As energy costs continue to soar, businesses are increasingly feeling the squeeze on their operational budgets. While solar power generation systems offer a promising solution for long-term cost reduction, the substantial upfront investment often gives financial decision-makers pause. However, government incentives have emerged as a game-changing factor in this equation, dramatically reducing the time it takes to recoup initial investments. For financial officers and business leaders, understanding how to leverage these programs effectively can transform what might seem like a daunting capital expenditure into a strategic financial advantage. This comprehensive analysis explores how various incentive programs interact to accelerate return on investment, providing crucial insights for organizations evaluating solar power investments. By mastering the intricacies of available incentives, businesses can significantly compress payback periods and accelerate their journey toward energy independence and sustainable operations.

Understanding Solar Power Generation System Economics

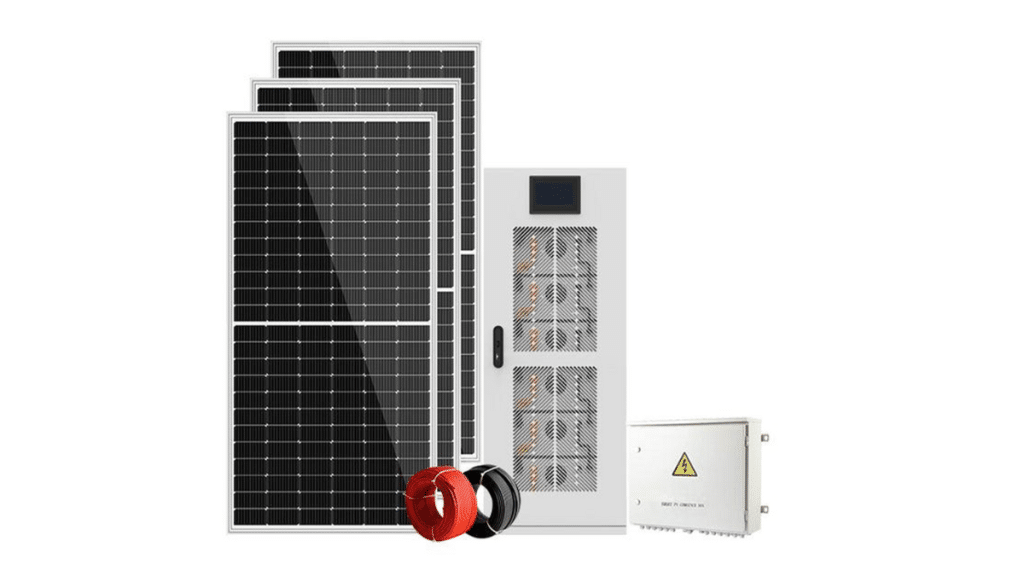

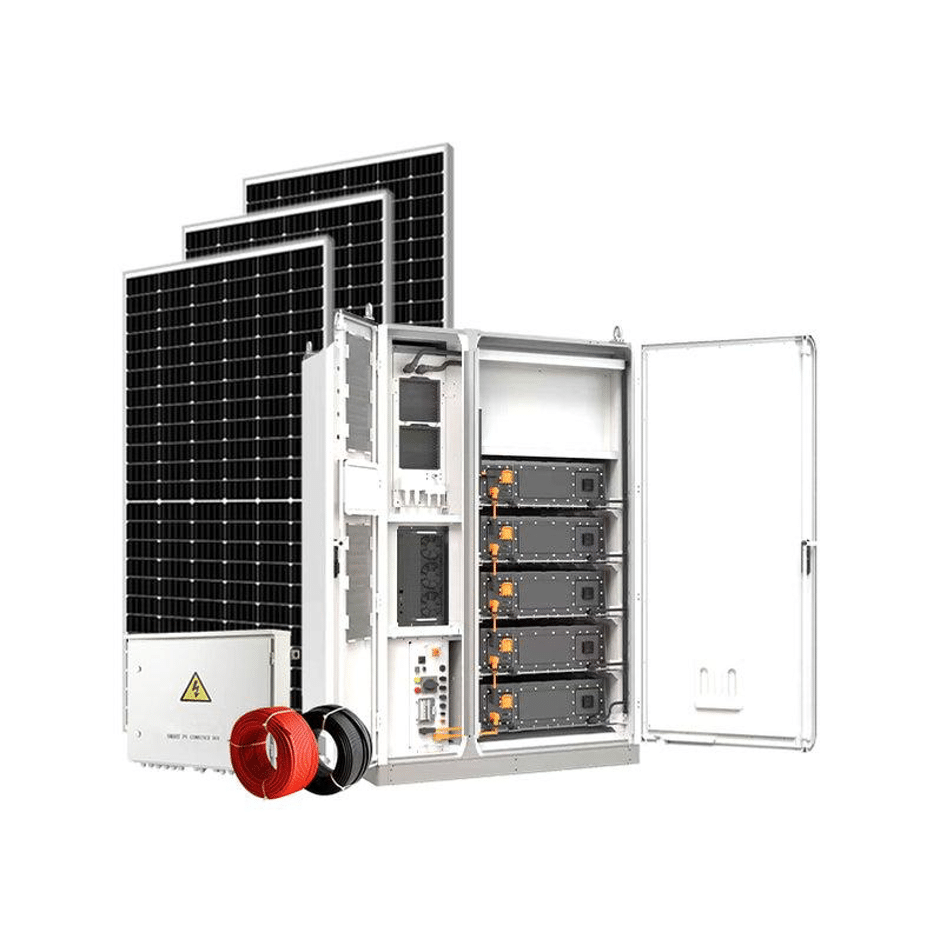

Commercial solar installations typically range from $2.50 to $3.50 per watt of capacity installed, with costs primarily driven by three core components: high-efficiency photovoltaic panels, string or micro-inverters for power conversion, and sophisticated mounting systems designed for commercial rooftops or ground installations. Without any incentives applied, businesses traditionally face baseline payback periods of 8-12 years, depending on local electricity rates and system size. The fundamental economics work through consistent operational cost reduction – each kilowatt-hour generated offsets utility purchases at retail rates while requiring minimal maintenance. A typical 100kW commercial system generates approximately 130,000 kWh annually in optimal conditions, directly reducing grid electricity consumption. Beyond direct energy savings, these systems provide predictable energy costs, protecting against future utility rate increases while delivering reliable power generation for 25-30 years. This long-term operational cost stability becomes increasingly valuable as grid electricity prices continue their upward trend, averaging 3-4% annual increases nationwide.

Government Incentives: Types and Financial Impact

Federal Tax Credits and Rebates

The federal Investment Tax Credit (ITC) currently offers businesses a substantial 30% tax credit on qualified solar installations through 2032. This direct reduction of tax liability dramatically improves project economics, effectively reducing a $300,000 system cost by $90,000. For non-profit organizations unable to utilize tax credits, direct cash grants through various federal programs provide similar financial benefits.

State/Local Solar Programs

State-level incentives vary significantly but often provide substantial additional value. Performance-based incentives (PBIs) offer ongoing payments based on system generation, while sales and property tax exemptions reduce both upfront and long-term costs. California’s Self-Generation Incentive Program (SGIP) provides up to $200 per kilowatt-hour for solar-plus-storage systems, while New York’s MWBE program offers additional incentives for minority and women-owned businesses, potentially covering up to 35% of project costs.

Depreciation Benefits

The Modified Accelerated Cost Recovery System (MACRS) allows businesses to depreciate solar investments over just five years, significantly faster than the system’s operational life. When combined with tax credits, businesses can recover up to 60% of project costs through tax benefits within the first year. This accelerated depreciation schedule creates substantial early-stage tax savings that can be reinvested into operations or used to fund additional clean energy projects.

Payback Period Calculation Methodology

Calculating an accurate solar investment payback period requires careful consideration of multiple variables within a standardized framework. The core formula divides net system cost (after incentives) by projected annual savings. However, the complexity lies in accurately determining these inputs. Net system costs must factor in all available incentives, including tax credits, rebates, and depreciation benefits. Annual savings calculations should incorporate current utility rates, expected energy consumption patterns, and projected system output based on site-specific factors like solar irradiance and panel orientation. Modern calculation tools like the System Advisor Model (SAM) or PVWatts enable detailed scenario modeling, accounting for variables such as utility rate escalators, maintenance costs, and panel degradation rates. Sensitivity analysis reveals how changes in key variables impact payback periods – for instance, a 10% increase in utility rates can accelerate payback by 1-2 years. Financial officers should particularly focus on three critical factors: the timing of incentive availability, seasonal variation in energy production, and potential changes in facility energy consumption patterns. Professional energy modeling software can generate monthly cash flow projections, helping organizations visualize how different variables interact to influence the ultimate payback timeline. This comprehensive approach ensures more accurate forecasting and helps identify opportunities to optimize system design for faster returns.

Commercial Energy Storage: Incentives and ROI Amplification

Battery storage systems have emerged as a powerful complement to solar installations, offering enhanced financial benefits through multiple revenue streams. Leading manufacturers like Anern have developed advanced storage solutions that seamlessly integrate with solar systems, providing reliable backup power and peak demand management capabilities. The federal Investment Tax Credit now extends to standalone storage systems, providing the same 30% tax benefit previously limited to solar-coupled installations. This expansion enables businesses to optimize their energy management strategy through strategic charge and discharge cycles. By storing excess solar production during peak generation hours, organizations can significantly reduce expensive demand charges that often comprise 30-50% of commercial electricity bills. Time-of-use arbitrage presents another compelling opportunity – systems can charge when rates are low and discharge during high-rate periods, typically yielding 15-20% additional savings beyond solar-only installations.

Energy Efficiency Synergies

When integrated strategically with solar installations, energy efficiency upgrades create powerful synergistic effects that further compress payback periods. LED lighting retrofits typically reduce electrical loads by 60-75% compared to traditional systems, while modern HVAC upgrades can decrease energy consumption by 30-40%. These reduced baseline loads mean solar systems can cover a larger percentage of total facility energy needs, effectively increasing the impact of renewable generation. Organizations can maximize financial benefits through incentive stacking – combining utility rebates for efficiency upgrades with solar incentives. For example, a comprehensive energy management system monitoring both solar production and efficiency measures enables real-time optimization of building operations. This data-driven approach helps facilities maintain peak performance while providing documentation for performance-based incentives. Smart building controls can automatically adjust HVAC schedules based on solar production forecasts, ensuring maximum utilization of on-site generation. By implementing these integrated solutions, businesses typically see their solar system payback periods reduced by an additional 15-20% while creating more comfortable, productive workspaces.

Implementation Roadmap: Securing Maximum Incentives

Step 1: Incentive Discovery Phase

Begin by thoroughly researching available incentives through the Database of State Incentives for Renewables and Efficiency (DSIRE). Engage specialized solar consultants to identify lesser-known local utility rebates and emerging opportunities. Subscribe to incentive tracking services that provide real-time updates on new program launches and deadline changes.

Step 2: Financial Modeling

Develop comprehensive financial models incorporating all identified incentives. Create multiple scenarios accounting for varying tax positions, utility rate escalators, and system sizes. Factor in seasonal production variations and potential changes in energy consumption patterns. Consider engaging certified public accountants with solar expertise to validate tax benefit calculations.

Step 3: Application Process

Create a detailed timeline mapping application deadlines and documentation requirements for each incentive program. Prepare technical documentation, including engineering drawings and equipment specifications. Submit interconnection applications early to secure capacity in limited programs. Maintain detailed records of all submissions and correspondence with program administrators.

Step 4: Post-Installation Compliance

Implement robust monitoring systems to track system performance and generate required reports for performance-based incentives. Maintain detailed operation logs and maintenance records to demonstrate ongoing compliance. Establish clear protocols for responding to any performance issues that could impact incentive eligibility. Schedule regular reviews with tax advisors to ensure continued compliance with ITC requirements and avoid recapture risks.

Maximizing Solar Investment Returns Through Strategic Incentive Management

The strategic utilization of solar incentives has emerged as a critical factor in accelerating return on investment for commercial solar installations. By effectively combining federal tax credits, state rebates, depreciation benefits, and performance-based incentives, businesses can reduce typical 8-12 year payback periods by 50% or more. The compounding effect becomes even more powerful when integrating energy storage systems and efficiency upgrades, creating multiple revenue streams while enhancing energy independence. Financial officers who master the complex interplay of these programs gain a significant competitive advantage in today’s energy marketplace. With federal tax credits currently locked in at 30% through 2032 and state programs continuously evolving, the time for action is now. Organizations that delay implementation risk missing out on limited-capacity incentive programs and face increasing competition for qualified installers. As utility rates continue their upward trajectory, solar installations backed by strategic incentive capture represent not just an environmental choice, but a fundamental business imperative for long-term financial sustainability and energy security.