Introduction: What is cloud mining

Cloud mining is a method of cryptocurrency mining that allows individuals to mine cryptocurrencies without the need for expensive hardware or technical expertise. It involves renting computing power from a cloud mining provider, who then takes care of the mining process on behalf of the user. This allows individuals to earn passive income from cryptocurrency mining without the hassle of setting up and maintaining their own mining rigs.

Cloud mining works by utilizing remote data centers that have powerful mining equipment. Users can purchase mining contracts from these providers, giving them access to some of the mining power. The provider then uses this mining power to mine cryptocurrencies, such as Bitcoin or Ethereum, and distributes the earnings among the users based on their contract terms.

One of the main benefits of cloud mining is that it eliminates the need for users to invest in expensive hardware and deal with the associated maintenance costs. It also allows individuals to mine cryptocurrencies without the technical knowledge required to set up and optimize mining rigs. Additionally, cloud mining offers a more flexible and scalable approach to mining, as users can easily adjust their mining power based on their investment goals and market conditions.

Step 1: Choose a Cloud Mining Provider

The first step in cloud mining is researching and choosing a reputable cloud mining provider. Many providers are available in the market, so it’s essential to consider factors such as reputation, fees, and contract terms before deciding.

Start by reading reviews and testimonials from other users to understand the provider’s reputation. Look for providers that have been in the industry for a while and have a track record of delivering reliable services. It’s also important to consider the fees charged by the provider, including any maintenance or additional charges.

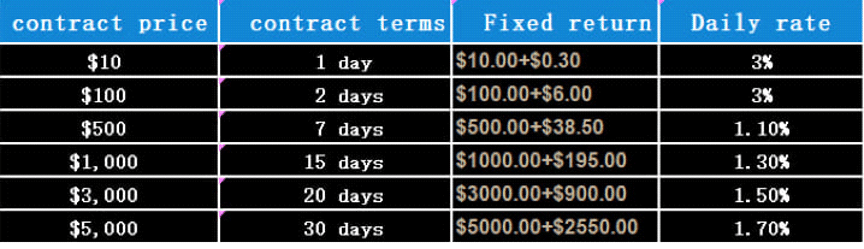

Another important factor to consider is the contract terms offered by the provider. Some providers offer fixed-term contracts, while others offer open-ended contracts. Fixed-term contracts have a specific duration, after which the mining contract expires. Open-ended contracts, on the other hand, continue indefinitely until the mining becomes unprofitable. Consider your investment goals and risk tolerance when choosing between these contract types.

Compare different providers based on these factors to find the best fit for your investment goals. It’s also a good idea to join online forums and communities to get insights and recommendations from experienced cloud miners.

Step 2. Register an account

Once you have chosen a cloud mining provider, the next step is to create an account with them. Visit the provider’s website and look for a sign-up or registration option. Fill in the required information, such as your name, email address, and password, to create your account.

After creating your account, you may be required to verify your identity and payment information. This is a standard procedure to prevent fraud and ensure the security of your account. Follow the provider’s instructions to complete the verification process.

Once your account is verified, you can set up your mining preferences. This includes selecting the cryptocurrency you want to mine, choosing the mining algorithm, and setting your mining power. Some providers offer different mining plans with varying levels of mining power, so choose the plan that best suits your investment goals and budget.

Step 3. Purchase a Mining Contract

After setting up your mining preferences, it’s time to purchase a mining contract. Browse through the available mining contracts offered by the provider and choose the one that fits your budget and investment goals.

Before making a purchase, it’s important to review the contract terms and conditions. Pay attention to factors such as the duration of the contract, the mining power allocated to you, and any fees or charges associated with the contract. Make sure you understand all the terms before proceeding with the purchase.

Once you are satisfied with the contract terms, make your payment using the accepted payment methods. Most providers accept payments in cryptocurrencies, such as Bitcoin or Ethereum, as well as traditional payment methods, such as credit cards or bank transfers. After making the payment, the provider will start mining on your behalf and you will start earning passive income from your mining contract.

Step 4: Earn passive income

After purchasing a mining contract, it’s important to monitor your mining progress and earnings. Most cloud mining providers offer a dashboard or user interface where you can track your mining statistics, such as the amount of cryptocurrency mined and your earnings.

Depending on the provider, you may have the option to withdraw your earnings or reinvest them for more mining power. Consider your investment goals and risk tolerance when deciding whether to withdraw or reinvest your earnings. Reinvesting your earnings can help you increase your mining power and potentially earn more passive income in the long run.

It’s also a good idea to diversify your cryptocurrency investments for even more passive income opportunities. Consider investing in different cryptocurrencies or exploring other passive income strategies, such as staking or lending, to maximize your earnings.

Conclusion

Cloud mining offers individuals the opportunity to earn passive income from cryptocurrency mining without the need for expensive hardware or technical expertise. By renting computing power from a cloud mining provider, users can participate in the mining process and earn a share of the earnings.

To get started with cloud mining, it’s important to choose a reputable provider and research their reputation, fees, and contract terms. Register an account with the chosen provider, verify your identity and payment information, and set up your mining preferences. Purchase a mining contract that fits your budget and investment goals, review the contract terms and conditions, and make your payment.

Once you have purchased a mining contract, monitor your mining progress and earnings. Consider withdrawing or reinvesting your earnings based on your investment goals. Remember to do your research and invest wisely, and explore other passive income opportunities in the cryptocurrency market for even more earning potential.

CGMD miner can enter “CGMD” in the Google App Store or Apple Store to download the application. To learn more about CGMD mining machines, kindly visit the official website at https://365miner.com/.