Introduction

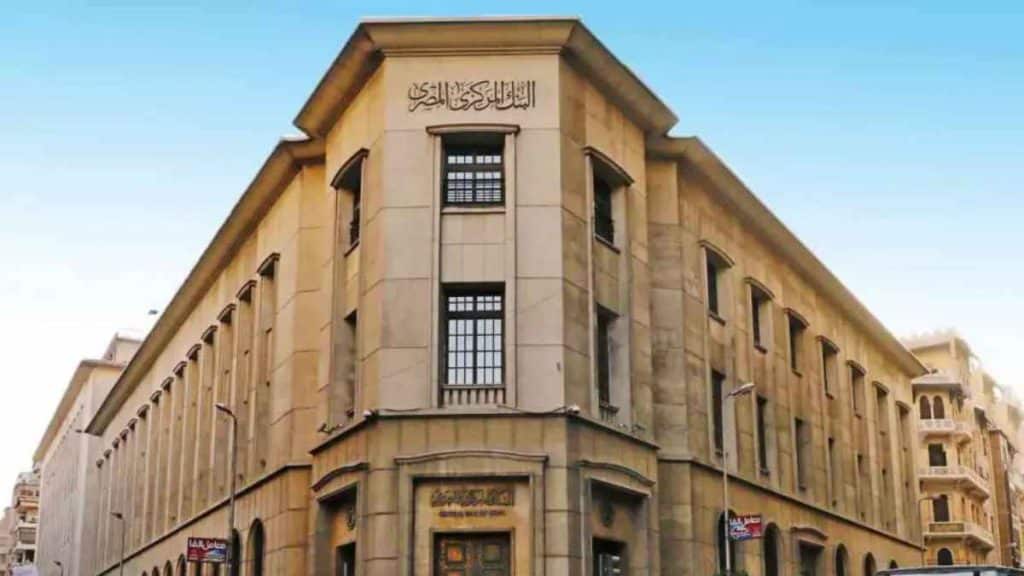

The need to restore stability in the forex market amidst the rising inflations within the country has caused the Central Bank of Egypt to take steps towards regulating its foreign exchange market. Can regulating its forex market curb the rising inflations within the country? Well, you need to read on to find out more.

Why is Egypt’s Central Bank eager to regulate the Forex Market today?

Egypt’s Central Bank is taking action to regulate its foreign exchange market as the country looks to stabilize its economy and attract more foreign investment.

The move comes amid a period of economic uncertainty in Egypt, as the country struggles with high inflation and a large trade deficit.

The Central Bank hopes that regulating the forex market can bring more stability to the country’s currency and make it more attractive to investors.

One of the main reasons for the Central Bank’s decision to regulate the forex market is to combat the illegal currency trading that has been taking place in the country. This black market activity has been a major contributor to the depreciation of the Egyptian pound and has made it difficult for the government to control inflation.

The Central Bank also hopes that by regulating the forex market, it will be able to better monitor and control speculative trading, which can lead to excessive volatility in the currency markets. This will make it easier for the bank to maintain a stable exchange rate and promote long-term economic growth.

Additionally, The Central Bank will also be implementing stricter rules and regulations for Forex traders and Brokers to ensure fair practices and transparency in the market. This will attract more foreign investors who will have more trust in the market, thus adding more liquidity to the market and making it more stable

Overall, the Central Bank’s decision to regulate the forex market is a positive step for the country’s economy. By bringing more stability to the currency and making it more attractive to investors, the Central Bank hopes to help Egypt overcome its economic challenges and promote long-term growth.

Advantages of regulating the forex market

1. Protection of consumers:

Regulation ensures that consumers are protected from fraudulent or unscrupulous practices by brokers or traders.

2. Transparency:

Regulations require that market participants provide accurate and transparent information, which helps to promote fair and efficient markets.

3. Reduced systemic risk:

By implementing regulations that promote stability and reduce leverage, the risk of a market collapse is reduced, which helps to protect the broader economy.

4. Maintaining the integrity of the market:

Regulations help to maintain the integrity of the market by ensuring that all participants follow the same rules and standards. This helps to prevent market manipulation and insider trading.

5. Consumer protection:

Regulation ensures that consumers are protected from fraudulent or unscrupulous practices by brokers or traders. This ensures that only the Best Online Trading Brokers are licensed to operate within the region.

Disadvantages of regulating the forex market

1. Increased costs:

Regulating the market can lead to increased costs for traders and businesses as they may need to comply with additional rules and regulations.

2. Reduced flexibility:

Excessive regulation can limit the flexibility of traders and businesses to make decisions and respond to market conditions.

3. Inefficiency:

Regulation can lead to inefficiency in the market as it may stifle innovation and competition.

4. Bureaucracy:

Regulation can lead to increased bureaucracy and red tape, which can be time-consuming and costly for traders and businesses.

5. Inadequate protection for small traders:

Regulation may not be able to provide adequate protection for small traders, who may be at a disadvantage compared to larger traders and institutions.