You may have heard the term “no-fault” accident state before. Some US states have this policy in place, while others do not. If you cause a car wreck or if a vehicle hits your car instead, you must consider whether you are in a fault or no-fault state when figuring out what you should do next.

We will talk about fault and no-fault accident states in the following article.

What Do the Terms “No-Fault” and “Fault” Mean?

Let’s say a vehicle hits your car while you’re out driving one day. If you live in a no-fault state, it doesn’t matter that the driver who hit you caused the accident. Each driver, both you and the one who hit you, will file a claim with your own insurance company to cover the damages.

A fault state doesn’t have this policy in place. Instead, since the other driver caused the accident, you need to file a claim with their insurance company since the other driver caused the damage.

In most no-fault states, you must have something insurance companies call personal injury protection insurance, or PIP. In many states, you must have at least $10K in PIP coverage. You can have a policy that gives you more coverage than that, but they’re more expensive.

Why Get a Policy with More Than the Required Amount?

Let’s say for a moment that you live in Florida. Florida has a no-fault policy in place. There, you must have the minimum amount of PIP coverage, $10K.

You can pay a relatively small amount per month to have that amount of coverage. You can also pay a yearly policy if you want to get the whole year’s payment out of the way all at once.

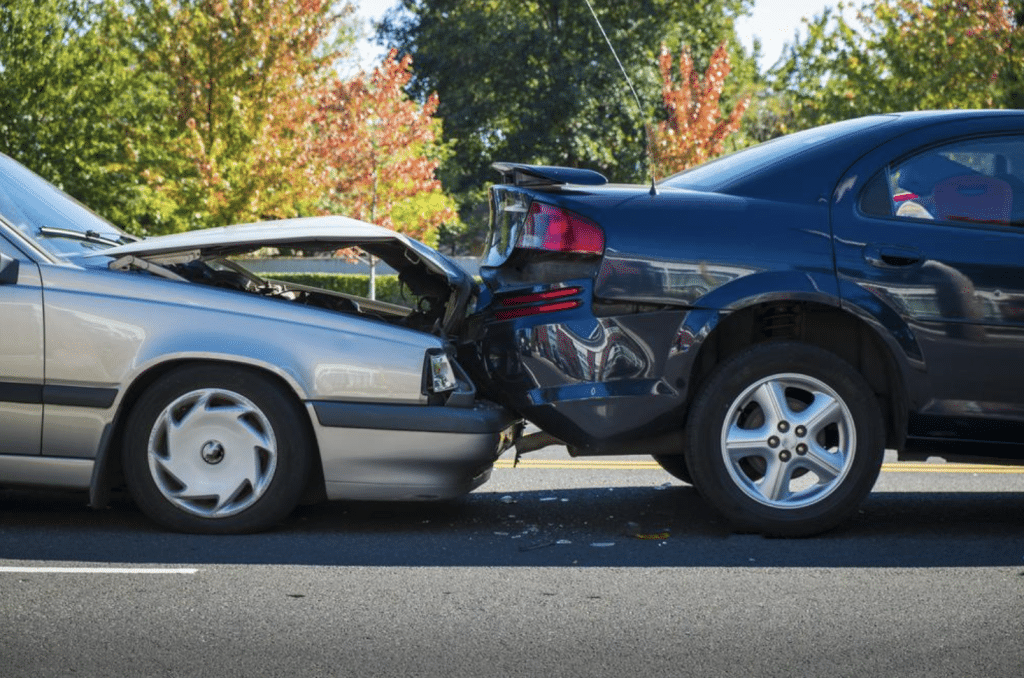

However, you might also get a policy that gives you much more coverage than that. Why would you want more? It’s because if you get into a very serious car wreck, you might damage your vehicle so that it requires a lot more than $10K worth of repairs.

If you get a policy worth more than $10K, you have more money on that policy that you can use to repair your badly damaged car. However, if you get a policy that covers you for more than the minimum amount, you must also pay a higher cost each month, or every year if you’re paying the yearly amount all at once.

You Should Consider Getting a PIP Policy Worth More than the Minimum Amount

In this sense, insurance and gambling have a lot in common. You can always get the minimum amount of coverage, but you’re essentially betting that you won’t get into a very serious car accident. If you do get the minimum amount and then severely damage your vehicle, you must pay the rest of what it costs to get it fixed out of your pocket.

Maybe you feel like you are a safe driver, so you don’t think you will ever cause a very serious car wreck. Even if you’re a very cautious driver, though, that doesn’t mean every other driver on the road has that same designation. You might always encounter a drunk driver or someone who doesn’t know the rules of the road very well.

Should You Live in a No-Fault State or a Fault One?

Most people don’t choose what state they’ll live in based on whether it has a fault or no-fault car accident policy. Most individuals think that’s a relatively minor detail. For the most part, they’re right.

If you ever get in a car accident, though, you might understand pretty quickly how much this matters.

Maybe you cause an accident in a fault state, or an at-fault state, as you sometimes hear insurance agents or lawyers describe them. Perhaps you pulled into traffic before checking both directions to see whether it was clear. You caused an accident and damaged your car and the other vehicle as well.

In no-fault states, the other driver’s mandatory PIP insurance would cover their car’s damage. That’s not the case with at-fault states. There, you would file a claim with your insurance to fix your vehicle, but so would the other driver. If you only have the minimum coverage amount, that probably won’t cover all the damages.

You might pay to fix your car at least partially out of pocket, but the other driver may also sue you if the coverage you have won’t pay for all the damage to fix their car. They might also have some medical bills the accident caused. They may go after you in court for pain and suffering.

What Happens Next?

In these situations, the other driver usually hires a lawyer. They’re pursuing a civic case against you, not a criminal one.

It’s possible that the police might bring criminal charges against you as well. That can happen if you ingested excessive amounts of alcohol before driving or something along those lines. The police might bring a reckless driving charge against you.

In any event, if you lose the civil case against you, you might need to pay a significant amount to the other driver. If you live in a no-fault state, you’re somewhat protected against these outcomes.

Some people like living in no-fault states, while others feel at-fault states have the right idea. Opinions vary. If you cause a car accident, though, you can see how this seemingly small and insignificant policy becomes vitally important very quickly.

If you’re a licensed driver and you’re on the road often, you should do some research into whether you’re in an at-fault or no-fault state. Make sure you understand what the concept means and that you have at least the minimum required policy amount.

If you buy a new car or a used one, the dealership won’t let you drive it off the lot without first confirming that you have the proper insurance amount. You may want to consider more than the minimum, though.