In a rapidly evolving financial landscape, few markets match the volatility and opportunity of cryptocurrency — particularly Bitcoin (BTC) and Ethereum (ETH). Yet, while many trading platforms have attempted to master these digital assets, most fall short due to outdated algorithms and an inability to adapt in real-time. Devvy, under the leadership of Stefan G., has introduced a paradigm shift with its AI-driven trading platform, leveraging the power of OMNI (Optimized Market Neural Integration) to perfect the art of crypto trading.

Specialization in Bitcoin and Ethereum

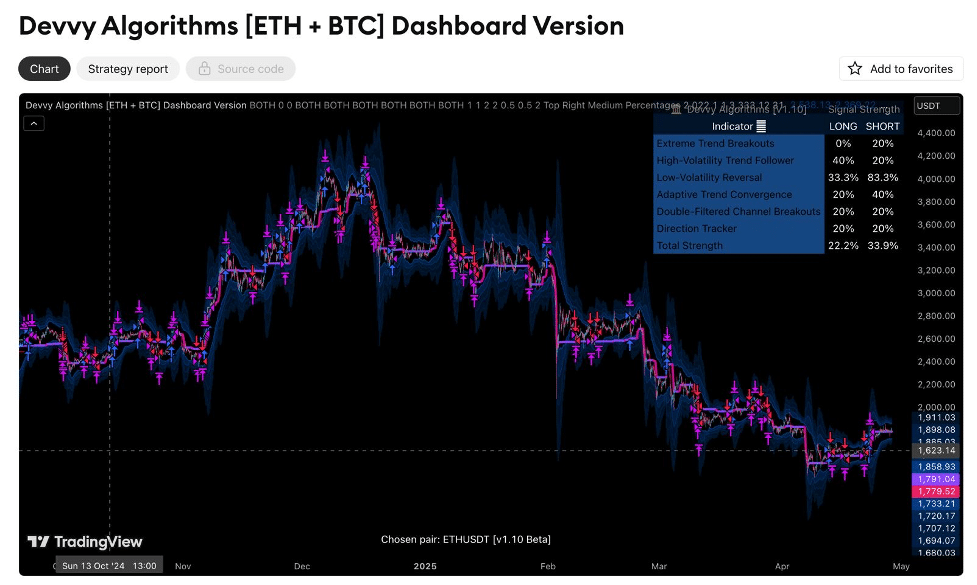

Rather than diluting focus across hundreds of altcoins, Devvy zeroes in on the most liquid and influential cryptocurrencies: Bitcoin and Ethereum. This targeted approach allows the OMNI engine to achieve a level of strategic refinement that broad-spectrum bots simply cannot match.

Key advantages include:

- Deep liquidity management, ensuring smoother execution and reduced slippage.

- Macro and micro-pattern recognition unique to BTC and ETH.

- Real-time news and blockchain updates integration, allowing the AI to adapt instantly to evolving events.

According to data from CryptoCompare, Bitcoin and Ethereum consistently account for the lion’s share of crypto trading volume globally, making them ideal assets for intelligent, AI-optimized strategies.

OMNI: A New Dawn for Crypto AI

At the heart of Devvy’s success lies OMNI — Optimized Market Neural Integration. OMNI is not a static bot or a rules-based program; it is a living, learning AI ecosystem capable of dynamically adjusting to shifting market conditions.

Features of OMNI include:

- LSTM-based sequence modeling, allowing prediction of short-term and long-term price patterns.

- Sophisticated indicator fusion, synthesizing signals across multiple technical and sentiment-driven data points.

- Continuous self-improvement, where every data point feeds back into refining future strategies.

OMNI’s architecture has enabled Devvy to attain a trade success rate approaching 90%, a level of performance unheard of in conventional crypto bots.

Fixed Risk. Consistent Growth.

One of Devvy’s most defining features is its fixed risk model. Every trade is structured with a 1:1 risk-to-reward ratio, ensuring that no position exposes the portfolio to excessive downside risk. Only one trade is active at any given time, promoting absolute clarity and precision in capital management.

Benefits of this disciplined model include:

- Elimination of devastating drawdowns.

- Predictable equity growth, even in turbulent markets.

- Greater investor confidence, knowing risk exposure is mathematically capped.

This structure positions Devvy as an ideal solution for investors seeking sustainable long-term gains rather than high-stakes gambling.

Closing the Accessibility Gap

In traditional crypto trading, success often depends on emotional resilience, market intuition, and constant monitoring — attributes that can vary wildly among individuals. Devvy neutralizes these variables by delivering a fully autonomous system that:

- Executes trades based on data, not emotion.

- Reacts to market changes instantly and intelligently.

- Protects capital through embedded AI-driven risk protocols.

Through this innovation, Devvy democratizes access to world-class crypto trading, previously available only to professional traders and hedge funds.

In the world of Bitcoin and Ethereum trading, where milliseconds and minor misjudgments can define success or failure, Devvy has established a new gold standard. Powered by OMNI true AI, backed by fixed risk integrity, and guided by Stefan G.’s forward-thinking vision, Devvy offers traders a future where opportunity is maximized, and risk is scientifically managed.

Crypto markets will continue to evolve. With Devvy, intelligent investors won’t just keep up — they’ll stay ahead of the curve.