Oil and gas investments offer a unique mix of high-stakes challenges and substantial rewards. With the ever-growing global demand for energy, this sector remains a magnet for investors seeking significant returns. However, the path to profitability in oil and gas is fraught with risks, ranging from volatile markets to environmental controversies. This guide provides a comprehensive roadmap to help you navigate these complexities, offering insights into maximizing opportunities while mitigating potential pitfalls.

What Makes Oil and Gas a Profitable Investment?

The oil and gas industry has long been a cornerstone of global economic growth. The profitability of this sector is driven by a mix of market forces, technological advancements, and supportive policies. The benefits of investing in oil and gas include its potential for high returns, portfolio diversification, and leveraging global energy demand. Here are the key factors contributing to its appeal:

- Global energy demand: As economies grow and populations expand, the demand for energy continues to rise, keeping oil and gas in high demand.

- Technological advancements in extraction: Innovations like hydraulic fracturing and deep-sea drilling have unlocked previously inaccessible reserves, boosting profitability.

- Tax incentives and favorable regulations: Governments often provide tax breaks, such as the depletion allowance, to encourage investment in this critical sector.

Risks to Consider

While the potential for profit is undeniable, investors must be aware of the inherent risks, including:

- Market volatility: Oil and gas prices are influenced by geopolitical events, OPEC decisions, and global economic trends.

- Environmental concerns: Stricter regulations and public scrutiny on emissions and habitat destruction can impact operations and profitability.

How Do Oil and Gas Investments Work?

Investing in oil and gas involves a variety of opportunities, each with unique risk and reward profiles. Here’s an overview of the main types:

- Exploration and production: Investors fund the discovery and development of new oil and gas reserves, sharing in the profits from successful extractions.

- Royalties and leasing: By owning mineral rights, investors earn royalties when oil or gas is produced on their land.

- Equipment and services: This involves investing in companies that supply the tools, machinery, and logistics required for oil and gas operations.

The Life Cycle of an Oil and Gas Project

The journey of an oil and gas project typically involves the following phases:

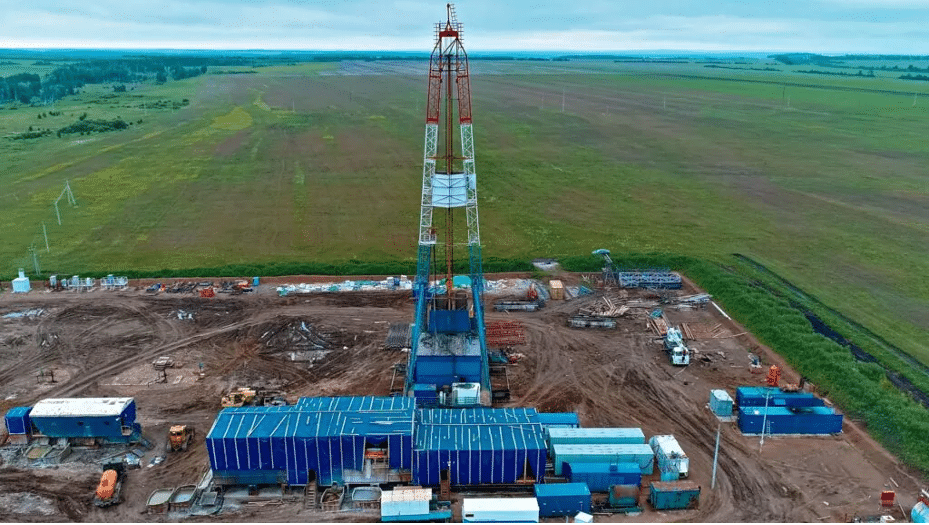

- Exploration: Geologists and engineers identify potential reserves using seismic surveys and other technologies.

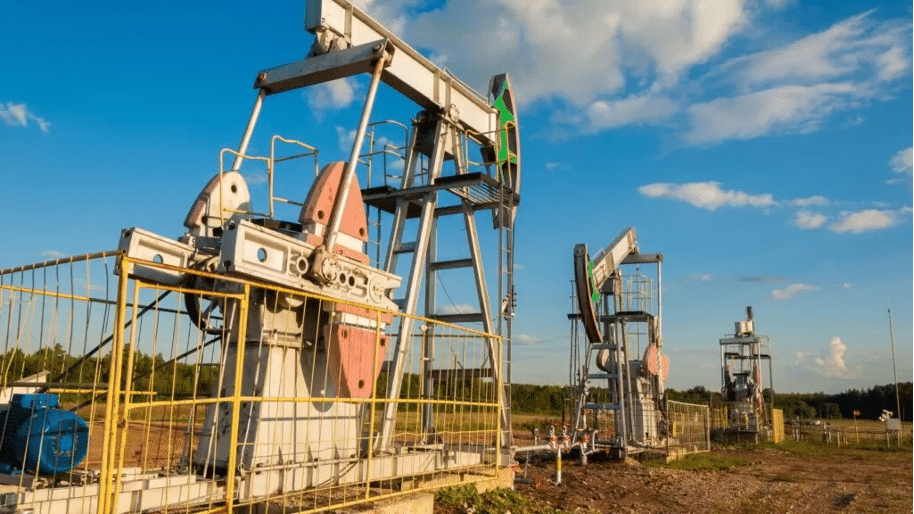

- Development: Drilling and infrastructure construction take place to extract the resource.

- Production: Oil and gas are extracted, processed, and transported to market.

- Decommissioning: Once reserves are depleted, the site is restored to its natural state, adhering to regulatory standards.

Revenue Generation in the Industry

Revenue is primarily derived from the sale of extracted resources. Pricing depends on global benchmarks like Brent Crude or WTI, while operational efficiency and production volumes determine profitability.

What Are the Different Types of Oil and Gas Investments?

Oil and gas investments come in various forms, each offering unique opportunities and risks. Understanding these types is crucial for selecting the right fit for your investment goals.

Direct Participation

Investors can directly participate in oil and gas projects by funding exploration and production activities. This approach provides significant profit potential but comes with high risks.

- Advantages: Direct participation offers a share of the revenue generated from successful projects, providing lucrative returns.

- Drawbacks: It requires substantial capital and exposes investors to risks like dry wells and operational delays.

Energy Stocks and ETFs

Another option is investing in companies involved in the oil and gas sector through stocks or exchange-traded funds (ETFs).

- Advantages: Offers liquidity and diversification, making it suitable for smaller investors.

- Drawbacks: The performance of stocks and ETFs depends on market trends, oil prices, and company management.

Royalties and Mineral Rights

Owning mineral rights allows investors to earn royalties from production on their land. This is a more passive investment option.

- Advantages: Steady income with less involvement in day-to-day operations.

- Drawbacks: Requires careful due diligence to ensure the reserve’s potential and operational reliability.

Master Limited Partnerships (MLPs)

MLPs are publicly traded entities that combine tax benefits with income generation.

- Advantages: MLPs avoid double taxation and often provide regular distributions to investors.

- Drawbacks: They are sensitive to market conditions and require a thorough understanding of the partnership’s structure.

What Are the Risks of Oil and Gas Investments?

The oil and gas sector is inherently risky. Investors must be aware of potential pitfalls and prepare accordingly.

Price Volatility

Oil and gas prices can fluctuate dramatically due to a variety of factors:

- Geopolitical instability.

- Decisions by OPEC and other major producers.

- Shifts in global demand due to economic trends or renewable energy adoption.

Environmental and Regulatory Risks

Stricter regulations on emissions, drilling, and environmental protection can increase costs and delay projects. Investors should consider the liabilities associated with environmental compliance.

Exploration and Production Risks

The uncertainties of drilling are a significant risk. Common issues include:

- Dry wells: Drilling does not always result in resource discovery.

- Operational delays: Equipment failures or weather conditions can disrupt timelines.

Market Risks

Changing energy trends, such as the rise of renewables, can reduce demand for oil and gas, affecting profitability. Long-term shifts in consumer preferences and technology also pose challenges.

How Do You Mitigate Risks in Oil and Gas Investments?

Investors can take proactive steps to reduce their exposure to risks in this volatile sector. Here are some strategies:

- Diversifying investments: Spread your capital across multiple projects and types of oil and gas investments.

- Conducting thorough due diligence: Research the operator’s track record, reserve estimates, and financial health.

- Partnering with reputable operators: Work with experienced companies known for operational efficiency and regulatory compliance.

- Using hedging strategies: Employ financial instruments like futures contracts to offset potential losses from price fluctuations.

What Are the Tax Benefits of Oil and Gas Investments?

Tax incentives make oil and gas investments particularly attractive. Key benefits include:

- Intangible Drilling Costs (IDCs): Investors can deduct a significant portion of the costs related to drilling, such as labor and materials, in the first year.

- Depletion Allowance: Allows investors to account for the reduction in reserves as a tax deduction, boosting profitability.

- Passive Income Deductions: Income from royalties and partnerships often qualifies for deductions that lower taxable income.

How to Conduct Due Diligence on Oil and Gas Investments

Thorough due diligence is essential to identify profitable opportunities and minimize risks.

Evaluating the Operator

Assessing the operator’s credentials is critical. Key factors include:

- Experience in the industry.

- Reputation for ethical practices and efficiency.

- Track record of successful projects.

Assessing the Reserve Potential

Evaluate the quality and quantity of reserves through:

- Geophysical surveys.

- Reserve estimates from reliable third-party sources.

- Historical production data for existing wells.

Reviewing Financials and Contracts

Examine financial statements and contracts to ensure transparency and fairness. Focus on:

- Revenue-sharing agreements.

- Projected operational costs.

- Any clauses that could affect your returns.

What Are the Environmental and Social Impacts of Oil and Gas?

Investors must consider the broader implications of their investments. Common impacts include:

- Greenhouse gas emissions: Oil and gas operations contribute to global warming.

- Habitat destruction: Drilling and infrastructure development can disrupt ecosystems.

- Community displacement: Projects may require relocating communities, leading to social and ethical concerns.

What Are the Latest Trends in Oil and Gas Investments?

The oil and gas sector is evolving, with several trends shaping its future:

- Shale production: Advances in fracking have made shale resources a major contributor to global supply.

- Carbon capture and storage (CCS): Innovative technologies are helping reduce the sector’s carbon footprint.

- Transition to renewables within the sector: Many companies are diversifying into renewable energy to remain competitive.

What Are the Advantages of Investing in Oil and Gas?

Oil and gas investments offer several compelling benefits, making them an attractive option for many investors. Here are the key advantages:

- High earning potential: Successful projects can generate substantial returns, often outpacing other investment sectors.

- Diversification opportunities: Adding oil and gas investments to a portfolio can reduce overall risk by balancing it with other asset classes.

- Tangible asset investment: Oil and gas reserves are physical assets with intrinsic value, offering stability during economic uncertainty.

What Are the Steps to Start Investing in Oil and Gas?

Entering the oil and gas industry requires a strategic approach. Follow these steps to begin:

Research the Industry

Gain a comprehensive understanding of the oil and gas market by focusing on:

- Key market trends and emerging technologies.

- Energy policies and regulatory frameworks.

- Historical price patterns and their driving factors.

Choose an Investment Vehicle

Evaluate the available options and select the one that aligns with your financial goals and risk tolerance:

- Master Limited Partnerships (MLPs) for consistent income.

- Direct participation for hands-on involvement and high returns.

- Stocks and ETFs for diversification and liquidity.

Develop a Risk Management Plan

A solid risk management strategy is essential to protect your investment. Key elements include:

- Portfolio diversification across multiple projects and sectors.

- Adequate insurance coverage for potential liabilities.

- Contingency plans for market or operational setbacks.

How to Evaluate ROI in Oil and Gas Investments

Measuring the return on investment (ROI) in oil and gas requires analyzing specific metrics that reflect project performance:

- Return on investment (ROI): Calculate the percentage gain or loss relative to the initial capital invested.

- Break-even price: Determine the price at which production becomes profitable, accounting for operational costs.

- Production decline rates: Assess how quickly output decreases over time to project future revenue accurately.

How Do Oil and Gas Investments Compare to Other Energy Investments?

Investors often weigh oil and gas against other energy sectors, such as renewables, coal, and nuclear. Here’s a comparison:

- Risk and reward: Oil and gas offer higher earning potential but come with greater volatility compared to renewables and nuclear energy.

- Market growth potential: While renewables are experiencing rapid growth, oil and gas remain dominant in meeting global energy demands.

- Environmental impact: Renewables have a lower environmental footprint, but oil and gas continue to face criticism for greenhouse gas emissions and habitat disruption.

What Are the Common Mistakes to Avoid in Oil and Gas Investments?

Avoiding common pitfalls can significantly improve your chances of success in this sector. Here are the mistakes to watch out for:

- Ignoring due diligence: Failing to thoroughly research the operator, reserves, and financials can lead to poor investment decisions.

- Over-concentration in one project: Investing too heavily in a single project increases vulnerability to market or operational failures.

- Underestimating operational costs: Misjudging expenses like drilling, maintenance, and regulatory compliance can erode profits.

Conclusion

Oil and gas investments present a unique blend of opportunities and challenges. While the sector offers high earning potential and portfolio diversification, it requires careful navigation to mitigate risks. By conducting thorough due diligence, diversifying investments, and staying informed about market trends, investors can unlock the potential rewards of this dynamic industry.

Whether you’re a seasoned investor or just starting, understanding the risks and rewards is essential for making informed decisions. With the right strategies and a balanced approach, you can confidently drill into profits and make the most of the opportunities in oil and gas investments.