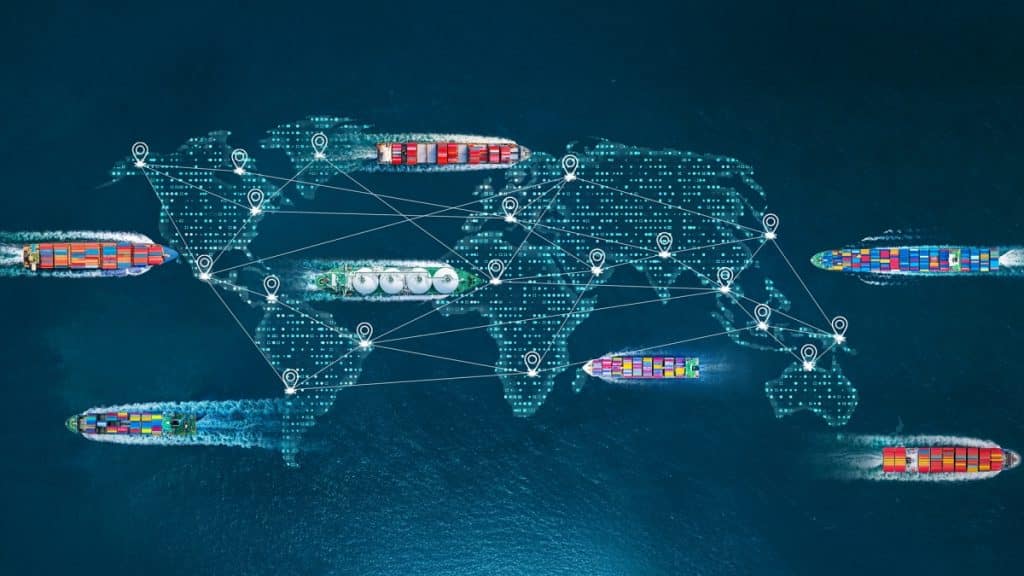

China’s role in global trade and supply chains is undeniable, and any shifts in its policies or economy ripple worldwide. Recent developments suggest that policy changes and economic slowdowns in China have reshaped the way goods are produced, transported, and consumed internationally. You’ll learn how these changes affect businesses—from manufacturing hubs to retail shelves—and what they mean for global markets. Whether you’re a business owner or a curious observer, understanding these impacts is key to navigating the evolving dynamics of international trade.

Factors Fueling Global Trade Tensions

Shifts in China’s policies and international responses are intensifying trade disputes, disrupting supply chains, and impacting global commerce. This section breaks down the driving factors.

China’s Economic Policy

China’s recent economic policy adjustments have centered on self-reliance and reducing dependency on foreign technology. Export restrictions on critical materials like gallium and germanium reflect this stance. Such moves, reported widely in recent China news, challenge key industries worldwide, especially semiconductors. Slower domestic growth has also diminished import demands. When a former colleague had to switch suppliers due to delayed exports from China, the cascading effects on delivery timelines and production highlighted the repercussions of such policy measures.

US Trade Policy

US protectionist approaches, evident in tariffs on Chinese goods and the CHIPS Act’s incentivization of domestic semiconductor production, are deepening tensions. Trade restrictions targeting Chinese firms like Huawei aim to curtail influence in sensitive sectors. These measures contribute to countermeasures from China, complicating supply chain stability. There have been indications that a notable portion of U.S. firms are reconsidering their operations in China amid evolving trade policies and market uncertainties.

Global Industrial Policy

Global industrial plans now emphasize diversification. Countries like India and Vietnam are emerging as manufacturing alternatives due to incentives for foreign companies. For instance, the Indian government’s Production-Linked Incentive (PLI) schemes attract electronics and mobile manufacturing. Supply chain realignments shift trade flows as firms diversify away from China following prolonged disruptions. Economic resilience becomes paramount amid these competing policies shaping global commerce.

China’s Response to Trade Tensions

Recent reports suggest that China may have introduced retaliatory tariff measures amid ongoing trade tensions in response to certain U.S. executive actions. Sources indicate that these measures target key sectors, including energy resources such as coal, LNG, and crude oil, as well as various industrial goods like agricultural machinery and vehicles. However, the exact tariff rates and implementation timelines remain uncertain, with details varying across reports. This move is part of a broader pattern of escalating trade policy actions between the two countries.

Impact on Global Trade

Tariffs on Chinese exports are shifting trade flows. For example, China’s 10% tariff on U.S. agricultural machinery might push American exporters to seek markets in countries like Brazil or India. Similarly, China’s exporters may target European and Southeast Asian markets to offset U.S. tariffs.

Retaliatory measures are disrupting supply chains. China’s 15% tariff on U.S. coal and LNG affects energy trade routes. Nationwide diversification efforts, including shifts to India and Vietnam, further reshape global manufacturing hubs.

Reduced Chinese imports influence global suppliers. Slower domestic growth in China dampens demand for commodities like crude oil and automotive parts, affecting exporters globally.

Shifting Trade Dynamics

China’s foreign trade growth of 4.9% in 2024, reaching $5.43 trillion, highlights its resilience amid global tensions. Export restrictions on critical rare earth metals like gallium and germanium, which are crucial for semiconductors, underscore shifting trade priorities.

Recent tariffs redirect supply chains, including China’s 15% on U.S. coal and LNG. American exporters target regions like Brazil, while Chinese markets are pivoting to Southeast Asia. Diversification is altering manufacturing hubs, with India and Vietnam gaining prominence.

Supply Chain Restructuring

Rising wages in China have prompted shifts in labor-intensive industries. Textiles and low-cost manufacturing, for instance, are now transitioning to Vietnam and Mexico. This redistribution reduces dependency on China for production.

Export controls, like restrictions on gallium and germanium, are impacting global semiconductor production. These policy changes have led industries to explore alternative sources outside China.

A combination of tariffs and trade tensions is further diversifying manufacturing hubs. Countries such as India and Vietnam are benefiting from incentives attracting foreign investments. These shifts reflect the need for flexible global supply chain strategies.

Potential Economic Consequences

China’s earth metals export ban directly threatens industries reliant on semiconductors, electronics, and renewable energy technologies. According to insights from China Global Television Network (CGTN), companies dependent on gallium and germanium face increased costs as they source alternatives globally. These disruptions expose the fragility of single-source supply chains.

Trade policy shifts, including China’s 15% and 10% tariffs on U.S. energy and machinery, alter global trade flows. For example, U.S. agricultural exporters may pivot to Brazil, while Chinese manufacturers eye Southeast Asia. Such changes recalibrate market dynamics and reduce dependency on specific regions.

Global supply chain strategies are adjusting as nations like India and Vietnam welcome manufacturing transitions from China. Rising Chinese wages and export controls accelerate the shift of labor-intensive industries.

Technological Competition

China’s export controls on rare earth metals like gallium and germanium reshape global supply chains. These materials are critical for semiconductors and electronics production. Companies are sourcing alternatives from nations such as Australia and Canada, increasing costs and extending timelines.

The US-China trade tensions are accelerating the transition of semiconductor manufacturing. U.S. policies like the CHIPS Act incentivize domestic production, while China invests in self-reliance—a dynamic highlighted by CGTN. This rivalry impacts global tech sectors, including renewable energy and advanced computing.

Export bans and China’s slowing domestic demand further underscore the competitive strategies that are defining technological dominance in global markets.

Conclusion

China’s shifts in trade policies and rare earth metals export restrictions are driving significant changes in global supply chains. As rare materials like gallium and germanium become harder to access, industries reliant on semiconductors and advanced electronics face mounting challenges. China’s resilience in foreign trade growth, reaching $5.43 trillion in 2024, highlights its continued influence on global markets even though trade tensions.