Investment firms need to comply with SEC rules to conduct business and gain investors’ trust.

This guide describes practical lessons in a list format consistent with current writing on the topic.

SEC Compliance Guidance for Advisors

SEC compliance guidance for advisors begins with registering under the Advisers Act if managing significant assets, requiring a tailored compliance program that identifies and mitigates unique risks.

Advisors are required to hire a chief compliance officer, conduct annual compliance reviews, and maintain five years of trade confirmations, communications with clients, and financial records.

Fiduciary duty requires acting in clients’ best interests, full disclosure of conflicts, and distribution of brochures with fees, services, and disciplinary record.

Marketing claims, cybersecurity, valuation, and custody practices are examined.

Firms should pre-emptively prepare for the new regime with mock reviews and policy updates.

Understanding SEC Compliance Basics

SEC compliance refers to federal laws and regulations enforced by the SEC requiring accurate reports and disclosures, internal controls, and timely filing of reports to prevent investment fraud and market manipulation.

Firms receive risk-based examinations of key operational areas such as technology and operational resilience.

Breaches and gaps risk monetary penalties, reputational damage, and disruptions to operations, requiring strong business continuity programs.

Registration and Reporting Obligations

Registered firms file Form ADV detailing their business, services, and fees, and update it annually and when materially amended.

Books-and-records rules require firms to maintain records of communications and business matters in readily accessible formats.

Failure to file or keep records triggers enforcement actions, eased by automated compliance systems.

2026 Examination Priorities Overview

Marketing, valuations, portfolio management, disclosures, and custodial activities all require effective compliance programs.

With changing market conditions, increased regulation, and more common reliance on technology, firms need to show strong governance at all levels.

Fiduciary breaches, accuracy of fees, and conflicts of interest are also examined.

Newer or smaller firms may experience greater scrutiny at their foundation.

Strategy 1: Build a Robust Compliance Program

Hire a seasoned chief compliance officer to monitor policies preventing violations based on firm size and clientele.

Test controls annually, document results, and take corrective action promptly if deficiencies are noted.

Firm-wide compliance can be strengthened through board oversight and employee training.

Strategy 2: Strengthen Cybersecurity Defenses

Multi-layered cybersecurity infrastructures should be deployed, with artificial intelligence (AI) controls and systems for risk assessment of third-party vendors, incident and breach notification, penetration testing, and tabletop exercises.

Train employees to identify phishing and store sensitive data appropriately to reduce human error.

Vendor and Third-Party Oversight

Thoroughly vet service providers that handle sensitive data, and include in contracts an obligation to abide by security standards and quarterly threat environment reviews.

Strategy 3: Master Marketing Rule Adherence

Thoroughly vet service providers that handle sensitive data, and include in contracts an obligation to abide by security standards and quarterly threat environment reviews.

Care needs to be taken to ensure that all performance claims, testimonials, and ratings are based on contemporaneous records, not hypothetical or selective presentations.

Regularly audit distribution channels and disclosure practices for conflicts of interest.

Strategy 4: Perfect Valuation Practices

For illiquid or complex assets, have written policies for valuing a security, use independent prices when available, and consistently document the valuation methodology.

Reconcile periodically, and quickly challenge outlier valuations.

Strategy 5: Optimize Portfolio Management Oversight

Recommendations must consider client goals, and advisors must review tax strategies, transfers, and assist senior investors.

Pre-trade compliance checks and post-trade surveillance are used.

Watch for excessive risk concentration or favoritism of accounts.

Strategy 6: Enhance Disclosure Accuracy

Use accurate, completed checklists for all documentation, and invite appropriate auditors early to perform financial statement reviews when necessary.

Notify clients of material changes promptly through updated brochures or reports.

Strategy 7: Fortify Trading and Custody Controls

Regularly reconcile and surprise audit custody assets.

Trading, compliance, and management functions should be segregated.

Use insider trading surveillance tools and train staff on personal trading.

Document every trade reasoning, linking it to client mandates.

Strategy 8: Prepare for Regulation S-P Amendments

Larger companies have incident response, notifications, and safeguards in place by mid-year; smaller companies follow shortly thereafter or in the following year. Test programs quarterly for data at rest, in transit, and in use.

Strategy 9: Integrate AI and Technology Governance

Assess AI systems to identify biases and transparency issues in advice, marketing, and trading.

Set human oversight policies and limit automated decision-making.

Technology undergoes regular audits for fiduciary compliance.

Strategy 10: Prioritize Anti-Money Laundering Measures

Screen clients, monitor, and report on transaction activity.

Update, compare, and validate sanctions programs.

Screen for new and emerging risks.

Annual training helps staff identify red flags.

Strategy 11: Conduct Thorough Annual Reviews

Assess all compliance areas for evidence of testing, remediation plans, and reports to senior management.

Consider external audits for independent verification.

Adapt to shifting priorities dynamically.

Strategy 12: Excel in Examination Readiness

Conduct mock exams, centralize records, and physically practice response procedures.

Maintain all risk assessments on hand.

Communicate compliance policies and incentivize compliance across the company.

Additional Best Practices for Long-Term Success

Automation and Contingency Planning

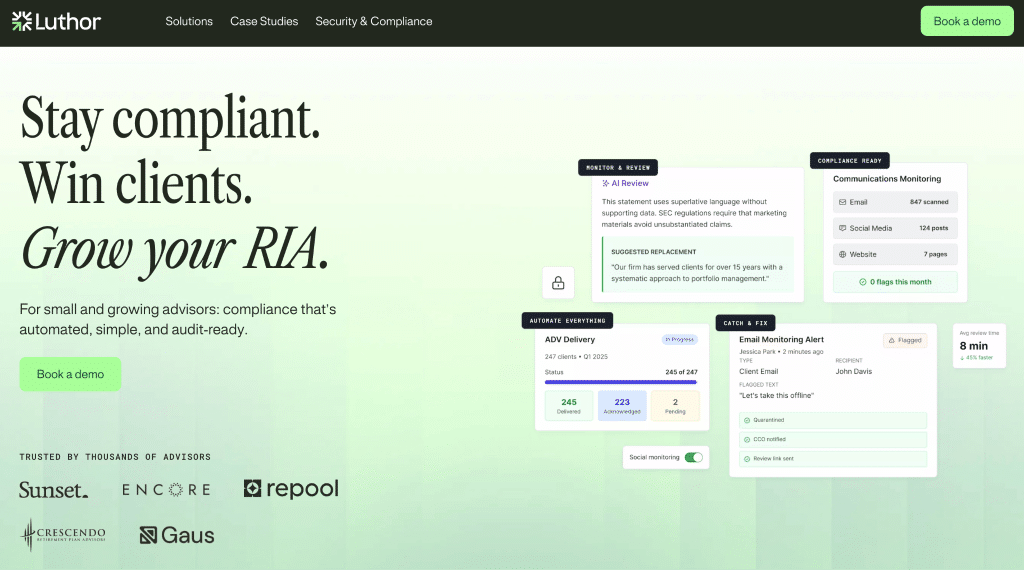

Utilize Luthor.ai for filing and monitoring efficiency, reducing the onus on staff and minimizing errors.

Test a backup and disaster recovery plan.

Cross-Functional Accountability

Bring operations, legal, and front office teams into the compliance workstreams.

Track rule changes through calendars and alerts.

These strategies, implemented to a high degree, can impart regulatory confidence, improve productivity, and provide a competitive advantage to those companies.