Loan calculators are considered to be an important advancement in the area of information and technology. Now a person can easily know about banks and lenders including their loan amount and repayment period in a few seconds. A consumer loan calculator is a helping hand to work efficiently without depending on loan brokers.

A person can get a quick and accurate overview of lenders and match the requirements with your loan profile. By using this tool you can easily apply for a loan at your desired place to get the maximum benefit. The calculators are very efficient in calculating the initial details including interest, amount, procedure, and repayment.

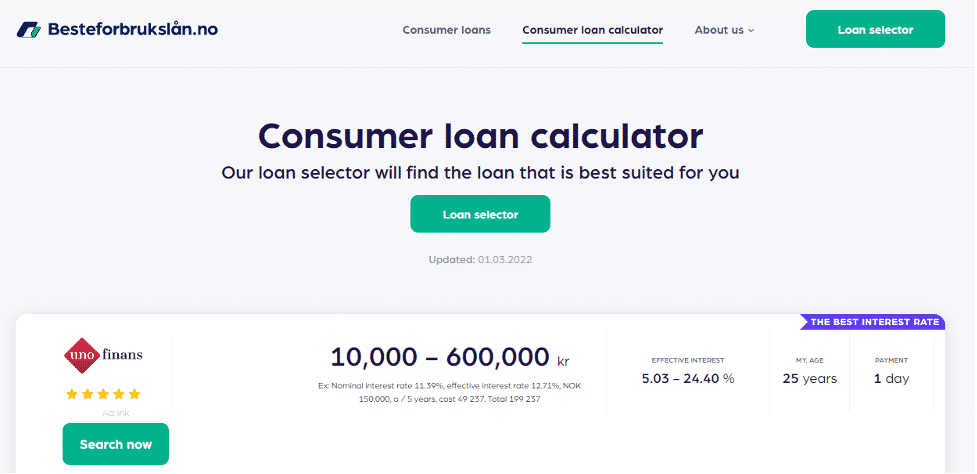

Loan Calculator

A loan calculator is a special tool that is designed to provide an overview of all the information related to consumer loans. A person can get all the minor as well as major information related to loan procedures by using this tool.

Besteforbrukslån loan calculator provides all the interest rates in the form of an estimated sample. The estimated sample is the actual interest amount that is calculated according to the finance company after the application is approved by the lender.

How to Use It?

Using a consumer loan calculator is not a tricky task as a person just needs to select the desired amount of loan less than NOK 600,000. The selected amount must be repaid between the limitation of 1 month to almost 60 months.

The calculator works efficiently to provide the estimated cost of the repayment account monthly. The tool also provides the interest rate estimated according to the financial company.

Purpose of Loan Calculator

A person may witness a large but confusing market of consumer loans in which a consumer loan calculator is a beacon of light. You can easily get an overview of the cheapest consumer loan with an estimated price per month. The other purposes are:

i. To know the Expense of the Loan

At the time of borrowing money, a person must understand that no finance office will provide a consumer loan for free. Banks always take money from the loan by considering it to pay interest, term fees, or setup fees. The loan calculator explains how much money is going to be deducted and what is the estimated amount of money a consumer is going to get.

ii. To get the Estimated Interest Rate

The payment of the interest during loan taking is compensation for the risk a bank takes during the process of lending money. By using the above-mentioned consumer loan calculator a person can get the lowest interest rate. Hence a person can easily get a loan from such places which provide a maximum loan with a low-interest rate.

iii. To find the Cheapest Consumer Loan

It is always encouraging to compare different sites before taking a loan. A loan calculator helps you to find the cheapest consumer loan with significant differences from the competitors. An effective interest amount and a long repayment period would be a helping hand to get stable at your grounds.

iv. How much Money is Needed to Repay Per Month?

The main purpose of using a loan calculator is to know about the repayment period. A person can easily get an idea about installments and interest per month. It would be an ideal consumer loan if the interest is less and the per month installment is sufficient enough to make a person stable in the personal finances.

Sum Up

Norwegians are getting more indulged in the loan-taking process in the recent era. Every person must understand the basic knowledge about consumer loans and their strategies. There is a tool known as a loan calculator that works to provide all the information related to a financial company, amount, interest, repayment, etc.