In a world where nearly every aspect of life has gone digital, auto loans are no exception. Borrowers can now apply for financing online, get approvals within minutes, and even sign contracts electronically without ever stepping into a dealership. While this digital transformation offers speed and convenience, it also introduces new risks that can erode trust between lenders and borrowers. That’s where identity verification comes in. KYC Verification Software For Regulated Industries plays a critical role here, helping lenders confirm identities quickly and accurately while staying compliant with financial regulations. As the gatekeeper of digital trust, robust identity verification ensures a smoother, safer experience for both sides, helping the auto loan process run faster and more securely.

The Acceleration of Digital Auto Financing

Digital auto financing is on the rise, especially among younger generations who expect seamless, smartphone-driven experiences. Online marketplaces, fintech lenders, and even traditional banks are offering quick auto loan approvals through streamlined applications and remote processing. This shift reduces paperwork, wait times, and the need for in-person visits. However, with that speed comes a critical need for assurance. Lenders need to confirm that the person behind the screen is who they say they are—and that’s not always easy in a digital-first world.

Identity theft and synthetic fraud have surged in parallel with the rise of online lending. Fraudsters can now fabricate entire digital personas using stolen data, compromising loan systems before a human ever gets involved. This not only threatens financial losses for institutions but also damages their reputations. For digital financing to be sustainable, lenders must find a way to combine speed with security.

The Role of Identity Verification in Building Trust

Trust is the foundation of any financial relationship, and digital lending is no different. Identity verification acts as the first—and arguably most important—step in building that trust. By validating a customer’s identity in real-time, lenders can confidently move forward with the loan approval process. It’s not just about catching fraudsters. It’s also about giving honest borrowers a faster, more frictionless experience.

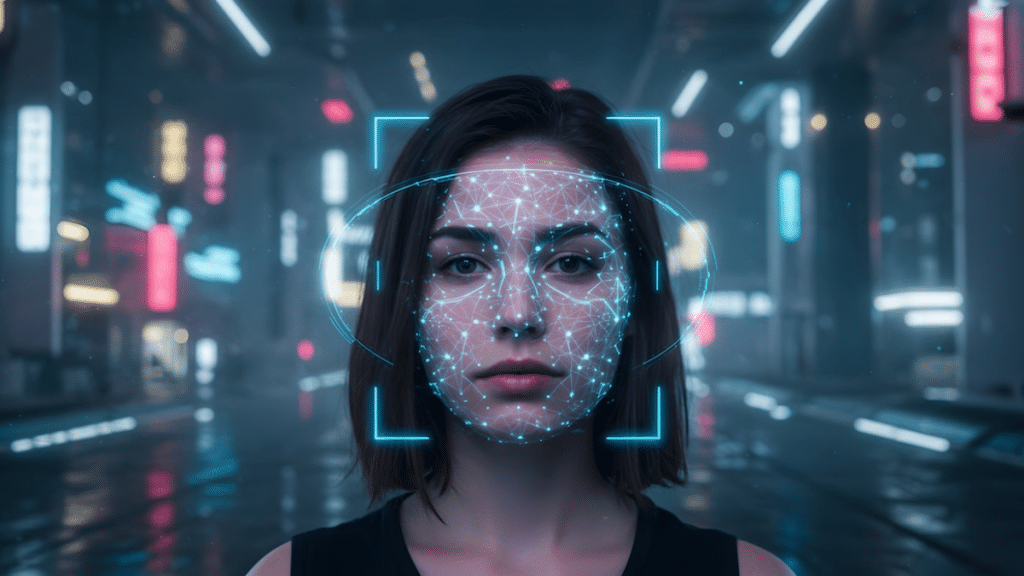

Modern identity verification solutions use a mix of technologies, such as biometric authentication, document scanning, and AI-powered fraud detection. These tools assess whether the applicant’s submitted ID matches their selfie, check for signs of tampering, and compare data across multiple sources to verify legitimacy. It’s a layered approach that goes beyond checking a driver’s license—it’s about analyzing digital behavior, historical data, and even device signals.

When done right, identity verification can be almost invisible to the user. They snap a photo of their ID, take a selfie, and within seconds, they’re approved. This smooth experience builds trust not just in the process, but in the brand itself.

Speed Without Compromise

A major concern for digital lenders is that stronger identity checks might slow down the approval process. But today’s tech proves that’s no longer the case. With automated tools and machine learning, identity verification can take place in under a minute. That means lenders can offer both security and speed—two things today’s customers expect.

And there’s an added benefit: fewer manual reviews. Traditional fraud checks often require loan officers to manually verify documents, call applicants, or request additional paperwork. With smart identity tools like kyc verification software, much of this work is done automatically. That frees up human resources and cuts operational costs while maintaining high standards of due diligence.

Compliance and Customer Confidence

Digital lenders also have to navigate a complex web of compliance standards. From Know Your Customer (KYC) requirements to anti-money laundering (AML) regulations, verifying identity isn’t optional—it’s mandatory. Automated identity verification systems help financial institutions meet these regulatory obligations without slowing down the user experience.

On the customer side, visible verification steps can actually increase confidence. When borrowers see that a lender takes security seriously, they’re more likely to feel safe sharing sensitive information. This is especially true for consumers new to digital lending, who may be skeptical about sharing personal details online. Clear, secure identity checks send a message that the lender values their privacy and protection.

A Smarter Future for Auto Loans

The future of auto financing is digital, but it needs to be smarter—not just faster. As more consumers turn to online platforms to secure their next car loan, identity verification will become a vital competitive edge. It enables lenders to process applications rapidly, keep fraud in check, and build lasting customer relationships based on trust.

For borrowers, it means less time waiting and more time driving. For lenders, it means fewer risks and stronger brand loyalty. And for the industry as a whole, it sets a higher standard for how digital financial services should operate.

Conclusion

Digital auto loans are here to stay, offering unmatched convenience and speed. But that speed must be backed by security. Identity verification ensures that both borrowers and lenders can trust the process, reducing fraud and increasing confidence in online financing. By embracing modern, frictionless identity tools like KYC Verification Software For Regulated Industries, auto lenders can meet compliance standards while streamlining the user experience. This unlocks a new era of digital trust, driving faster approvals and stronger relationships in a world that’s moving at full throttle.