Table of Content

Introduction

What is Crypto Mining?

How does Crypto Mining Work?

How Crypto Miners Receive Payments?

Factors that affect Crypto Miners Earnings

Frequently Asked Questions

Conclusion

Quick Summary

In this blog, we’ll delve into the fascinating world of cryptocurrency mining and uncover how miners generate income. Crypto miners play a pivotal role in validating transactions on blockchain networks like Bitcoin. They use powerful computers to solve complex mathematical puzzles, ensuring the integrity of the network.

In return for their computational efforts, miners are rewarded with newly minted cryptocurrencies and transaction fees. Join us as we demystify the process, explore mining rewards, and shed light on the profitability factors that shape this dynamic and ever-evolving landscape.

Introduction

In the ever-evolving landscape of cryptocurrency, crypto mining rewards stand as a beacon of opportunity for tech-savvy individuals and investors alike. At its core, crypto mining validates transactions on blockchain networks, ensuring their security and integrity. Armed with powerful computers, Miners compete to solve complex mathematical puzzles, earning coveted rewards through newly minted cryptocurrencies and transaction fees.

This blog delves into the intricate mechanisms behind crypto mining rewards, shedding light on how miners contribute to the decentralisation of networks while reaping the benefits of their computational prowess.

What is Crypto Mining?

Cryptocurrency mining is essential for creating and adding new units of cryptocurrencies to a blockchain. This decentralised ledger supports digital currencies like Bitcoin. In this detailed process, participants solve complex maths problems using high computational power, which validates and confirms transactions on the network.

Miners, who can be individuals or groups, use specialised hardware and software to compete in solving these puzzles. The individual who can solve the puzzle gets a reward and the right to add a new block to the blockchain network. A famous example of this can be Bitcoin Mining. In the context of the Bitcoin network, miners employ high-performance computers to decode cryptographic puzzles.

Once a puzzle is solved, the miner validates and groups transactions into a block added to the Bitcoin blockchain. Miners are like digital treasure hunters who use powerful computers to confirm transactions and keep the cryptocurrency network safe. They get new bitcoins as a reward for their hard work and the energy they spend on these tasks. They also get fees from users who want their transactions to be processed quickly.

This process does two important things: it makes new bitcoins and ensures the network is secure and honest. Likewise, Ethereum, another form of cryptocurrency, previously operated under a similar principle. However, its operational mechanism is undergoing a transformation. Instead of relying on miners, Ethereum is transitioning to a concept known as proof-of-stake. It’s like a new system they’re building to ensure transactions are real and create new Ether coins. This new system is part of the upgrade to Ethereum 2.0.

Ethereum miners, through solving intricate cryptographic puzzles, enabled the functioning of the network. Litecoin, Monero, and Dash utilise diverse mining mechanisms to generate new coins and safeguard their individual networks.

With the rise in popularity of cryptocurrencies, there was a corresponding increase in the demand for mining equipment and energy resources. Mining farms, comprising numerous high-performance computers, emerged to cater to the computational needs of the process. However, the energy-intensive nature of cryptocurrency mining sparked debates over environmental impact and energy consumption.

Cryptocurrency mining is the backbone of blockchain networks, enabling transaction validation and new coin creation. While it has fueled innovation and investment in technology, the sustainability of its energy usage remains a topic of concern. As the landscape evolves, the industry seeks to balance technological advancement and environmental responsibility.

How Does Crypto Mining Work?

The process by which new digital currencies are produced and added to a blockchain network is known as cryptocurrency mining. It involves solving complex mathematical puzzles using computational power. Below is a detailed explanation of how crypto mining works:

Step 1: Understanding Cryptocurrency Mining

Keeping up with the integrity and security of blockchain networks like Bitcoin relies vigorously upon cryptocurrency mining. To guarantee the precision and immutability of the blockchain, miners are accountable for creating new blocks and confirming transactions.

Step 2: Mining Hardware Selection

Miners use specialised hardware to solve cryptographic puzzles. For instance, people typically use specialised hardware, such as Application-Specific Integrated Circuits (ASICs) or Graphics Processing Units (GPUs), while mining Bitcoin. The choice of hardware depends on several variables, including the cryptocurrency being explicitly mined and the miner’s financial resources.

Step 3: Joining a Mining Pool

Solo mining is challenging due to the high computational power required. Miners often join mining pools, where participants combine their computational resources to increase the chances of solving puzzles and receiving rewards. Pools distribute rewards based on each miner’s contribution.

Step 4: Installing Mining Software

Miners need to install mining software compatible with their hardware and the targeted cryptocurrency. Popular software includes CGMiner, BFGMiner, and EasyMiner. The software connects the miner’s hardware to the blockchain network and mining pool.

Step 5: Blockchain Network Connection

Miners connect to the blockchain network through nodes. Nodes are computers that maintain copies of the entire blockchain and validate transactions. Miners fetch transaction data from nodes and include them in new blocks.

Step 6: Verifying Transactions

Miners collect transactions from the network and verify their validity. This involves confirming that the sender has sufficient funds and that the transaction adheres to network rules. Invalid transactions are rejected.

Step 7: Creating a Block Header

A block header contains crucial information, including a reference to the previous block, a timestamp, and a unique number called a nonce. Miners alter the nonce to create a hash value that meets specific criteria set by the network – the target difficulty.

Step 8: Proof-of-Work (PoW) Algorithm

Miners repeatedly adjust the nonce and calculate the hash until a value satisfies the network’s difficulty level. This procedure necessitates substantial computational capacity and is recognized as the Proof-of-Work (PoW) algorithm.

Step 9: Finding the Solution

Once miners discover a nonce that generates a hash matching the target difficulty, they share this solution with the network. Other miners can quickly verify the solution’s correctness.

Step 10: Block Addition and Reward

The miner who successfully solves the puzzle broadcasts the new block to the network. Other nodes confirm its validity, adding the block to the blockchain. As a reward for their efforts, the miner receives newly minted cryptocurrency coins and any transaction fees from the included transactions.

Step 11: Continuous Mining

Mining remains an ongoing procedure, necessitating adding new transactions to the blockchain. Miners consistently verify transactions, form block headers, and unravel cryptographic puzzles to ensure the network’s security and operational effectiveness.

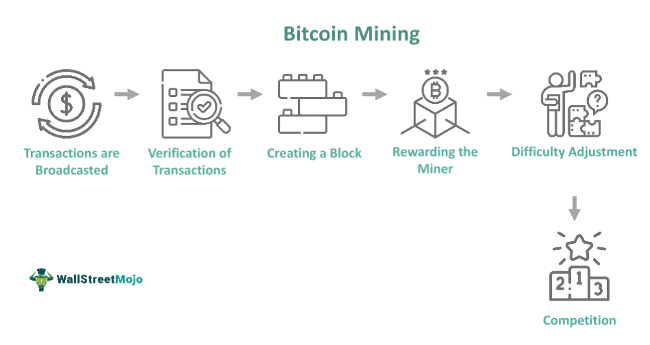

Reference Image Link : https://www.wallstreetmojo.com/bitcoin-mining/

How Crypto Miners Receive Payments?

Understanding the payment process for cryptocurrency miners is essential in comprehending how new coins are introduced into circulation. The method of issuance differs from traditional currencies, as the supply of new coins in Proof of Work (PoW) cryptocurrencies relies on a process called mining. Unlike fiat currencies, PoW blockchains have a predictable and pre-programmed issuance of new coins, which occurs with the mining of each new block.

Blockchain Block Rewards

In the context of Bitcoin and similar Proof of Work (PoW) blockchains, miners utilise specialised mining hardware known as ASICs to discover the accurate solution for the upcoming block. When a valid solution is discovered, a new block is generated, verifying the transactions contained within on the blockchain.

Miners are compensated with brand-new coins from the mined block since verifying transactions and protecting the blockchain require a lot of resources. Furthermore, they receive transaction fees from included transactions, creating incentives for miners to process numerous transactions and support the network.

Solo Mining

Solo Mining involves miners receiving block rewards directly from the blockchain. Solo Miners maintain their own full nodes, connecting to other nodes in the blockchain. They constantly work to find the solution for the next block and, upon succeeding, receive the block rewards directly into their specified wallet.

However, large blockchain networks like Bitcoin rarely feature Solo Miners due to the high level of hashrate required for consistent block validation. Instead, most miners join mining pools.

Mining Pools and PPS

Mining Pools, such as PPS (Pay Per Share), act as a collective Solo Miner on the network, distributing rewards to participating miners. Pools allow smaller miners to collaborate, sharing work and rewards based on the preferred reward system, which may include PPS.

PPS is straightforward: miners are paid for each valid share they submit. NiceHash uses this method, where earnings depend on share difficulty and average pay rate. Variants like FPPS consider transaction fees from mined blocks, enhancing the reward.

PPLNS System

Pay Per Last N Shares (PPLNS) is a popular pool reward system that discourages pool hopping, which harms the pool’s stability. PPLNS rewards miners who submit valid work within the last N shares, removing older shares as new ones are added. Notably, if a miner’s work isn’t in the last N shares when a block is mined, no rewards are received.

PPLNS pools often have lower fees and can yield higher profits for uninterrupted miners. It’s important to select the most suitable reward system based on your mining operation’s needs.

Factors that affect Crypto Miners Earnings

Cryptocurrency mining is influenced by a multitude of factors that can significantly impact miner earnings. These factors span technical, economic, and environmental domains, determining the profitability of mining operations.

1. Hash Rate (Computational Power)

Hash rate represents the speed at which a miner’s hardware can perform calculations necessary to solve complex mathematical problems. A higher hash rate means more attempts are made to solve these problems, increasing the likelihood of successfully mining a block. Miners with a greater hash rate have a competitive advantage in terms of block discovery and thus can earn more rewards.

2. Network Difficult

Network difficulty is a parameter that adjusts over time to ensure that new blocks are mined at a consistent rate. When more miners are active, the difficulty increases to maintain the desired block interval. Higher network difficulty means miners need more computational power to find a valid solution for a block, leading to fewer successful block mining attempts and potentially reduced earnings.

3. Block Reward Halving

Certain cryptocurrencies, like Bitcoin, have a fixed supply capped at a predetermined number of coins. To control the rate of coin issuance and inflation, these networks halve the block rewards at specific intervals. This event directly impacts miner earnings, as they receive half the rewards they used to for successfully mining a block.

4. Electricity Costs

Electricity is a significant operational cost for miners. The cost of running mining hardware can vary widely depending on geographic location and local electricity prices. Miners located in regions with cheap electricity have a competitive advantage, as their operational costs are lower, leading to higher profitability.

5. Hardware Efficiency

The efficiency of mining hardware refers to its ability to perform calculations with minimal energy consumption. Modern and efficient hardware can produce more hash rate per unit of energy used, maximising the potential for successful block mining. Outdated or inefficient hardware may not provide competitive hash rates, negatively impacting earnings.

6. Coin Price

The price of the cryptocurrency being mined directly affects the value of the rewards received by miners. Higher coin prices mean that the block rewards and transaction fees earned are worth more in terms of fiat currency, contributing to increased overall earnings for miners.

7. Transaction Fees

In addition to block rewards, miners also earn transaction fees for including transactions in the blocks they mine. When the network experiences high transaction volume or congestion, transaction fees can rise significantly, adding an extra income stream for miners.

8. Mining Pool Rewards

Mining pools allow individual miners to combine their computational power, increasing their chances of successfully mining blocks. When a mining pool discovers a block, the rewards are distributed among pool members based on their contributed hash power. While individual rewards may be smaller, mining pool participation provides a steadier and more predictable income stream.

9. Geographic Location

Miners’ geographic locations play a crucial role in determining their profitability. Energy costs, regulatory environments, and even climate conditions can impact operational expenses and overall earnings. Miners in regions with low electricity costs and favourable regulations have a competitive advantage.

10. Technological Advancements

The arena of cryptocurrency mining is ever-evolving, marked by continuous progress in hardware, algorithms, and software. Technology advancements can give rise to more effective mining machinery or alterations in mining algorithms. Miners who remain well-informed about the latest technology can uphold their competitive edge and optimise their earnings.

All these elements interplay to determine the profitability of crypto mining, rendering it an intricate and multifaceted undertaking that demands meticulous thought and strategic decision-making.

Frequently Asked Questions

Who are Crypto Miners?

Crypto miners are individuals or groups who use powerful computers to solve complex mathematical puzzles that validate transactions on blockchain networks. This process secures the network and creates new units of cryptocurrency as rewards.

How crypto miners make money?

Crypto miners earn money through two main avenues: block rewards and transaction fees. Successfully mining a new block grants them a reward in the form of cryptocurrency. Additionally, users making transactions on the network pay fees, some of which go to the miners who include those transactions in the blocks they mine.

Can anyone be a crypto miner?

In principle, individuals equipped with the required hardware, software, and internet access have the potential to engage in crypto mining. Nonetheless, the escalating intricacy of mining algorithms and the substantial energy expenses involved have led to more specialisation.

Dedicated miners frequently allocate resources towards high-performance equipment and collaborate within mining collectives to enhance their likelihood of receiving incentives.

Conclusion

In conclusion, we can say that the process of crypto mining offers a unique avenue for individuals to earn money within the realm of digital currencies. By dedicating computing power to validate transactions and secure the network, miners are rewarded with newly minted cryptocurrency coins.

This intricate process not only fuels the functionality of blockchain systems but also provides miners with a potential source of income. As the world of cryptocurrencies continues to evolve, mining remains a fundamental element that contributes to the growth and sustainability of these decentralised financial networks.