Choosing the Right Shipping Strategy for 2025

You got a great CIF quote—then paid £500 more than expected.

If you’ve ever felt blindsided by port handling fees, customs delays, or warehouse delivery issues, you’re not alone. In 2025, freight decisions aren’t just logistics—they’re business strategy.

Importing from China to the UK has changed. Post-Brexit customs rules, tighter VAT enforcement, rising port charges, and growing eCommerce demand now make shipping choices more consequential than ever.

Whether you’re a first-time Amazon seller or a growing brand with monthly sea shipments, your choice of freight method—traditional terms like FOB/CIF or modern options like DDP freight—can dramatically affect your cost predictability, risk exposure, and internal workload.

This guide offers a side-by-side comparison to help you choose the model that fits your operations—not just your quote.

Understanding the Basics of Shipping from China to UK: Traditional Sea Freight (FOB, CIF)

Most importers are familiar with terms like FOB (Free on Board) and CIF (Cost, Insurance, Freight). When it comes to shipping from China to UK, under the FOB terms, the supplier delivers goods to the departure port, but after that, you’re responsible for everything—from booking freight to managing UK customs, VAT, and last-mile delivery.

CIF offers additional services like marine insurance and transport to a UK port, but it still leaves you handling the rest.

Not sure how these terms affect your margins? Our Sea freight from China to UK guide helps clarify port costs, customs, and key trade-offs with real-world examples.

Here’s what’s on your plate with traditional shipping:

- Booking UK-side freight forwarder and broker

- Clearing customs and paying VAT to HMRC

- Registering for EORI and acting as Importer of Record

- Coordinating final-mile delivery from port

This approach works well if you have an in-house logistics team or long-term shipping experience. But for many SMEs, eCommerce sellers, or new importers, the risks and coordination overhead quickly add up.

For example, one cosmetics seller in Manchester received a £1,200 CIF quote—only to face an unexpected £550 in THC, VAT, and port storage charges.

What DDP Freight Really Offers

DDP stands for Delivered Duty Paid. When you choose a DDP freight service, you’re outsourcing the entire door-to-door process to your logistics provider—from factory pickup in China to delivery at your UK location.

With ddp freight services from providers like GORTO, importers get a fully-managed shipping solution designed for efficiency and compliance.

DDP typically includes:

- Export clearance in China

- International sea freight

- UK customs declaration & clearance

- VAT & duty payment on your behalf

- Final-mile delivery (including FBA or 3PLs)

- No need for EORI/VAT registration (your freight provider acts as importer)

For example, a skincare brand shipping 600 kg of products from Guangzhou switched to DDP and saved 4 hours of coordination time and £180 in unexpected VAT filing fees.

DDP vs Traditional: 2025 Comparison Table

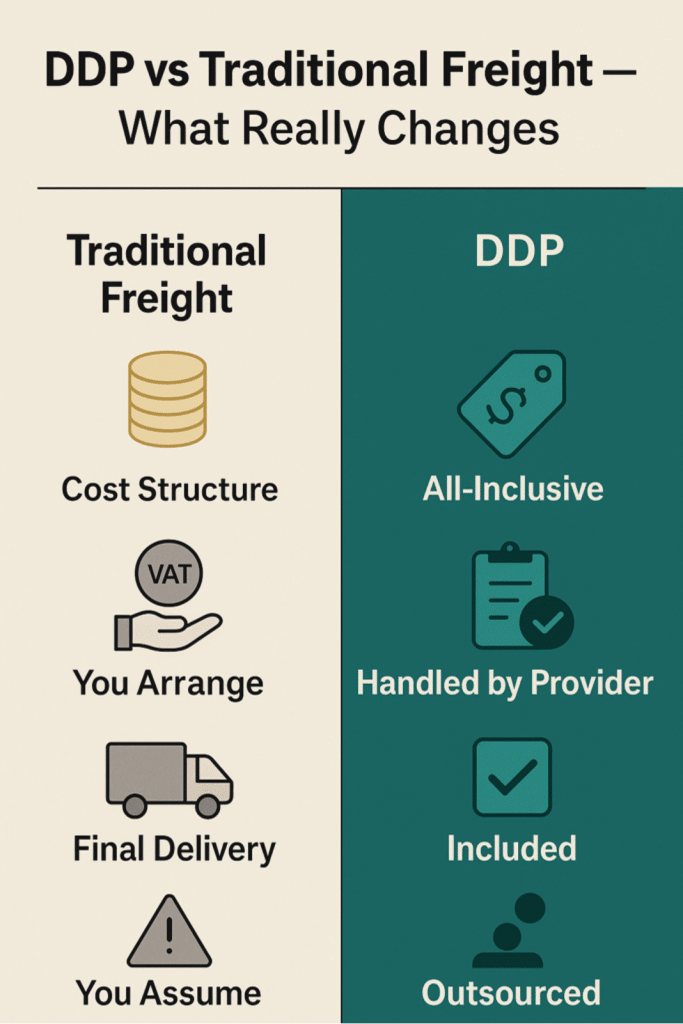

| Factor | Traditional (FOB/CIF) | DDP Freight |

| Cost Structure | Fragmented: multiple invoices & hidden port fees | All-inclusive, flat quote |

| VAT & Duties | Paid by importer upon arrival | Pre-paid by provider |

| Importer of Record | You | Freight forwarder (e.g., GORTO) |

| Final-mile Delivery | You coordinate trucking | Included in quote |

| Customs Risk | On you (errors, misclassifications) | Managed by provider |

| Time Investment | High (multiple agents) | Low (single point of contact) |

| Best for | Experienced importers with ops teams | SMEs, eComm, Amazon FBA, new importers |

Key Insight: If you import small to mid-size volumes without dedicated ops staff, DDP simplifies operations and improves landed cost predictability.

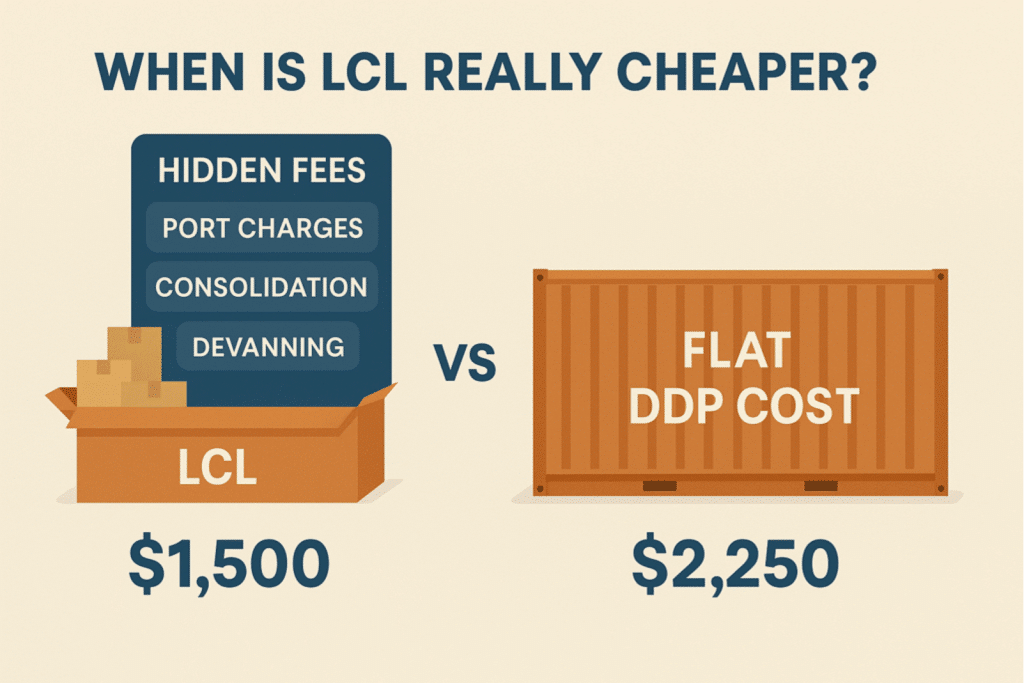

The Cost Curve: LCL vs FCL in DDP Terms

Aside from choosing DDP vs traditional, importers often face another question: LCL (Less than Container Load) or FCL (Full Container Load)?

Let’s break down the numbers using DDP quotes:

Example: LCL (10 CBM) DDP Shipment

- Freight: 10 × $85 = $850

- Handling, docs: $260

- UK delivery & customs: $390

Total: $1,500

Example: 20ft FCL (28 CBM max) DDP Shipment

- Flat rate: $2,250

- All-in: Includes customs, delivery, VAT

Effective per CBM cost: $80.35

Key Takeaway: If you’re shipping over 12 CBM, ask your forwarder for a break-even analysis. Batching SKUs to cross the FCL threshold can optimize cost-per-unit.

While LCL appears cheaper for small loads, extra handling fees, delays, and higher per-unit charges often erode savings.

Who Handles VAT, Customs, and Delivery?

This is where many importers underestimate traditional shipping costs.

With Traditional Freight (FOB/CIF):

- You or your broker files customs declaration

- You pay VAT/duties upon arrival

- You arrange delivery from port

- You must register for EORI and act as Importer of Record

Risks include:

- HMRC audits

- Misclassified HS Codes

- Delays due to incorrect documentation

With DDP Freight (e.g., via GORTO):

- Provider handles all paperwork

- VAT/duties included in quote

- Delivery coordinated directly to warehouse or FBA

Result: Clear landed costs. No legal responsibility for customs. No unexpected port charges.

Avoid These Common Mistakes in 2025

Even experienced importers fall into traps that inflate landed costs. Here are key mistakes to watch out for:

Mistake 1: Judging DDP as “Too Expensive”

A DDP quote looks higher upfront—but includes all VAT, customs, handling, and trucking. Many CIF quotes exclude:

- Port handling charges

- Brokerage fees

- Delivery booking surcharges

When all’s tallied, DDP is often 15–25% cheaper overall.

Mistake 2: Ignoring the Importer of Record Role

Acting as the Importer of Record in the UK means you’re legally liable for declarations, VAT compliance, and audits. DDP transfers that responsibility to your provider.

Mistake 3: Misjudging Delivery Complexity

Especially with Amazon FBA or strict 3PLs, late delivery windows or non-compliant paperwork can result in penalty fees. DDP models usually handle these nuances directly.

Is DDP Always Better? Not Necessarily

Here’s how to decide based on your operations:

| Scenario | Recommended Option |

| You have in-house freight & customs team | FOB or CIF |

| You’re a first-time importer | DDP |

| You sell via Amazon or eComm | DDP (FBA-compatible) |

| You value lowest visible quote | Traditional (but compare hidden fees) |

| You want cash flow predictability | DDP |

| You’re scaling quickly with limited ops | DDP |

Pro Tip: Always ask for a full quote breakdown—DDP or not. Clarify whether duties, port fees, and delivery are fixed or variable.

Final Verdict: Fit Your Freight to Your Business, Not Just Price

Choosing the right shipping method isn’t about chasing the lowest quote—it’s about optimizing for reliability, visibility, and operational efficiency.

If you’re confident managing customs, VAT, and logistics, traditional models like FOB or CIF offer control. But for most UK SMEs, lean teams, or multichannel sellers, ddp freight delivers consistency and reduces admin strain.

With providers like GORTO, you get a full-service experience: one quote, one contact, no customs chaos.

Ultimately, the smartest move is to match your shipping method to your operational capabilities—not just your budget line.