Commercial real estate, a lucrative business for the ultra-wealthy, is changing with the emergence of tokenization. With this purchase, warehouses, high-rise towers, and other apartments have become more accessible to millions. The transformation of real estate investment is making it more affordable through fraction ownership of property. Therefore, commercial real estate tokenization creates bit-by-bit property ownership, a tamper-proof and transparent system through blockchain.

The tokenization of properties is redefining the real estate space. It allows property ownership via digital tokens on the blockchain. It has democratized commercial real estate investment with interoperability, security, and transparency. The technology complexity can be navigated with ease. This game changer offers exciting opportunities for all globally.

With the life-changing opportunities that can come with owning a fraction of a property anywhere in the world, let us explain tokenization in commercial real estate and its potential in the current world order.

Understanding Tokenization

Tokenization is turning a real-life asset or value into a digital token that can be traded, stored, or transferred on blockchain technology. This means creating a digital representation of an asset, such as art, commodities, or real estate, and distributing tokens that represent a fractional ownership of that asset on a digital platform.

What is the Tokenization of Commercial Real Estate?

Now, let us answer the question: what is real estate tokenization? The tokenization of commercial real estate is the fractional ownership of the property through the acquisition of a digital token that represents such an asset. Unlike the traditional real estate process, in this case, you do not need a billion dollars to own an entire property. The real estate is divided into tiny pieces of tradable units that can be acquired. Owning a token equates to access to income generated through a lease or capital appreciation of a property. Commercial real estate tokenization eliminates cumbersome paperwork, high costs, intermediaries, and even fraud because all processes take place on the blockchain, sometimes through smart contracts.

Tokenization of commercial real estate relates especially to the tokenization of office buildings, retail stores, industrial properties, and other commercial assets. Commercial property tokenization offers investors a fresh approach to access profitable real estate investments, which were formerly the territory of big companies and institutional investors.

Now that we understand real estate tokenization and how its traction is changing the real estate world, dissecting its structure and how it works is crucial for investors to choose the best real estate tokenization company.

Key Components of Real Estate Tokenization:

- Blockchain Technology: Blockchain technology guarantees open, unchangeable, safe token ownership and transactions.

- Smart Contracts: Smart contracts exclude middlemen from purchasing, selling, and transferring property tokens, therefore streamlining the procedures involved.

- Regulation: Tokenized real estate has to follow securities laws and rules in order to safeguard investors and keep market stability.

How Tokenization Works in Commercial Real Estate

There are thorough steps involved in tokenizing a digital property. Tokenizing commercial property calls for numerous phases. Investors hoping to join this expanding market must first understand these stages:

1. Property Valuation and Due Diligence: A property needs to be thoroughly valued in order to be tokenized. Usually, this entails legal due diligence, financial analyses, and appraisals to guarantee the property is free of liens or conflicts.

2. Structuring the Tokens: One can split the value of the property into digital tokens once it is known. Every token stands for a fractional ownership piece of the land. A $10 million commercial property, for instance, might be split into 10,000 tokens, with each token worth $1,000 of ownership.

3. Issuance on a Tokenization Platform: Following the structure, the tokens are released on a real estate tokenizing platform open to buy by investors. These systems guarantee that tokens follow pertinent legal and regulatory criteria and control their production and distribution.

4. Smart Contracts and Automation: Smart contracts manage the tokens automatically. These contracts enforce guidelines on token transfers, dividends—should the property generate income—and other facets of ownership. These contracts run immediately once they are entered on the blockchain, therefore removing the middleman requirement.

5. Trading and Liquidity: Trading their tokens on secondary markets allows investors the freedom to enter and leave investments as needed. Among the most appealing features of commercial property tokenization is this higher liquidity.

The technical knowledge of how tokenization works and how it interacts with blockchain makes it unique. Hence, what role does blockchain play in commercial real estate tokenization, and in what remarkable ways has that transformed this industry?

The Role of Blockchain in Commercial Real Estate

A token is built on the blockchain where all interactions are transparent, secure, and on a decentralized ledger for recording transactions. Here is how blockchain backs tokenization:

Transparency

All participants can see the transactions of this real estate. The blockchain records every transaction, making it even more difficult to defraud. The transfer of ownership through tokens is visible, thereby increasing the trust in the system.

Security

Blockchain technology is tamper-proof because it uses a cryptographic hash to secure ownership and transaction records. This makes all data impossible to be changed by unauthorized parties.

Decentralization

Blockchain has no centralized control system, which means it operates on a chain of decentralized networks. This enhances the system’s reliability and security.

Benefits of Commercial Real Estate Tokenization

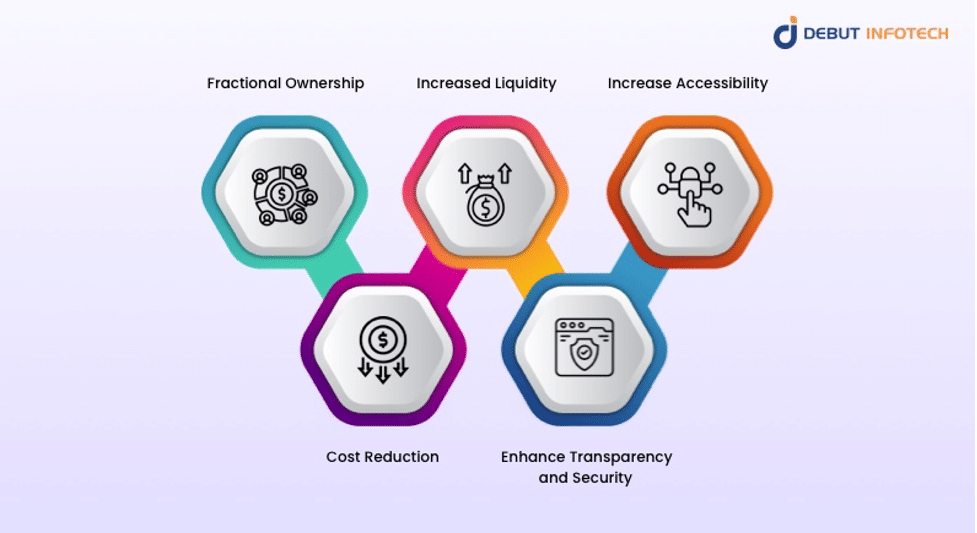

Tokenization is changing how investors purchase, own, or interact with their potential properties. Access to properties around the globe is becoming easier and more affordable. Here is how it is unlocking tremendous benefits

Fractional Ownership

The lucrative market is no longer for the wealthy or behemoth institutional investors who were dominant players in the traditional commercial real estate. Conversely, you can now hold fractional ownership thanks to tokenization that allows investors with smaller amounts. This is a significant transformation allowing a wider pool of investors to have access to real estate asset investments.

Cost Reduction

Tokenization utilizes smart contracts and blockchain technology to automate and execute transactions, which reduces time because there are no middlemen and transaction costs are minimal. This is unlike traditional real estate transactions, which have heavy paperwork, are time-consuming, and are expensive because of intermediaries, including banks and lawyers.

Increased Liquidity

Tokenization of commercial real estate offers more flexibility, makes it even easier to get property off market, how? Tokenizing your real estate offers high liquidity since ownership is divided into smaller segments via digital token. Investors can trade these tokens in a secondary marketplace, enabling them to exit the market sooner than the traditional illiquidity market.

Enhance Transparency and Security

Blockchain technology is immutable, which makes it secure and trustworthy. It also reduces the risk of fraud and streamlines disputes. Transaction details such as ownership records, property details, and transaction history can be recorded on the decentralized ledger. This is visible for all verification, and smart contracts built on blockchain automate and enforce the terms and conditions of the contracts.

Increase Accessibility

The major benefit of tokenization to commercial real estate is the increased accessibility to a diverse range of investors. Typically, real estate investment requires a huge amount of investment, making it unwelcoming for smaller investors. However, tokenization has shrunk the entry barrier, making it easier for more people to enter the real estate world.

Future Outlook for Commercial Property Tokenization

As more real estate developers and investors see the advantages of blockchain technology, commercial property tokenization seems to have bright future prospects. tokenized real estate assets could find more acceptance as the legislative environment gets clearer and the technology develops. Numerous developments like the ones listed below are determining the direction of tokenization:

- Institutional Adoption: tokenization is being explored by big real estate firms and financial institutions more and more as a means of diversifying their investment portfolios and accessing fresh income sources.

- Global Market Expansion: Tokenization systems are expanding their influence so that investors can engage in worldwide commercial real estate markets. This worldwide availability will likely continue to drive demand for tokenized real estate.

- Increased Liquidity: As secondary markets for real estate tokens expand, liquidity is likely to increase, therefore facilitating investor purchase and selling of commercial property tokens.

- Integration with DeFi: Decentralised Finance (DeFi) systems are anticipated to interact with real estate tokenized platforms, providing fresh means to use tokenized assets in lending, borrowing, and yield farming operations.

Why Choose Debut Infotech for Commercial Property Tokenization

Leading real estate tokenizing business Debut Infotech presents innovative ideas for commercial property tokenization. Having developed blockchain technologies for a great deal of time, the company offers end-to-end services to assist investors, developers, and property owners in negotiating the complexity of tokenizing real estate assets. With its experience in developing safe and transparent smart contracts, Debut Infotech guarantees adherence to legal requirements and facilitates a smooth interface with real estate tokenization platforms. Debut Infotech provides scalable, tailored solutions to fit your company’s needs, whether your goal is to unlock liquidity or give fractional ownership of commercial buildings.

Conclusion

Tokenizing commercial real estate is transforming investor buying, selling, and management of real estate holdings. Property tokenization—that is, turning commercial buildings into tradable digital tokens—allows increased liquidity, openness, and accessibility in the real estate market. Although there are still difficulties, this field clearly presents opportunities for expansion and creativity. The future of commercial property investment is being defined for a new era of financial inclusion and efficiency with real estate tokenization platforms and firms at the front stage.