The world of cryptocurrency is at a turning point with the rapid growth of Ether-based ETFs (exchange-traded funds). Since May 16, these financial products have seen an unprecedented influx of capital, attracting $837.5 million in cash in just two weeks.

This surge starkly contrasts the performance of Bitcoin ETFs, which experienced net outflows of $346.8 million by the end of May. Investors’ growing interest in Ether signals increasing confidence in this asset as a strong alternative to Bitcoin.

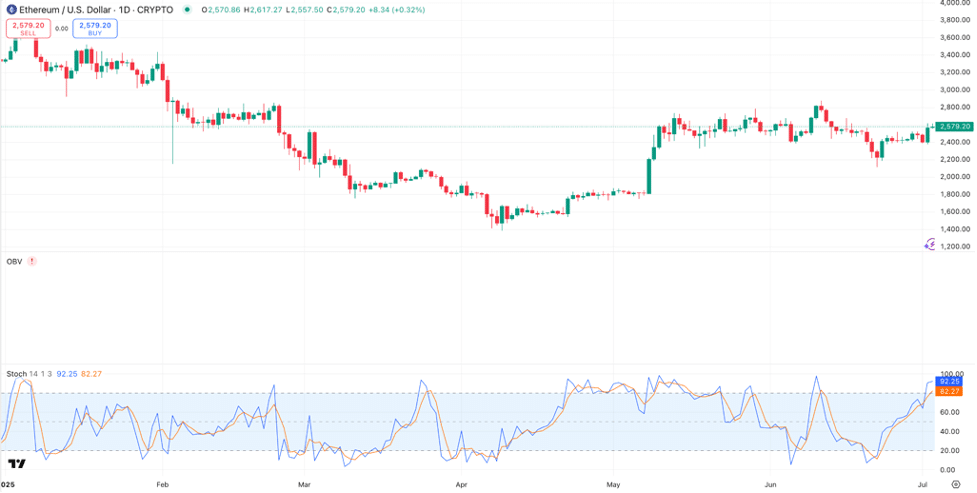

This recent wave of institutional enthusiasm has fueled a 31% increase in Ethereum price over the past 30 days, with the price now hovering around $2,586.

As mentioned in a piece by Crypto Eagles, some analysts are even considering a scenario in which Ether could reach $6,000. Much of this optimism is based on comparisons between Ether’s trajectory and that of gold. But innovation doesn’t stop there.

Companies such as REX Shares are developing ETFs that incorporate staking, a feature that allows investors to earn yield while remaining in the Etherverse. These ETFs could offer far more than traditional ETFs and may signal unexpected ways in which Ether could further integrate into the financial system.

A major driver behind the surge of institutional capital into Ether ETFs is the growing perception that Ethereum represents more than just a speculative asset.

Increasingly, Ethereum tokens are being viewed as financial benchmarks — tools that major players like pension funds and insurance companies use to measure performance and place significant bets.

This creates a positive feedback loop: the more credibility Ethereum gains, the stronger the tokens become, both as an investment vehicle and as a foundation for new forms of financial engineering.

Meanwhile, Bitcoin continues its steady march toward institutionalization, with its own ETFs reinforcing its status as a digital “store of value.” If these trends persist, we may soon find ourselves in a world where crypto has moved from the financial periphery to the center of modern financial strategies. At that point, Bitcoin and Ether may no longer be seen as alternative assets — but as key pillars of the global financial system.