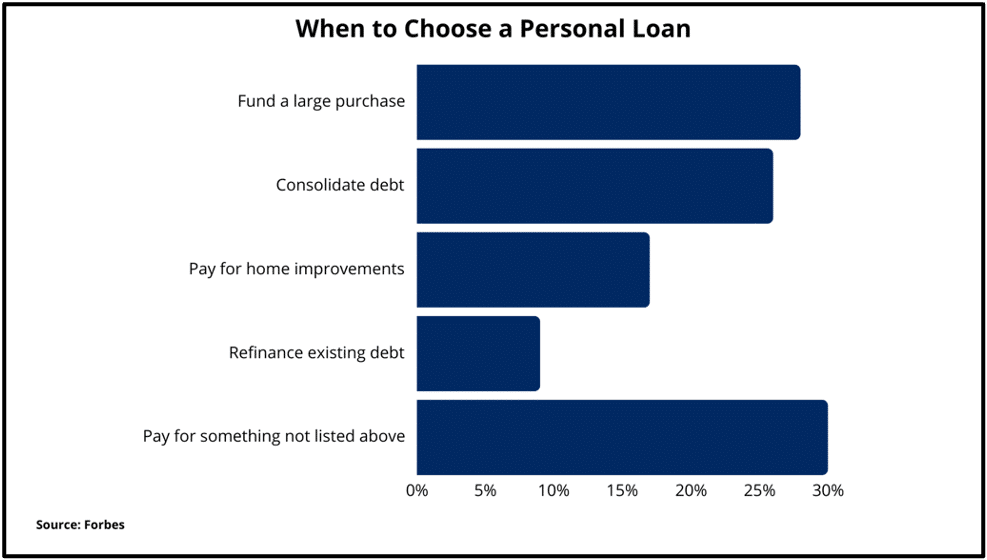

When deciding between a credit card and a personal loan, it’s crucial to carefully evaluate your financial situation and the specific purpose of the funds you need. If you’re facing the challenge of unpredictable credit card rates, have a substantial purchase or project to finance, or are looking to consolidate existing debts, a personal loan may be the better option.

These loans can offer the stability and predictability you need to plan your financial future effectively, allowing you to make informed decisions that align with your long-term goals. By considering factors such as your cash flow, repayment ability, and the intended use of the funds, you can determine whether a personal loan provides the financial certainty and control you desire, compared to the volatility of credit card financing.

The chart given below shows the factors that caused people to take out personal loans according to a survey conducted.

Navigating the Personal Loan Landscape

As you explore the world of personal loans, it’s essential to understand the various aspects of the application process, qualification criteria, and lender options. This knowledge will empower you to make informed decisions that align with your financial goals and provide the stability you seek.

Personal Loan Application Process

The personal loan application process typically involves providing information about your income, employment, and credit history. Lenders may also require documentation such as pay stubs or tax returns to verify your financial information. Once you submit your application, the lender will evaluate your creditworthiness and provide a decision, often within a few business days.

Personal Loans Pre-qualify and Pre-approval

Before applying for a personal loan, you can often pre-qualify or get pre-approved. Pre-qualification involves a soft credit check, which allows you to see estimated loan terms without impacting your credit score. Pre-approval, on the other hand, involves a hard credit check and a more thorough evaluation, often resulting in a more accurate loan offer.

Credit Score for Personal Loans

Your credit score plays a vital role in determining both your eligibility for a personal loan and the interest rate you may be offered. Lenders tend to favor borrowers with credit scores of 700 or higher, which are considered good to excellent. However, some lenders may extend personal loans to individuals with lower credit scores, though these often come with higher interest rates.

Personal Loan Lenders

Various lenders offer personal loans, including traditional banks, credit unions, and online lenders. Each lender may have different requirements, interest rates, and loan terms, so it’s essential to shop around and compare offers to find the best fit for your financial needs.

Unsecured Personal Loans

Unsecured personal loans do not require collateral, making them a popular choice for many borrowers. These loans are based solely on your creditworthiness, and the interest rate you receive will depend on factors like your credit score, income, and debt-to-income ratio.

Choosing the Right Personal Loan

When considering a personal loan, it’s important to carefully evaluate the terms, interest rates, and fees offered by various lenders. By taking the time to compare options and understand the details, you can find a personal loan that best suits your financial needs and preferences. This diligence will help you secure the stability and control you seek, empowering you to make informed decisions that align with your long-term goals.

| Feature | Credit Cards | Personal Loans |

| Interest Rates | Variable | Fixed |

| Repayment Structure | Minimum monthly payments, no set end date | Fixed monthly payments with a set repayment period |

| Credit Utilization | Impacts credit utilization ratio, which can affect credit score | Less impact on credit utilization ratio |

| Fees | Annual fees, late fees, and other charges common | May have lower or no upfront fees |

| Flexibility | Can be used for ongoing expenses and emergencies | Better suited for larger, one-time purchases or debt consolidation |

Frequently Asked Questions

1. What impacts my eligibility for a personal loan with a favorable rate?

Your credit score, income stability, and debt-to-income ratio are all key factors that lenders consider when determining your eligibility and the interest rate on a personal loan.

2. Can I pay off a personal loan early without penalties?

The prepayment policies for personal loans can vary among lenders, so it’s essential to read the loan terms carefully. Many lenders allow for early repayment without any penalties.

3. How do personal loans affect my credit score compared to credit cards?

Personal loans, being installment loans, have a different impact on your credit score than credit cards, which are revolving credit. Personal loans can potentially have a positive effect on your credit utilization ratio and credit history, leading to a better credit score over time.

Conclusion

Personal loans offer a steadfast alternative to the unpredictability of credit cards, providing the stability and predictability your finances crave. By understanding the benefits of fixed rates, streamlined repayment, and enhanced control, you can make a well-informed decision that aligns with your long-term financial goals and provides the peace of mind you deserve.