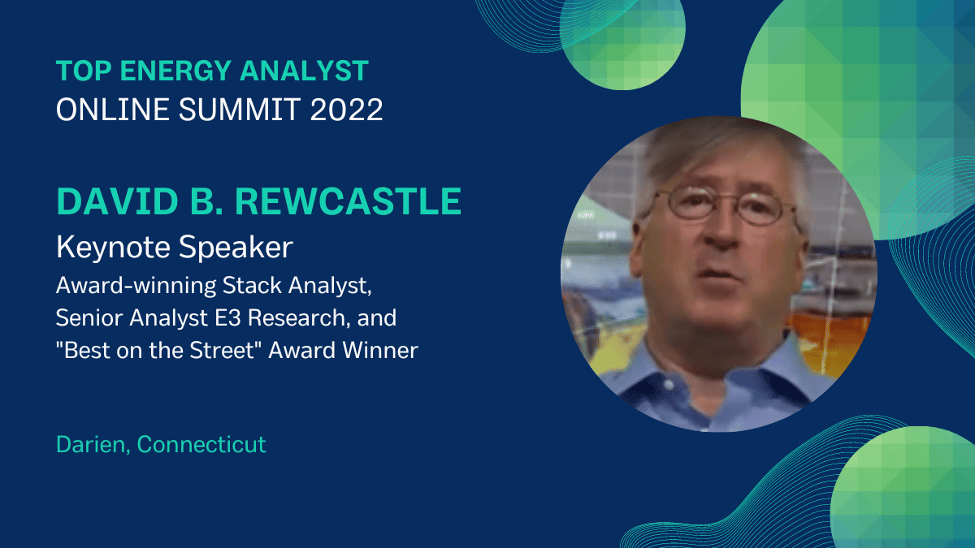

David B. Rewcastle, a Fixed Income, and Equity Analyst have experience in Finance and Economics. David has been an analyst for nearly 20 years in various industries. He started out focusing on Energy and Utilities and earned many awards as a senior analyst. He currently works as a Senior Analyst for an independent Research and Analytics Company and is a former Instructor at The University of New Haven.

His most notable achievement is the Wall Street Journal’s “Best on the Street” award for the Oilfield Services Sector. Financial Times rated him the #3 analyst. He is frequently quoted in Bloomberg News and Wall Street Journal, Forbes, and Investor’s Business Daily.

Recently, we had the opportunity to meet David Rewcastle. We spoke about many things, including his work in energy analysis as a professor, and his opinions on current crises.

How did you get started in energy analysis?

I was privileged to receive my Master in Arts & Business Administration, Finance, and Petroleum Economics major from New York University. Afterward I was invited by Schlumberger of Alberta, Canada to become an analyst for their Western Geco Seismic Division. Therein, I managed databases and quantitatively interpreted seismic data while organizing bids for oil-and-gas exploration projects with precision.

In 2003, I was welcomed as a Market and Securities Associate Analyst to September Group Partners Research. Here, I had the privilege of being a Buy-Side Equity Analyst which enabled me to gain an in-depth understanding of market trends within the energy industry.

September Group gave me an abundance of beneficial short-term and long-term market catalysts. At the start of my career, this was a great starting point to understand Wall Street trends and enthrallment for the New York Stock Exchange.

Let us know about your journey as a Senior Analyst.

Since 2018, I have been a senior analyst and partner at E3 Research Associates. This independent third-party research company specializes in equities and energy. My consulting services include research and analysis for both publicly traded and privately owned companies. Recent years have seen me expand my research into biotechnology.

E3 Research Associates is where I come from RHK/Source Capital Group and Compass Point Partners in Westport CT. I was there as a Senior Analyst for Energy-Related Equities & Fixed-Income products. Prior to this, I was a senior energy analyst for Divine Capital Markets, New York, NY. This covered oilfield services, natural gas utilities, and energy-related equities.

Additionally, I worked as an analyst for oilfield services, gas utilities, and energy-related equities at Argus Research Corp in New York, NY.

How will you define cash flow projections?

Cash flow projections show how much money is flowing into your business. This will help you identify months and categories in which expenses are higher than anticipated. These data can be used to identify potential problems before they become more serious.

Businesses can use cash flow forecasts to plan for corrective action such as liquidating assets and fine-tuning collection methods. You can also use it to predict the surplus and mitigate the negative effects of cash shortages.

What has your teaching experience at the University of New Haven been like?

In 2020, I started teaching Energy in America Economics. This course examines the U.S. energy and utility sector and how they may change.

This course examines the history and economic principles of European integration.

What are your thoughts on recent energy crises?

The energy crisis of 2022 is unlike anything else. While battling a pandemic, we are now facing oil and gas blockades that were imposed by foreign conflicts. The world is also undergoing a huge transition to renewable energy.

Tariffs, shortages, and clogged supply chains are all factors that can affect the critical components of solar or wind power. It is almost impossible to invest in new projects without knowing if Russian oil and gas will not be available for months, years, or even decades.

According to me, the current oil shock is just the beginning. It’s not only about oil. It also affects other industrial and food commodity markets that have an impact on the economy. This could also lead to more disruption in the global supply chain than what we’ve seen.

Are You Positive That Energy Inflation will Fall Soon?

I believe that the Fed is able to act with the conviction necessary to lower inflation.

There are also immediate ways to lower energy prices, which I believe is also true. The United States will likely have to shoulder a larger share of the responsibility for lowering demand through monetary policy. The Fed will need to monitor the data to determine if there are any changes in supply and demand. This will help them make the best possible decision.

Summarizing the David Rewcastle Interview

David Rewcastle is a well-respected utility and energy analyst who has been a respected industry leader for almost three decades. He shared his story about his journey as a master’s student, senior analyst, and finally into teaching.

His views on the recent energy crises were notable. We were told by him that he believes biotechnology can benefit the fossil fuel sector. It could help in the production and overhaul of fossil fuels as well as the biological treatment of water and ground and corrosion control.

To read his latest analysis of the U.S. energy crisis, visit his website today.