How can debt collection agencies effectively manage increasing regulatory demands while boosting operational efficiency? Automation has become an essential tool, allowing agencies to meet compliance standards more easily while optimizing everyday processes.

By automating tasks like communication tracking, payment reminders, and regulatory monitoring, agencies can reduce manual errors and ensure adherence to laws such as the FDCPA. This not only improves operational flow but also mitigates the risks of non-compliance, making it easier for agencies to navigate the complexities of modern debt collection.

The Evolution of Debt Collection Compliance

Dealing with a lawsuit can be intimidating, but it’s crucial to approach the situation with a solid defense strategy. Debt buyers like Midland often rely on default judgments when individuals fail to respond properly in court, which can lead to wage garnishments or bank levies.

If you’re facing a midland funding lawsuit or any similar legal challenge, having expert guidance can make a significant difference. Services that specialize in assisting with debt lawsuits help by providing resources to:

- Draft an effective response (Answer) to the lawsuit.

- Understand critical legal concepts like “affirmative defenses” and “burden of proof.”

- Ensure timely and accurate submission of court documents.

- Negotiate settlement options with creditors.

With the right support, consumers can reduce the risk of default judgments and explore options for dismissing or settling their debts, protecting their financial future.

Enhanced Data Tracking and Reporting Capabilities

In debt collection, accurate records and real-time monitoring are vital. Automation boosts these, enabling efficient tracking and reporting. It ensures precise logs of borrower interactions, creating a complete case history.

Automated systems also check compliance automatically, cutting error risks and ensuring rule-following. They provide detailed audit trails for reviews, showing compliance and integrity.

This leads to a more organized, transparent debt collection method. It improves recovery and ensures compliant operations. Companies using automation enhance oversight and accuracy, making debt recovery more effective and efficient.

Reducing Human Error in Regulatory Compliance

Human error in debt collection can lead to serious compliance violations. Automation provides a reliable solution:

| Aspect | Manual Process | Automated Process |

| Error Rate | Up to 30% | Less than 5% |

| Response Time | 24-48 hours | Instant |

| Compliance Cost | High | Reduced by 30% |

| Documentation | Manual logging | Automatic tracking |

| Risk Level | High | Significantly lower |

Key Benefits:

- 80% reduction in manual errors through automated task management

- Protection against costly FDCPA violations (up to $1,000 per incident)

- Consistent application of compliance rules

Automated Communication Tools Aligned with Regulations

Effective communication must be employed while collecting debts. Ensuring compliance with the regulations is the objective. In this regard, automated communication tools help organizations maintain strict adherence to only permitted contact hours. Thus, these tools call the borrowers at times when they can be contacted appropriately. There is also consistent messaging that aligns with legal compliance and minimizes the risk of non-compliance.

Automated systems also capture all interactions because of which communication history is reliable. Such key features include automated email scheduling, compliant SMS, interactive response systems with built-in compliance checks, and AI-powered chatbots for consistent interaction with borrowers that give immediate responses while adhering to compliance. Using these automated communication tools can make businesses develop their communication processes better and legally.

Compliance Monitoring through AI and Machine Learning

The incorporation of AI and machine learning is revolutionizing compliance monitoring in debt collection with robust oversight capabilities for collection practices. This creates the ability to continuously monitor as well as track activities, on a minute-to-minute basis, the compliance status of organizations. It automatically flags areas where a potential violation may exist, allowing their potential risks to be detected even before they gain prominence and result in some corrective action being taken by the organizations.

This further utilizes the pattern recognition technique to detect practices of collections while providing insights that may prove useful to enhance compliance efforts. Hence, it helps in mitigating risks attached to non-compliance and fosters a culture of accountability within the organization. This, therefore, means that businesses will look to improve their strategies towards better compliance and sustain adherence to regulations much better.

Building a Robust Audit Trail

Automation is the most significant aspect of debt collection with regards to creating a very strong audit trail for regulatory reviews because it creates comprehensive documentation of all collection actions through digital record-keeping systems, even including timestamped communication logs that capture every interaction between borrowers for higher precision and accountability.

Automated compliance reports add to this process by harmonizing key data into the most accessible formats. The result is a regulatory review that becomes much leaner and meaner-meaner and will get streamlined access to documentation and detailed interaction histories required for the ultimate goal. This level of organization not only makes for smooth and streamlined compliance but also results in working to make the debt collection process more sound in all ways.

Real-Time Adaptability to Regulatory Changes

Automated systems are required by any organization that needs to respond to changes taking place within the regulatory environment. Regulation updates can be instantly acted on; thus, the different operations carried out within the organization are well aligned with the newest requirements. With automatic adjustments by workflows responding to newly enacted regulations, businesses can ensure compliance at all points of their procedure. It thereby reduces the possibility of non-compliance and keeps the organization efficient as well as prompt in its operations.

Conclusion

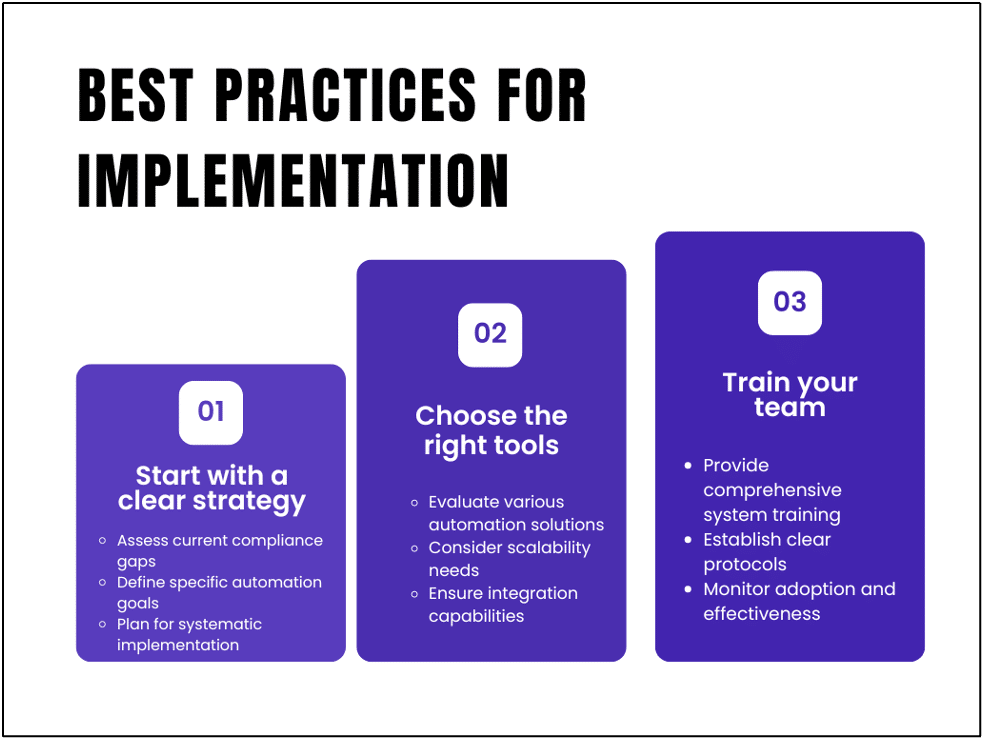

Modern debt collection practices mainly use automation to ensure updates on regulations, control risks, and enhancement of efficiency. Automated solutions enable organizations to adjust quickly to new regulations while ensuring that their accuracy is maintained in compliance efforts. Automated solutions simplify processes and deliver relevant documentation for audits and regulatory reviews.

Furthermore, automated communication tools help organizations act according to legal guidelines on outreach thereby reducing the chances of violations. It is necessary for businesses, which are looking at the efficient management of the complexities of compliance while improving their operations in a competitive market, to invest in strong automated solutions. For a more detailed understanding of the role of automation in debt collection, relevant resources can be consulted.

FAQs

How does automation help with compliance with debt collection laws?

Process automation maintains similar, standard processes based on regulation requirements, with minimal margin for error in carrying out those operations, thereby maintaining consistent compliance with regulations such as the FDCPA.

Can automated systems keep track of the changes in regulations?

Yes, automated systems can be updated in real-time, reflecting new regulations, and therefore compliance would be achieved without disturbances to current operations.

How do automated communication tools contribute to compliance?

This tool would ensure that all communications met the necessary criteria about timing, content, and frequency of communication and kept detailed records of everything exchanged.